Shares of chip makers like Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD) have gained quite a lot, driven by the AI (Artificial Intelligence) boom. While both of these stocks have risen significantly, analysts’ outlook remains positive, and their average price targets suggest considerable upside potential for NVDA and AMD stock from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this backdrop, let’s understand what’s in store for Nvidia and AMD shareholders in the future.

Will Nvidia Stock Go Up?

Nvidia stock has gained about 220% year-to-date. Despite this massive growth, analysts’ average price target indicates that it could increase from current levels. Nvidia has benefitted from the advancements in AI. It witnessed solid demand for its accelerated computing and AI platforms, which drove its revenue and share price.

The company’s management remains upbeat and expects the momentum to be sustained in the coming quarters, led by higher demand for its HGX platform. Furthermore, in response to robust demand from cloud service providers and consumer Internet companies, Nvidia is broadening its enterprise product range and concentrating on enhancing its supply chain.

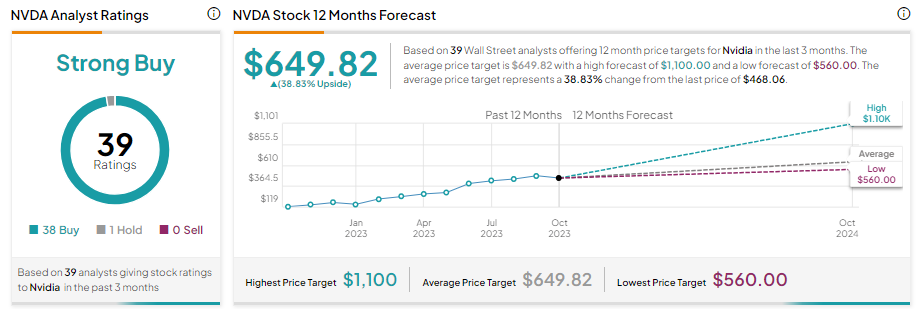

As Nvidia is poised to deliver solid financials, it has received 38 Buy and one Hold recommendations for a Strong Buy consensus rating. At the same time, these analysts’ average price target of $649.82 implies 38.83% upside potential from current levels.

What is the Future of AMD?

Like Nvidia, AMD is also likely to benefit from the strong demand for and deployment of AI. Investors should note that AMD’s CEO, Lisa Su, believes that AI presents multibillion-dollar growth opportunities for the company across several verticals.

Thus, to boost its market share, the company has ramped up its investments in AI. Moreover, AMD introduced new Instinct MI300X GPUs (graphics processing units), which will accelerate its growth as it is the world’s most advanced accelerator for generative AI. The MI300 GPUs are scheduled for release in the fourth quarter. In addition to the AI opportunity, a potential recovery in the PC market will add to the positive momentum in AMD stock.

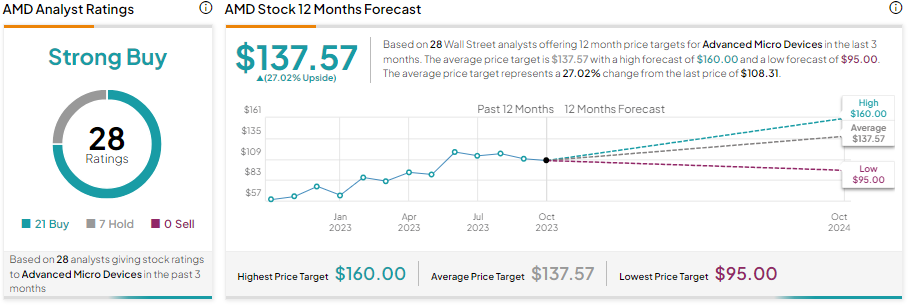

Wall Street analysts are bullish about AMD stock, given its solid growth prospects. It has received 21 Buys and seven Hold recommendations for a Strong Buy consensus rating. The average analysts’ price target of $137.57 implies 27.02% upside potential from current levels.

Bottom Line

The impressive demand for chips and GPUs (graphics processing units) that power AI systems provides a solid platform for growth for NVDA and AMD stock. Both of these companies are likely to capture a substantial market share in the AI space and deliver solid financials. Despite the substantial increase in the value of these stocks, analysts’ average price target suggests considerable upside potential in their prices from current levels.