Crypto has facilitated a whole new industry. But these new assets’ ascent is also making a serious dent in other well-established industries, from finance to art and much in between.

The chip industry has also felt the impact; demand for GPUs has reached new heights, as they are used to mine digital currencies. This has been a boon for Nvidia (NVDA), as the outsized demand has added another significant revenue stream. But now that the crypto bull run is coming to an end, investors are getting jittery about what the possible lack of demand could mean for the GPU giant.

Evercore analyst C.J. Muse does not believe there is much to be worried about due to one major reason.

“Despite rising crypto concerns and current supply constraints, we believe investor fears for NVDA’s Gaming business are largely overdone based on our view that true gaming demand remains greatly underappreciated,” the 5-star analyst said.

That’s not to say the crypto revenues are to be sniffed at. Ex-CMP (crypto mining processors) for 2H20+CY21, Muse estimates crypto related revenues are likely to be around $1.2 billion. However, as Ethereum moves to a PoS (proof of stake) consensus mechanism, by the end of CY21, these “will likely cease” and some miners will “offload these GPUs into the channel.”

Is this a problem? Not necessarily, says Muse. The analyst’s “bottoms up math” indicates that $3.5 billion in pent-up gaming demand “can more than offset any crypto demand falloff.”

With this in mind, Muse expects gaming revenues in CY21/CY22 will increase to $12.2 billion and 13.7 billion, respectively, which is 8% and 12% higher than consensus estimates. This should help the company generate EPS of $16.35 and $19.00, respectively, compared to the Street’s forecast of $15.32 and $17.09.

All of which leads Muse to believe good times await Nvidia shareholders with or without crypto.

“With line of sight to consensus estimates moving higher despite a slowdown in crypto combined with Data Center that is expected to reaccelerate in 2H21 followed by next-gen architecture ramp in 2H22 (Lovelace) followed by ARM server CPU ramp in 1H23, and we see a clear path of positive catalysts to lift shares higher,” Muse summed up.

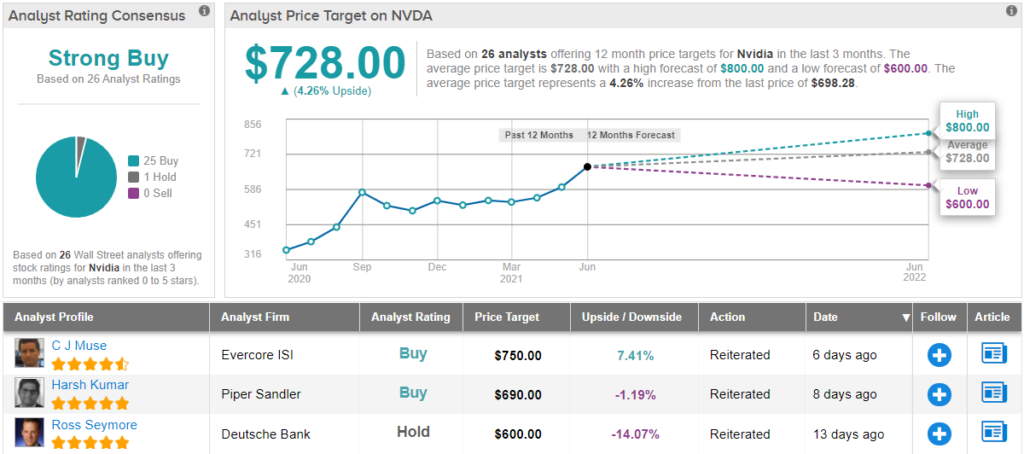

That said, with shares up by 35% year-to-date, at present, Muse’s $750 price target suggests only ~7% upside from current levels. The analyst’s rating stays an Outperform (i.e. Buy). (To watch Muse’s track record, click here)

The discrepancy between rating and price target is also evident in Muse’ colleagues’ appraisal. Barring one Hold, all 25 other recent reviews say Buy, naturally coalescing to a Strong Buy consensus rating. However, the upside remains capped; at $727, the average price target suggests shares will gain a modest 3% over the coming months. (See Nvidia stock analysis on TipRanks)

To find good ideas for chip stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.