After a disastrous 2022 impacted by underwhelming sales of its Covid-19 vaccine NVX-CoV2373, which saw the shares lose a brutal 93% of their value, Novavax (NVAX) investors will be hoping the company can be one of 2023’s turnaround stories.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It remains to be seen whether that’s the narrative that will unfold, but meanwhile H.C. Wainwright’s Vernon Bernardino thinks the company will be capable of doing so.

The 5-star analyst’s latest endorsement comes on the back of Novavax announcing the initiation of a Phase 2 trial for its COVID-19-Influenza Combination (CIC) vaccine candidate, in addition to a stand-alone flu vaccine candidate.

Bernardino thinks that partially on account of it being new technology in addition to some “significant side effects,”mRNA-based Covid-19 vaccines’ popularity has peaked, and that makes NVX-CoV2373 an “important alternative.”

“Thus,” says Bernardino, “we are positive on advancement of this CIC vaccine as NVX-CoV2373 has demonstrated high rates of protection against COVID-19 infection, hospitalization and death, comparable to protection observed with mRNA-based vaccines.”

Also standing in the vaccine’s stead are the CIC vaccine candidate’s “positive” Phase 1/2 results from earlier in 2022. These indicate the “high potential” for positive results in Phase 2 and Phase 3 testing.

Moreover, given the positive Phase 3 results of both the Covid-19 and influenza vaccines, Bernardino believes Novavax is “closest to a Biologics Licensing Application (BLA) and potentially offering a CIC vaccine for future global distribution.”

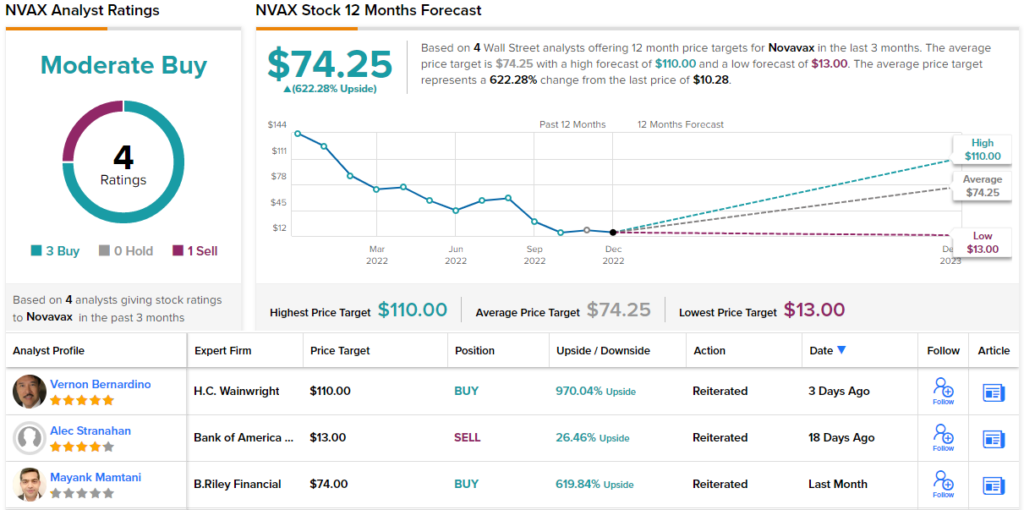

With anticipation of a catalyst in mid-2023 from the the CIC Phase 2 trial’s initial results, Bernardino sticks with a Buy rating. That said, given the company has lowered its total revenue guidance for 2022 from the range between $4 billion to $5 billion to between $2.0 billion to $2.3 billion, the price target is reduced from $207 to $110. No need to get too despondent; there’s still potential upside of a huge 970% from current levels. (To watch Bernardino’s track record, click here)

On Wall Street, one analyst remains in the NVAX bear camp, but 2 others join Bernardino in the bull enclave, giving this stock its Moderate Buy consensus rating. At $74.25, the average target might not be quite as exuberant as Bernardino’s but could still generate a mighty return of 622% in the year ahead. (See Novavax stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.