September saw eight more companies involved in artificial intelligence (AI) commit to the White House to follow security safeguards not currently required by government legislation voluntarily. These eight names are some of the best AI companies.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move began in July with commitments from Amazon (NASDAQ:AMZN), Anthropic, Alphabet’s (NASDAQ:GOOGL) Google, Inflection, Meta Platforms (NASDAQ:META), Microsoft (NASDAQ:MSFT) and OpenAI.

“These commitments, which the companies have chosen to undertake immediately, underscore three principles that must be fundamental to the future of AI – safety, security, and trust – and mark a critical step toward developing responsible AI,” stated the July 21 statement from the White House.

It’s not just the right thing for these companies to do; it’s good business. All of them will make tremendous amounts of money from AI. To be responsible about how the technology evolves is merely taking care of their business interests.

You have four possible AI stocks to buy from the eight names above. With the addition of Adobe (NASDAQ:ADBE), International Business Machines (NYSE:IBM), Palantir (NYSE:PLTR), Nvidia (NASDAQ:NVDA), and Salesforce (NASDAQ:CRM), there are another five possible options.

Here are the three I would buy.

Nvidia (NVDA)

Nvidia stock got some help on September 29 when Citi analysts commented to clients that the chipmaker’s Blackwell B100 GPU would be a significant catalyst to future sales. Its shares rose slightly on the news. They’re now up 206.9% year-to-date.

From a financial standpoint, the company has never been healthier. CEO Jensen Huang’s proactive move to everything AI has created a cash-flow gusher that won’t be shut down for some time. According to reporting from The New York Times, Nvidia now accounts for 70% of AI chip sales.

In Q2 2024, its Data Center revenue was $10.32 billion, 141% higher than Q1 2024 and 171% higher than a year earlier. The segment includes Nvidia’s flagship H100 AI chip. As a result, its free cash flow in the first six months of 2024 was $8.7 billion, about 4x the amount from a year ago. I would not be surprised to see it generate $20 billion in free cash flow for the entire fiscal year.

I’ve liked Nvidia for many years. It all comes down to Huang. He’s easily one of the top CEOs in America. He’s not afraid to make big bets, and they usually pay off.

Adobe (ADBE)

Adobe stock isn’t having the same kind of year in the markets as Nvidia, but it’s still up more than 54% in 2023. In mid-September, the content creation software provider launched Adobe Firefly, the company’s generative AI platform.

“With over 2 billion images generated during the Firefly beta, Generative AI is ushering in a new era of creative expression for customers across every segment,” said David Wadhwani, president, Digital Media Business, Adobe.

At the same time it launched Firefly, it released its Q3-2023 results. It reported record quarterly revenue of $4.89 billion, 13% higher excluding currency over Q2 2022. It finished the quarter with Remaining Performance Obligations (RPOs) of $15.7 billion.

The company is also raising prices for its Creative Cloud subscriptions. For the nine months ended September 1, 2023, its subscription revenue rose 9% to $13.5 billion.

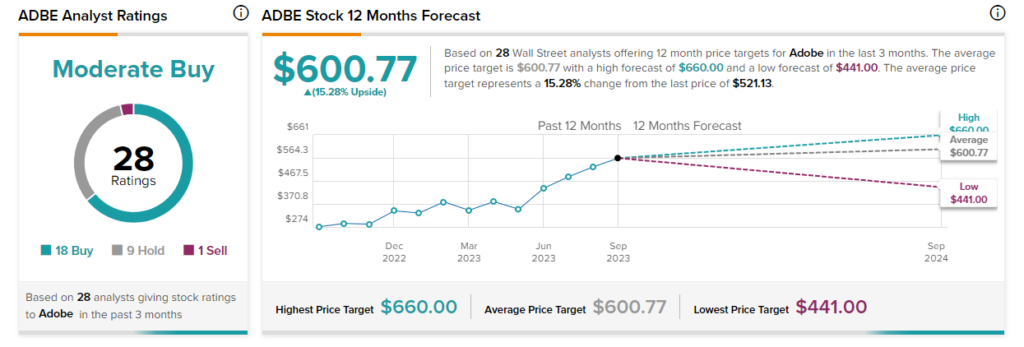

Analysts generally like ADBE stock. Of the 28 who have covered it in the past three months, 27 rate it Hold or an outright Buy — I consider anything over 50% good — with a consensus target price of $600.77, 15% higher than where it’s currently trading.

I like Adobe for two reasons: its customers are very loyal, and Firefly will help it make them more so.

Microsoft (MSFT)

It’s hard to believe that Microsoft has the worst performance of these three stocks in 2023, up 31.3% year-to-date. However, over the past five years, its stock is up 202.9%, nearly double the performance of the Nasdaq 100 (NDX). Over the long haul, it’s hard to go wrong with MSFT.

Goldman Sachs analyst Kash Rangan believes Microsoft’s AI initiatives are on track to provide it with another significant revenue stream.

“Microsoft’s speed to market, strong presence across the tech stack and well-established footprint within the enterprise give us confidence that Microsoft is well positioned to drive growth on the back of these announcements and be a key leader in the Gen-AI era,” CNBC reported, quoting the analyst’s comments on October 1.

Further, the company’s Microsoft 365 product should continue to capture more of the $135 billion total addressable market it competes in. And that doesn’t consider Azure, Windows, and all its other products and services.

Fifty-two analysts cover MSFT stock, and 34 have given ratings in the past three months. Rangan has a Buy rating and a $400 target price, while all the remaining analysts have a Hold or outright Buy rating on the stock, with a $397.19 consensus price target, implying 23.4% upside potential.

I like Microsoft stock because CEO Satya Nadella continues to create significant revenue streams across the most crucial tech areas, including AI and the cloud. Nadella and Huang are two of the best CEOs.