Nvidia has been an AI juggernaut for the past couple of years as it challenges for the title of the world’s most valuable corporation. Nvidia’s 156% year-to-date gain and 2,700% gain over the past five years may lead many to suspect there’s limited upside from here, but artificial intelligence is still in its early innings. Understanding the AI opportunity and Nvidia’s unique position in the industry leads me to be bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Diving into the AI Boom

Although artificial intelligence has already captivated investors for multiple years, the boom is still going strong, and that leads to my optimism for NVDA stock. Corporations are making significant investments in artificial intelligence, and that demand has resulted in a projected 19.3% compounded annual growth rate from now until 2034.

Artificial intelligence helps businesses enhance their products and services. For example, CrowdStrike (CRWD) has been investing in Charlotte AI and other AI features to fortify its cybersecurity software. Adobe (ADBE) has also invested in artificial intelligence to help individuals and businesses create better images and videos.

Nvidia supplies the AI chips that power these tools. While other semiconductor firms also offer AI chips, Nvidia continues to innovate its chip offerings to stay ahead of the competition. The company is working on its new Blackwell chip, which is expected to be released in 2025.

The High Cost of AI Infrastructure

Right now, artificial intelligence looks similar to the early days of the internet, in my view. The groundbreaking technology has substantial barriers to entry. Nvidia wins much of the new business, contributing to my bullish outlook for NVDA stock.

Big tech companies within the Magnificent Seven have been pouring billions of dollars into the technology. Oracle (ORCL) founder Larry Ellison recently said that the company is behind on its AI infrastructure goals. Oracle will likely turn to Nvidia to close that gap, resulting in billions of dollars of additional sales potentially heading Nvidia’s way. Elon Musk’s companies are also in the fray. Tesla and xAI are set to spend a combined $20 billion on AI projects in 2024 alone.

Corporations aren’t flinching and seem resolved to making additional investments in 2025 and beyond. AI infrastructure is expensive to set up, maintain, and scale. This dynamic benefits Nvidia tremendously as it has established a near monopoly in the industry. According to the IDC, organizations are projected to nearly triple their AI investments by the end of 2028. This research suggests a 30% compounded annual growth rate during that stretch.

Nvidia’s Many Partnerships

Nvidia is knocking elbows with the ‘who’s who’ of big tech and publicly traded corporations. It’s another reason to feel bullish about the company’s prospects, and Nvidia’s partners have deep wallets. The AI chipmaker has partnerships with Meta Platforms (META), Alphabet (GOOGL), Amazon (AMZN), and other titans in the industry.

Many of these same tech companies have been reporting record profits. Nvidia’s biggest customers are relatively well-insulated and can continue to pour money into artificial intelligence even during an economic slowdown. The technology’s mainstream appeal is relatively new, and investments are still ramping up. Nvidia’s partnerships make it more likely that the company will continue outgrowing the broader market regardless of whether the economy stalls.

Even better, key partnerships are likely to expand with age. As Nvidia continues to deliver top-class AI chips to its customers, those clients are more likely to stick with Nvidia and make further large investments. Nvidia has been working with Amazon for more than a decade, while Alphabet recently expanded its partnership with Nvidia.

Nvidia’s Valuation Isn’t Prohibitive

Nvidia’s valuation is still reasonably low in considering its revenue and earnings growth rates. While a 58x trailing P/E ratio seems high, especially when compared to other big tech companies, Nvidia has been more than doubling its net income on year-over-year comparisons.

On a forward basis, Nvidia stock is priced at a 43.5x P/E ratio, making the valuation look more affordable. Furthermore, the company reported 152% year-over-year net income growth in Q2 FY25. High revenue growth paves the way for high net income growth. If Nvidia continues to report a few more quarters of triple-digit year-over-year revenue growth, the forward P/E ratio should continue to drop.

Is Nvidia Stock a Buy?

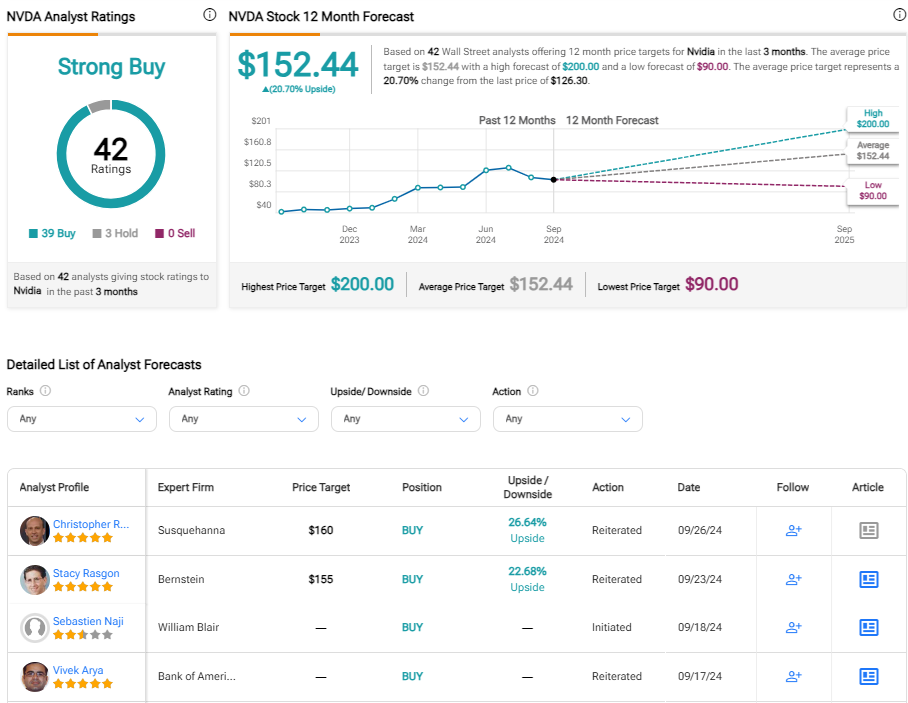

Nvidia stock is currently rated as a consensus Strong Buy among 42 Wall Street analysts. The average NVDA price target of $152.44 implies about 23% potential upside. The most optimistic price target of $200 reflects 62% upside from current levels. Wall Street analysts carry 39 Buy ratings, three Hold ratings, and no Sell ratings on NVDA stock.

The Bottom Line on Nvidia Stock

Nvidia is an undisputed leader within the artificial intelligence boom. It has established a leading position in supplying the demand for AI capabilities. Nvidia has some of the best customers on the planet, and these corporations are surely to continue investing in AI even during an economic downturn.

Revenue and net income growth remain superb and, when looking at forward multiples, NVDA stock doesn’t look unreasonably valued. Many Wall Street analysts feel the same way, hence the consensus Strong Buy rating. Alongside them, I continue to be bullish NVDA.