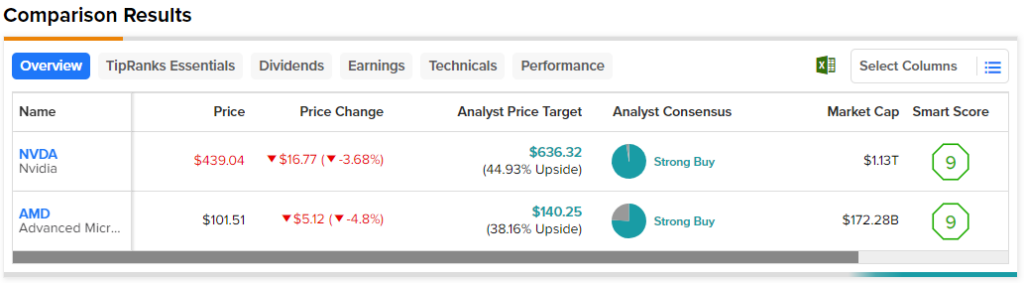

In this piece, I evaluated two chip stocks, Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), using TipRanks’ comparison tool to determine which is better. Nvidia targets the gaming, professional visualization, data center, and automotive markets, while AMD focuses on the data center, embedded, gaming, and PC markets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Both chipmakers have tapped into the artificial intelligence (AI) craze by highlighting their AI-related capabilities. However, Nvidia has been much more successful, with its stock up more than 200% year-to-date and over the last 12 months. Meanwhile, AMD is up only 64% year-to-date, flipping its one-year return back into the green at 24%.

With such a massive difference in their year-to-date rallies, it isn’t surprising that NVIDIA is the one that’s profitable. Due to AMD’s lack of profitability, we’ll compare their price-to-sales (P/S) ratios to gauge their valuations against each other and their industry.

For comparison, the U.S. semiconductor industry is trading at a P/S multiple of 7, higher than its three-year average of 5.8. For the profitable Nvidia, we’ll also compare its price-to-earnings (P/E) ratio to that of its industry. The semiconductor industry is trading at a P/E of 43.9, much higher than its three-year average P/E of 28.7.

Nvidia (NASDAQ:NVDA)

At a P/E of 109.1 and a P/S of 34.4, Nvidia looks grossly overvalued relative to its industry and to AMD. It’s even pricy versus its five-year mean P/S of 19.3 and mean P/E of 76.4. However, despite this irrational exuberance, which would generally trigger a bearish view, a combination of factors suggests a neutral view might be appropriate.

On the one hand, insiders have unloaded $146 million worth of Nvidia shares over the last three months, backing the bearish side of the argument. A closer look at the activity reveals many auto-sell transactions over the last week or two. These sales may be related to the insiders’ preset trading plans, in which they set prices at which they will automatically sell their shares.

However, there was also an Informative Sell transaction worth $25 million two weeks ago, just below $500 a share. Importantly, Nvidia’s 52-week high is $502.66, so this transaction and the large number of auto-sell transactions suggest insiders may see the chipmaker’s stock as unlikely to rise further from those levels.

On the other hand, there have been a few developments involving Nvidia that suggest a more constructive view might be in order. First, the company’s revenue more than doubled in the most recent quarter, but its cost of goods increased by only 7%, leaving some investors confused. However, a Bernstein analyst explained that Nvidia had taken a $1.34 billion charge, including $1.22 billion in inventory-related charges, that ran through the cost of goods sold in the same quarter a year ago.

A closer look reveals that when those charges are excluded, Nvidia’s cost of goods sold actually exploded, rising 70% between last year’s second quarter and this year’s second quarter. Still, the Bernstein analyst added that a surge of that magnitude was “entirely normal” based on the robust year-over-year growth in Data Center sales.

In fact, Nvidia’s total revenue rose 101% year-over-year to $13.5 billion, a new record, while its Data Center revenue rose 171% year-over-year to a new record of $10.3 billion. Both readings support a more constructive view.

Then, there was a “conspiracy theory” that involved allegations around CoreWeave, a GPU cloud vendor that recently listed its Nvidia chips as collateral for a $2.3 billion financing. Given Nvidia’s investments in CoreWeave, social media users suggested that CoreWeave’s reported inventory of Nvidia chips was actually where Nvidia’s data-center revenue beat came from.

However, the Bernstein analyst noted that the timing of CoreWeave’s August 3 release about the financing suggested that the Nvidia chips hadn’t been deployed yet and thus were not recorded in the company’s second-quarter revenues.

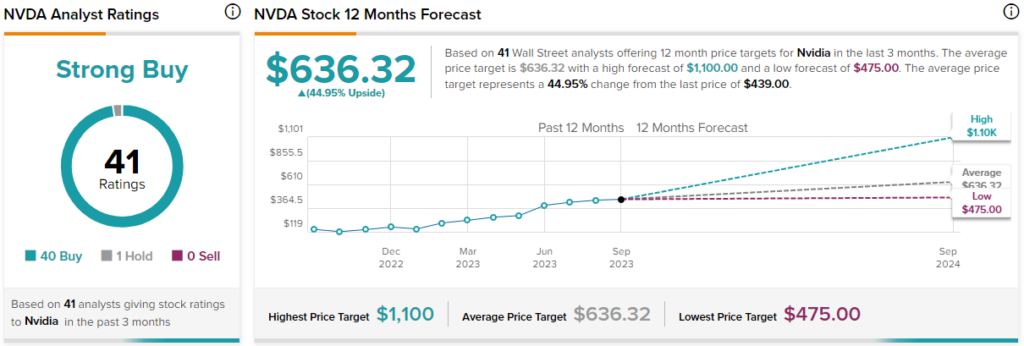

What is the Price Target for NVDA Stock?

Nvidia has a Strong Buy consensus rating based on 40 Buys, one Hold, and zero Sell ratings assigned over the last three months. At $636.32, the average Nvidia stock price target implies upside potential of 45%.

Advanced Micro Devices (NASDAQ:AMD)

At a P/S of 7.8, AMD looks much more reasonably valued than Nvidia, especially considering that AMD’s five-year mean P/S is 8. Importantly, AMD came up only a bit shy of profitability, with its net income margin at -0.1% over the last 12 months. Additionally, the company continues to generate robust growth, making a bullish view seem appropriate.

In its most recent earnings release, AMD said its AI engagements rose more than sevenfold. Meanwhile, the company is struggling with falling PC-related demand, which resulted in its first quarterly loss in years. However, AMD guided for double-digit-percentage sequential gains in Data Center and Client revenues for the third quarter.

In fact, the company plans to launch its first accelerator designed for AI in the fourth quarter, suggesting the stock could have much more room to rise over the long term. Nvidia’s supply chain is being pressured by the skyrocketing AI-related demand, presenting an opportunity for AMD. The company should also benefit from sales of the CPUs that data centers use for AI processing, something that Nvidia does not sell.

While AMD is playing a bit of catch-up versus Nvidia on AI, the company’s long-term track record of growth and upcoming products suggest it won’t be lagging its chief competitor for long. Thus, at current valuations, AMD looks attractive as a long-term buy-and-hold option, albeit a risky one.

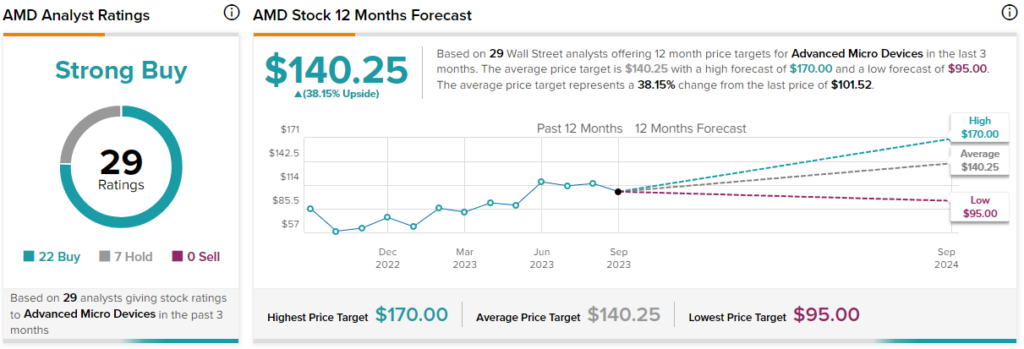

What is the Price Target for AMD Stock?

Advanced Micro Devices has a Strong Buy consensus rating based on 22 Buys, seven Holds, and zero Sell ratings assigned over the last three months. At $140.25, the average Advanced Micro Devices stock price target implies upside potential of 38.2%.

Conclusion: Neutral on NVDA, Long-Term Bullish on AMD

While both companies have benefited from the irrational exuberance over AI, Nvidia is far ahead of AMD, with multiple market watchers estimating the former’s market share of the AI data-center-chip market at 90%. Nevertheless, at some point, valuation becomes an issue, although in Nvidia’s case, the triple-digit revenue growth in the recent quarter offsets some of that concern, resulting in a neutral view.

Although AMD is the winner of this pairing, as more upside seems likely over the long term, Nvidia may also rise further. However, the irrational exuberance its valuation restrain my view on NVDA stock despite the robust revenue growth.