Nutrien (NYSE:NTR) is a fertilizer company that produces and sells potash, nitrogen, and phosphate nutrients. These nutrients help increase the productivity of farmers around the world by increasing crop yields and plant growth. Nutrien also has a fairly comprehensive retail business, concentrated in North America, Australia, and Brazil. I’m bullish on Nutrien because I believe the company is approaching a cyclical bottom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nutrien’s Business and Competitive Advantage

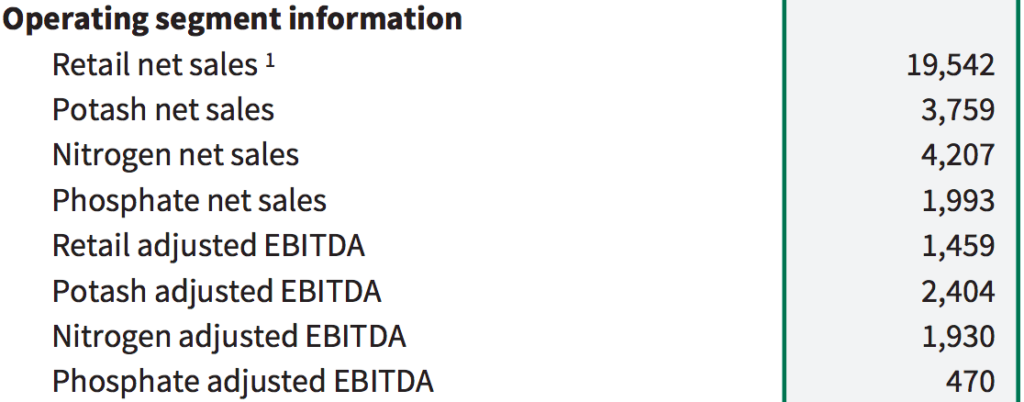

Nutrien generates sales and EBITDA through four segments: Retail, Potash, Nitrogen, and Phosphate, as shown in the image below. In 2023, the adjusted EBITDA margins for these four segments were 7%, 64%, 46%, and 24%, respectively. These margins indicate that Nutrien has a definite cost advantage in Potash and Nitrogen.

Nutrien mines potash at a very low cost in Canada. Its Nitrogen business is also cost-advantaged because it operates in the United States and Canada, where natural gas input costs are low. This allows Nutrien to earn profits and return cash to shareholders throughout the economic cycle despite being a commodity producer.

The Retail and Phosphate segments round out Nutrien’s business, but the competitive advantages here aren’t as strong. Retailing is a low-margin business, but Nutrien does benefit from a strong brand and entrenched relationships. Nutrien’s retail business supports its other businesses because it makes Nutrien vertically integrated. Unfortunately, the company has no competitive advantage in Phosphate, where margins are low and costs are high.

A Cyclical Bottom?

Nutrien’s earnings will likely follow potash and nitrogen prices lower in the near term. The price of these fertilizers spiked in 2022 due to the Russia/Ukraine conflict. The price of potash, for example, went from $245/mt in March 2020 to $321/mt in March 2021 to $978/mt in March 2022 and then all the way back down to $289/mt at the end of February 2024.

So, why did prices collapse like this? Well, a lot of Russian supply came back online, affecting the supply/demand balance. The market may also be anticipating increased supply from BHP’s new $10.5 billion potash mine, which is expected to come online at the end of 2026.

Despite all this bad news, I think the price environment could improve. Potash prices are now below the $310/mt marginal cost of production. If this continues, some of the higher-cost fertilizer companies could begin to lose money (note that Nutrien historically hasn’t because it has the cost advantage).

I believe its likely that Russian inventories will come down, and BHP’s increased supply won’t come online for another 2.5 years. This leaves room for fertilizer prices to increase in the near term, potentially boosting Nutrien’s 2025 profits and cash flow.

Nutrien Stock Is Cheap

With a cyclical stock like Nutrien, it’s better to look at average earnings rather than current earnings. The past several years have seen booms and busts in fertilizer prices. Since its 2018 merger, Nutrien’s averaged $2.85 billion of net income. When you consider that Nutrien has both increased its asset base and decreased its share count over this time, the stock looks quite cheap at ~$55 per share and a market cap of $27 billion.

I suspect 2022 was an anomaly due to the Russia/Ukraine conflict, but normalized earnings are probably still around $2 billion, or $4 per share. Nutrien is also a company with ample potash and phosphate reserves and long-term tailwinds. As the world’s population and per-capita GDP grow, demand for food should increase.

Over time, China and India may also begin to use more fertilizer to increase crop efficiency. This, combined with Nutrien’s propensity for share buybacks, should result in decent EPS growth.

Is NTR Stock a Buy, According to Analysts?

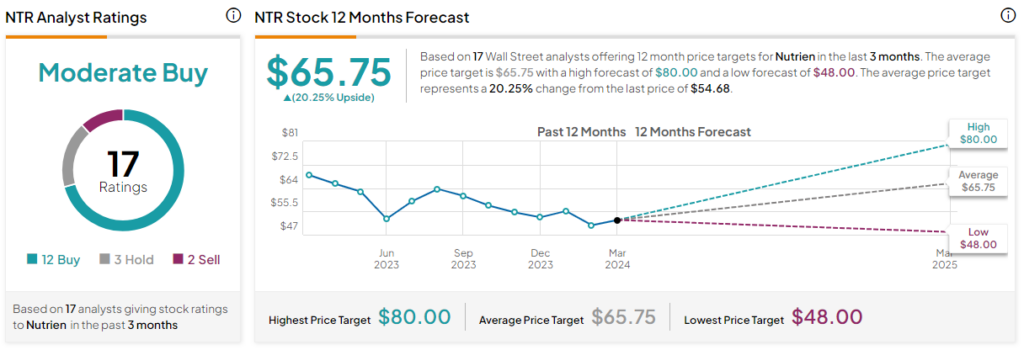

Currently, 12 out of 17 analysts covering NTR give it a Buy rating, three rate it a Hold, and two analysts rate it a Sell, resulting in a Moderate Buy consensus rating. The average NTR stock price target is $65.75, implying upside potential of 20.25%. Analyst price targets range from a low of $48 per share to a high of $80 per share.

The Bottom Line on NTR Stock

Nutrien is a globally diversified producer and retailer of fertilizers. The company is cost-advantaged in both potash and nitrogen fertilizer production, and it is vertically integrated from production to distribution.

Potash prices have crashed to levels below the estimated marginal cost of production. This was the result of Russian supply coming back online, but I think potash prices could rebound in 2024 and 2025. With Nutrien trading at a low multiple of its average earnings, the stock appears to have upside potential. I have not yet owned any NTR stock, but I will consider it if the price approaches $40/share. This would clear my expected return threshold.