Almost all of the market heavyweights have reported Q3’s financials, but Wednesday (November 16) will see one beaten-down behemoth go under the earnings spotlight.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nvidia (NVDA) will deliver its F3Q report occupying an unfamiliar spot. In sharp contrast to recent years, the company’s shares sit 43% into negative territory, downed by depressed Gaming sales and softening Data Center trends impacted by the new restriction on exports of advanced data center chips to China. These are set to affect data center sales by as much as $400 million in the quarter.

As such, heading into the print, Oppenheimer’s Rick Schafer sees a “soft setup” for F3Q/F4Q (October/January quarters).

Segment wise, given enterprise project push-outs and US export restrictions countering “robust US hyperscale spend,” Schafer now expects Data Center (which accounts for 57% of revenues) to climb 19% year-over-year but decline by 9% sequentially.

As for Gaming, not long ago Nvidia’s main bread winner but now accounting for around 30% of revenues, the expectation is for the “correction to persist” into 1H23, with management now working with channel partners to “burn off excess inventory.” On the plus side, highlighting the “resilience” of hardcore performance/enthusiast gamers, the recently launched RTX 4090 is sold out, having evidently been well-received.

Elsewhere, the Auto division is expected to show a year-over-year improvement of 66%. While the segment only represents 3% of total revenues, Schafer considers it a “key pillar” of future growth, with the emerging auto business led by “increasing ADAS adoption.”

While the near-term presents ongoing difficulties, Schafer considers the current headwinds as “transitory,” believing the company’s AI-led structural growth thesis remains “intact.”

“NVDA has an established DC AI hardware/software ecosystem,” the 5-star analyst summed up. “We expect mgmt. to leverage NVDA’s leadership position into rapid/material CPU share gains following ARM-based Grace’s 1H launch.”

Overall, Schafer says he remains a “long-term buyer,” and reiterates an Outperform (Buy) rating on NVDA shares. That rating comes with a $225 price target, suggesting shares now have room for 34% growth on the one-year horizon. (To watch Schafer’s track record, click here)

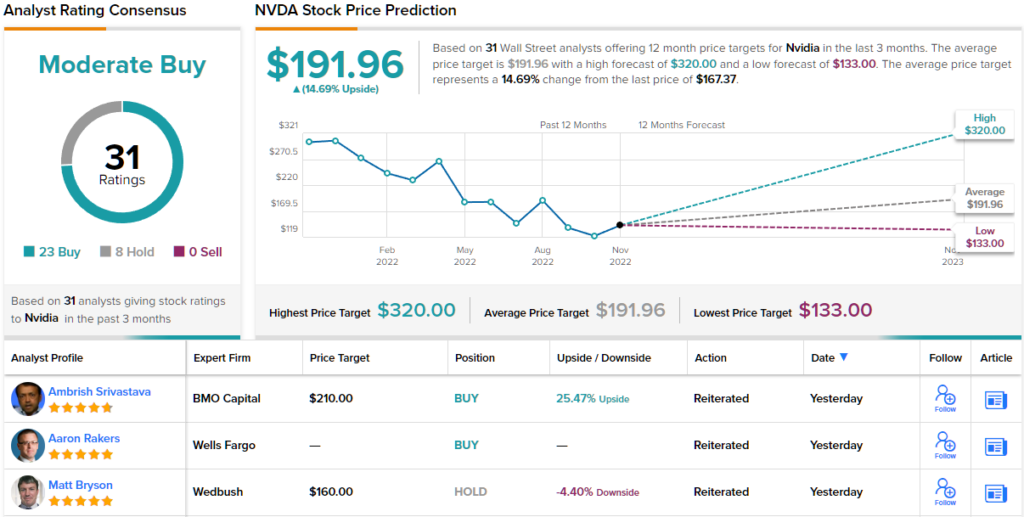

Over the past 3 months, 31 analysts have chipped in with NVDA reviews, which break down as 23 to 8 in favor of Buys over Holds, all culminating in a Moderate Buy consensus rating. The average target currently stands at $191.96, making room for ~15% share appreciation over the coming months. (See Nvidia stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.