There’s no question that hype has been in the driver’s seat for the broader basket of top artificial intelligence (AI) stocks. Undoubtedly, we’re fresh off one of the worst technology-centered sell-offs since the dot-com bust. As such, it’s not hard to imagine some investors are likely to remain somewhat skeptical about getting on the back of a new momentum-driven trend.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Though AI has fueled quite a bit of valuation multiple expansion across a large number of names that still face considerable macro headwinds, I don’t think you can consider mega-cap AI stocks as a bubble about to burst. Some mega-cap technology names may be on the expensive side, but a lot of them have still yet to hit new highs.

Therefore, let’s check in with TipRanks’ Comparison Tool to tune into three powerful tech giants that could leverage AI to increase their dominance.

1. Microsoft (NASDAQ:MSFT)

ChatGPT was the AI product that sparked the wave of AI enthusiasm back in late 2022. Microsoft’s stake in ChatGPT-maker OpenAI made Microsoft an early “go-to” stock to get one’s AI exposure. In recent quarters, Microsoft has really doubled down on AI by committing to bringing chatbot tech to its broader basket of software offerings.

Indeed, generative AI has become a must-add enhancer or “sweetener” for almost every tech firm these days, and that’s largely thanks to Microsoft. As the company moves forward with its AI rollout, I believe investors are right to forgive nearer-term macro-related headwinds for the longer-term growth runway paved by AI. The road ahead will be bumpy, but I believe it’s still worth staying on the ride. As such, I remain bullish on MSFT stock.

Though I do not doubt Microsoft’s AI prowess (it’s really one of the mega-cap AI pioneers), one must never lose track of the valuation. After Microsoft stock’s AI-assisted 53% surge off its November lows, the price of admission has gone in a hurry. Sure, AI excitement may have gotten a bit ahead of itself. However, I find it hard to believe that we’ll see the stock trading at pre-ChatGPT levels (think the mid-20 times earnings range).

Generative AI has the potential to be transformative, even for multi-trillion-dollar tech companies. At this juncture, AI’s impact on the growth of a company like Microsoft still seems difficult to fathom. If Microsoft can get AI right (regulation and all), it stands to win a lot. Arguably, Microsoft’s track record of seizing opportunities from emerging technological trends makes the stock worth the premium price tag.

At 33.6 times trailing price-to-earnings, the stock is trading slightly above its historical averages. Nonetheless, at the current pace of AI innovation, I don’t view the stock’s historically-stretched multiple as enough reason to take profits quite yet.

What is the Price Target for MSFT Stock?

Microsoft currently comes in at a Strong Buy, with 29 Buys, four Holds, and one Sell. The average MSFT stock price target of $328.70 implies a mere 0.9% gain.

2. Alphabet (NASDAQ:GOOGL)

Microsoft was touted as the AI frontrunner during the first few months of the year. For a while, it certainly did seem like Bing AI would put Google Search on notice. ChatGPT seemed like a more convenient and amusing way to get one’s questions answered, but now that Alphabet has had a chance to flex its AI muscles, the tides are turning back in Google’s favor.

Alphabet’s latest I/O event unveiled a slew of AI innovations that helped fuel a glorious double-digit percentage rally. Investors liked what they saw, and the stock has since been rewarded in a big way. Despite the sharp run, I remain bullish on GOOGL stock as it still looks like one of the cheapest (26.9 times trailing price-to-earnings) ways to gain AI exposure.

Further, the AI-heavy I/O event may help GOOGL stock sustain a rally back to its former highs. Earlier this week, Bank of America (NYSE:BAC) reiterated its “Buy” on the name, noting that Google retains an “edge” over ChatGPT and that there are no signs that ChatGPT is stealing Google’s lunch. Google’s search traffic has been holding steady, and it could gain ground as the firm slowly and cautiously rolls out new AI-driven features.

I like the way Alphabet is playing it cautiously with new AI features. Sure, Alphabet seems to be taking its time relative to Microsoft, but the AI race is one that’s likelier to be won by the firms that move slow and steady, not the one that moves fast and breaks things.

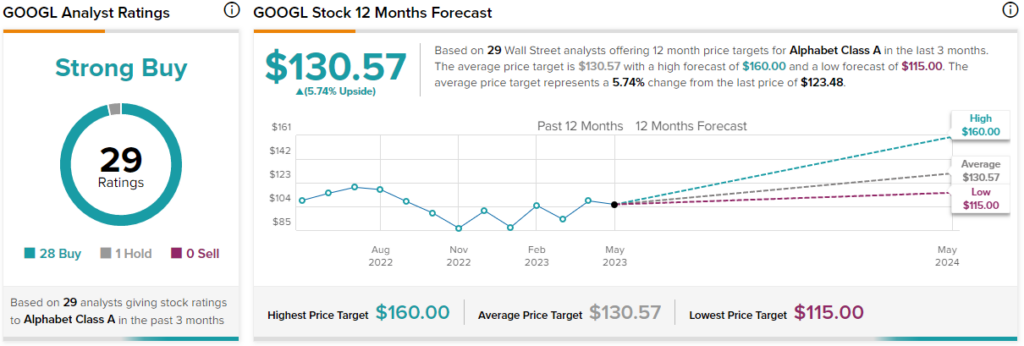

What is the Price Target for GOOGL Stock?

Alphabet sits at a Strong Buy, with 28 Buys and just one Hold. The average GOOGL stock price target of $130.57 implies a 5.7% gain from here.

3. Nvidia (NASDAQ:NVDA)

Nvidia stock shocked and awed as it delivered second-quarter guidance that sparked a ~24% rally today. Indeed, a move of that magnitude is uncommon for a giant like Nvidia, which now has a market cap near $1 trillion. As shares look to flirt with the $400 range, questions linger as to just how high the AI king can fly.

Nvidia has arguably been the biggest mega-cap winner from the AI race and has been a “pick and shovels” sort of play, at least according to Bank of America.

Nowadays, it seems like every firm is loading up on GPUs (Graphics Processing Units) to stay competitive on the AI front. Though it seems like GPU demand will stay higher for longer (the firm forecasted a whopping $11 billion in sales for this quarter against Wall Street’s expectations of $7.2 billion), I continue to find it hard to justify today’s lofty valuations.

I admire CEO Jensen Huang and the company’s dominant position in the AI race. However, I’m just not comfortable running the risk of paying up for many years’ worth of growth right off the bat.

Given the boom-and-bust nature of the stock, I have no issue waiting for the next bust before I’d consider initiating a position. For now, I am bearish, entirely due to valuation.

Deutsche Bank’s (NYSE:DB) Jim Reid recently stated that Nvidia stock is “trading on heroic valuations” and that “time will tell if they are justified.” These comments were made well before the latest spike.

At more than 28 times price-to-sales and 175 times trailing price-to-earnings, there’s little room for error as the stock eclipses new all-time highs.

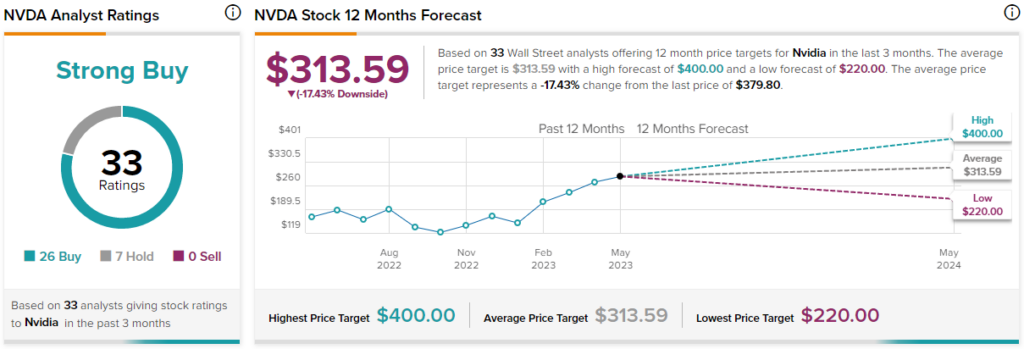

What is the Price Target for NVDA Stock?

Nvidia stock sits at a Strong Buy, with 26 Buys and seven Holds. Nevertheless, the average NVDA stock price target of $313.59 implies 17.4% downside potential.

Conclusion

AI has the potential to be profoundly disruptive. Given the number of doors it can open, a case could be made that valuations aren’t nearly as extended as they could be. Further, the recent rally in AI-driven tech companies may not be over, even if the market takes a step backward step amid U.S. debt ceiling jitters. While analysts (collectively) don’t really expect upside potential from MSFT and NVDA at current prices and expect minimal upside from GOOGL, the stocks are still worth keeping in mind.