Norwegian Cruise Line Holdings (NYSE:NCLH) isn’t in perfect financial condition. However, last Friday’s drop in Norwegian Cruise Line stock, which is continuing into today’s trading session, is inexplicable. Consequently, I am bullish on NCLH stock and expect it to recover within the next couple of weeks.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Miami-headquartered Norwegian Cruise Line is a famous cruise ship operator. Like some other cruise lines, Norwegian struggled during the peak of the COVID-19 pandemic but is now back in operation and working hard to regain its financial footing.

As we’ll see, analysts generally have a favorable outlook for Norwegian Cruise Line. On the other hand, a recent plunge in the NCLH share price indicates that short-term traders haven’t been in a bullish mood. So, let’s see if we can figure out what actually happened. Although I’ll admit, making sense of a senseless market isn’t such an easy task.

Norwegian Cruise Line Suddenly Drops – but Why?

The main stock market indices were slightly down on Friday, but it wasn’t a bloodbath by any means. Consequently, it was baffling and frustrating to watch NCLH stock fall by 7.45% in a single trading session.

In comparison, Carnival (NYSE:CCL) stock declined by 2.77%, and Royal Caribbean (NYSE:RCL) stock was down 3.27% on Friday. Thus, it’s fair to say that traders generally weren’t buying cruise ship stocks, but they really took Norwegian Cruise Line stock to the woodshed for some reason.

I scoured the financial headlines to try to figure this out. There wasn’t a sudden, new COVID-19 outbreak on Friday. Also, oil is above $90 per barrel, but that’s been the case since September 14.

One X/Twitter user suggested that Norwegian Cruise Line converted its debt to stock shares on Friday, but I couldn’t confirm this. On the other hand, a StockTwits post attributed the NCLH stock plunge to a resurgence of recession fears. Yet, the oil price (if that’s to be a recession catalyst) has been elevated for a while now, and the Federal Reserve hinted at “higher-for-longer” interest rates on Wednesday, not Friday.

At the end of the day, I just stopped asking “why” and just chalked it up to irrational, inexplicable short-term trading psychology. Does this mean it’s time for contrarian investors to consider buying the dip, though?

Analyst Sees a “Clear” Growth Opportunity for Norwegian Cruise Line

Personally, I think it’s a great time to think about scooping up some Norwegian Cruise Line shares at a discount. Furthermore, at least one prominent analyst seems to envision calmer seas, if not smooth sailing, for Norwegian.

Bear in mind that Norwegian Cruise Line actually flipped from income-negative to profitable in 2023’s second quarter while also beating Wall Street’s consensus EPS forecast. Moreover, analysts are generally expecting Norwegian to post another income-positive quarter for Q3.

Plus, Redburn analyst Alex Brignall seemed to suggest a brighter future for Norwegian Cruise Line. Brignall upgraded NCLH stock from Neutral to Buy not long ago and published a $25 price target on the stock, which is significantly higher than the current price.

According to the Redburn analyst, the fundamental investment case for the cruise lines of strong secular growth and margin opportunity (including Norwegian Cruise Line, presumably) “is clear.” Brignall also observed, “Today, with debt falling and profitability improving, the sector has exited intensive care and the fundamental investment case is becoming clearer.”

As I explained earlier, it’s definitely fair to say that Norwegian Cruise Line’s profitability is “improving” (to use Brignall’s phrasing). As far as Norwegian’s debt is concerned, it might not be falling, but it’s at least holding steady. So, enterprising investors should keep an eye on Norwegian Cruise Line and monitor the company’s upcoming financial reports.

Is NCLH Stock a Buy, According to Analysts?

On TipRanks, NCLH comes in as a Moderate Buy based on five Buys, eight Holds, and only one Sell rating assigned by analysts in the past three months. The average Norwegian Cruise Line stock price target is $21.18, implying 39.4% upside potential — not too shabby if their forecasts turn out to be true.

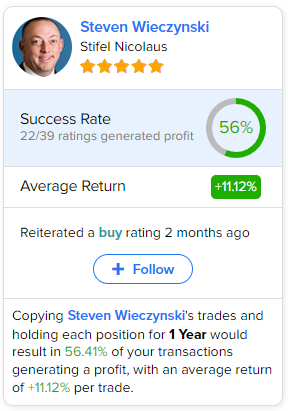

If you’re wondering which analyst you should follow if you want to buy and sell NCLH stock, the most profitable analyst covering the stock (on a one-year timeframe) is Steven Wieczynski of Stifel Nicolaus, with an average return of 11.12% per rating and a 56% success rate. Click on the image below to learn more.

Conclusion: Should You Consider NCLH Stock?

Risk-averse financial traders might not want to invest in Norwegian Cruise Line Holdings. On Friday, we witnessed an example of how volatile cruise ship stocks can be and of how random short-term share price moves are sometimes.

Nonetheless, Norwegian Cruise Line looks like a company that traders might hate one day but then flip back to liking it just a few days later. Hence, dyed-in-the-wool contrarians should consider NCLH stock if they envision an opportunity for Norwegian to improve its financials and for the market to stop selling the stock for no apparent reason.