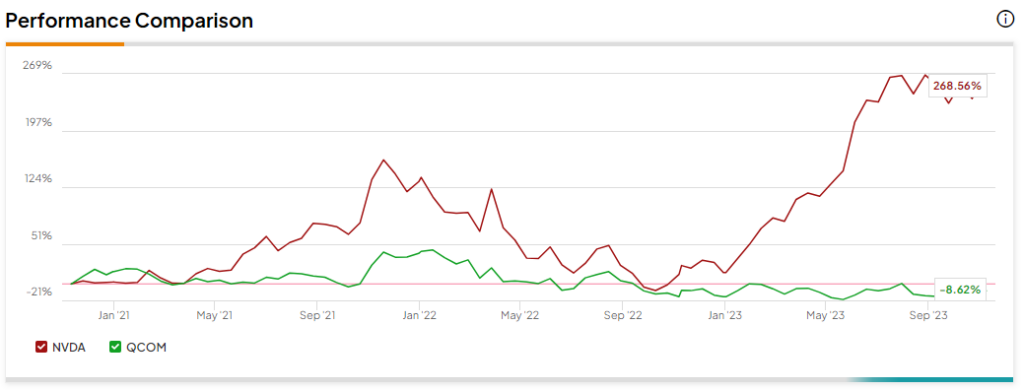

Nvidia (NASDAQ:NVDA) and Qualcomm (NASDAQ:QCOM) are semiconductor kingpins that have a lot to gain from the generative artificial intelligence (AI) race. AI isn’t the only significant growth driver, though, as both firms look to make a big splash into the CPU (central processing unit) chip waters, using none other than Arm’s (NASDAQ:ARM) technology. For those unfamiliar with Arm, it’s a firm that licenses its architecture to other companies seeking to create their own custom chips.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As Nvidia and Qualcomm rip a page out of the playbook of Apple (NASDAQ:AAPL) and its Arm-based Apple Silicon strategy, it will certainly be interesting to see how the next generation of Arm CPUs stack up against one another. Rising competition in the space is a big win for consumers but another potential hit to the chin for Intel (NASDAQ:INTC), the former CPU giant that’s really suffered a fall from grace.

Nvidia and Qualcomm both have a lot to gain relative to what they stand to lose as they join the arms race. And for that reason, I’m bullish on both firms as they ready their CPUs for launch.

Qualcomm and Nvidia Could Gain at the Expense of Intel

Up ahead, Qualcomm’s Snapdragon X Elite (along with its CPU core technology, Oryon) is slated to be launched in the middle of 2024. For now, Intel doesn’t seem to view Qualcomm, Nvidia, or any other Arm CPU combatant as making a dent in the laptop market.

Given Apple’s success with Apple Silicon and its latest M3 line of chips, I think it’s quite worrisome for Intel to downplay the credible threat of Arm CPUs. Indeed, Intel does not have much room to be complacent as the rising trend of more firms making their own custom silicon (with the help of Arm) continues to take off.

Apple has been leading the charge when it comes to custom silicon. And the per-watt performance jump from Intel-based Macs has been absolutely remarkable. In fact, Apple really encouraged its Intel-based Mac users to make the jump to Apple Silicon in its “Scary Fast” event.

Following in Apple’s Footsteps

Undoubtedly, the benchmarks for the M3, M3 Pro, and M3 Max chips were most impressive when compared to the original M1 line of chips. Compared to the M2 line, performance improvements seemed rather tame. That said, given that many Mac users are still on Intel-powered Macs, the real opportunity may lie in nudging pre-Apple Silicon users to make the leap. Given the power of Apple’s ecosystem, it’s not hard to imagine many Apple fans moving to Apple Silicon and away from Intel, perhaps for good.

As Qualcomm and Nvidia ready their own Arm offerings for launch over the medium term, there’s a good chance that both firms could add pressure on the PC side.

Not to discount the turnaround efforts going on at Intel, but things are not looking good for Intel in the slightest as we move into the next generation of Arm-based CPUs. Perhaps the only thing scarier than Apple (and its Scary Fast M3 chip, which was unveiled the day before Halloween 2023) is Nvidia. The GPU kingpin is one of the hottest Magnificent Seven players in recent years. And if it sets sights on Arm CPUs, I would not bet against the firm as it looks to get in on the action.

Nvidia recognized the power of Arm early in the game, with its failed attempt to acquire it around three years ago in a proposed deal worth $40 billion. Though Nvidia’s Arm acquisition hopes were called off in a hurry, the move doesn’t appear to be stopping Nvidia from pursuing its grand Arm ambitions.

Moreover, while the relief rally in INTC stock has been going strong for around a year, I’d not be surprised if it’s cut short at the hands of Qualcomm or Nvidia.

Is QCOM Stock a Buy, According to Analysts?

On TipRanks, QCOM stock comes in as a Moderate Buy. Out of 20 analyst ratings, there are 13 Buys, six Holds, and one Sell rating. The average Qualcomm stock price target is $135.59, implying upside potential of 9.7%. Analyst price targets range from a low of $100.00 per share to a high of $160.00 per share.

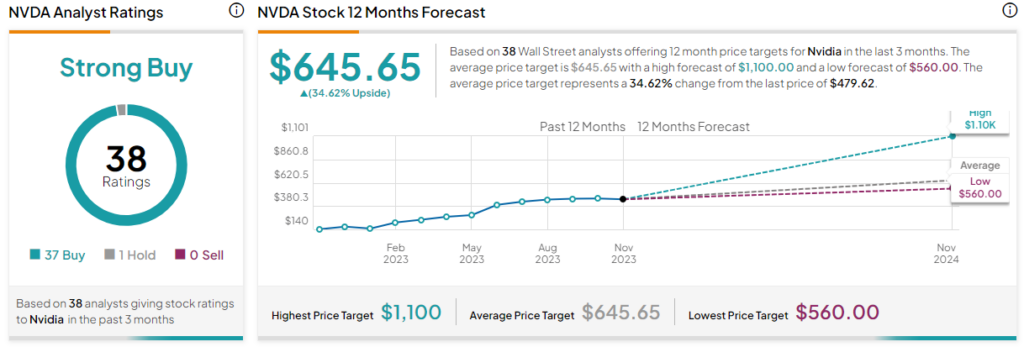

Is NVDA Stock a Buy, According to Analysts?

Meanwhile, NVDA stock comes in as a Strong Buy on TipRanks. Out of 38 analyst ratings, there are 37 Buys and one Hold recommendation. The average Nvidia stock price target is $645.65, implying upside potential of 34.6%. Analyst price targets range from a low of $560.00 per share to a high of $1,100 per share.

On the high end, Rosenblatt Securities sees NVDA stock more than doubling (129% upside) from current levels to $1,100.00 per share. That’s a Street-high target and one that may not be so out of sight if Nvidia can repeat the magic with its Arm-based CPU as it continues sprinting with the AI ball.

The Bottom Line

Getting into the Arm CPU scene has the potential to be lucrative — just ask Apple. Even if the offerings of Qualcomm or Nvidia fail to live up to the hype, it certainly seems like Arm is allowing more firms to challenge Intel. The only question is whether Intel will be able to hold its own as more punches come its way.