It’s probably safe to say the biggest story of the year in the markets has been the rise of AI. While various names have been well-positioned to reap the benefits for being involved in the AI game, Nvidia (NASDAQ:NVDA) has stood out above the rest. The company’s massive share gains (230% year-to-date) have come off the back of a series of beat-and-raise reports that have stunned Wall Street.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In fact, such has been their strength, Morgan Stanley analyst Joseph Moore thinks the upside to Nvidia’s topline revenue has been the biggest surprise in the semiconductor industry this year.

“Their guidance for $20bn of revenue in the January quarter is above the high end of even TSMC’s guidance for Q4, and with 20 points of additional gross margin,” the 5-star analyst went on to say. “A profit pool of this size in semiconductors being generated in such a short time is simply something we’ve never seen, and investors are very focused on if/when/how others may be able to compete away those excess profits. Our view is that the competitive threat to Nvidia in performance centric markets like training will be minimal for some time.”

Moore thinks that moving forward, enthusiasm for training competition will be rather muted given next year’s release of the B100, Nvidia’s next-generation compute GPU product for AI and HPC (high-performance computing) applications. “Our conversations suggest B100 will be a material performance boost relative to the already leading H100 product,” he said.

Additionally, recently unveiled custom ASICs by AWS and Microsoft are only anticipated to start rolling out in the second half of 2024, and Moore thinks they will eventually hit the market “well behind the state of the art.” In the training segment, where emphasis is placed on capabilities rather than costs, “being that far behind is of little value.”

Moreover, throughout the years, Google’s TPU aside, there has been very little success in bringing to market a product that “stacks up well with Nvidia for training.” And after having spent plenty of time on thorough due diligence for comparable solutions, a consistent pattern emerges that reinforces this perspective. “The gap to Nvidia has historically been difficult to bridge,” Moore sums up, “and where we have seen enthusiasm for new designs, we have often seen that enthusiasm diminish after Nvidia releases a next generation solution that raises the bar.”

To this end, along with ‘top pick’ status, Knoblauch rates NVDA shares an Overweight (i.e. Buy), with a $603 price target that implies a one-year upside potential of ~29%.

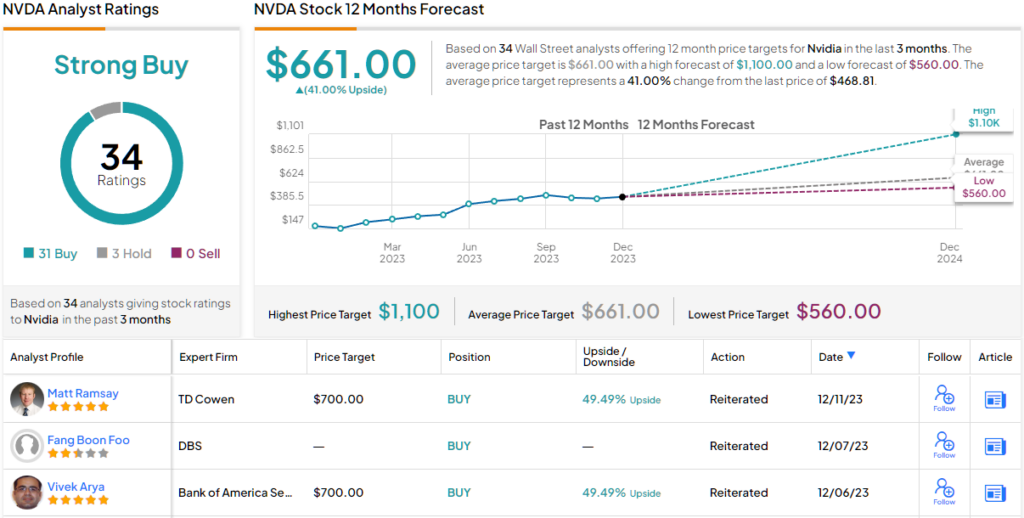

The rest of the Street sees more upside, too. NVDA’s Strong Buy consensus rating is based on 31 Buys and 3 Holds. At $661, the average price target represents possible upside of 41% over the next 12 months. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.