With some of the world’s top athletic apparel brands, Nike (NKE) and Adidas (ADDYY), stepping off the international stage at the 2024 Paris Olympic Games, questions linger about which of these leading names might emerge as the better buy post-Olympics. Analysts had anticipated that the Olympics could serve as a catalyst to help reverse the fortunes of these top apparel players, who have struggled in recent years. The early signs suggest a positive shift for both stocks, which supports my bullish outlook on Nike and Adidas.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Given the recent stock performance, I am optimistic about both Nike and Adidas. Nike’s significant 13% increase and Adidas’ 4% rise since the end of the Olympics are clear indicators that the Olympic spotlight has benefited these brands. The boost in share prices not only reflects the immediate impact of their enhanced visibility but also supports my belief that both companies are well-positioned to leverage their Olympic exposure into sustained growth.

Nike’s Demonstrates Market Strength and Future Prospects

Turning to Nike’s specific performance, I am particularly bullish because the company stole the show during the Paris 2024 Games. Its iconic swoosh was front and center on Team USA, which tied with China for the most gold medals. The company’s marketing push featuring LeBron James and Kylian Mbappe, timed perfectly with the Games, should pay off nicely in the near future.

Even though Nike’s stock has bounced back 17.6% since its August lows, it’s still trading at a low trailing P/E ratio of 22.5, suggesting it’s undervalued. This situation indicates that Nike has a great chance for continued growth as it builds on its boosted brand image and favorable valuation.

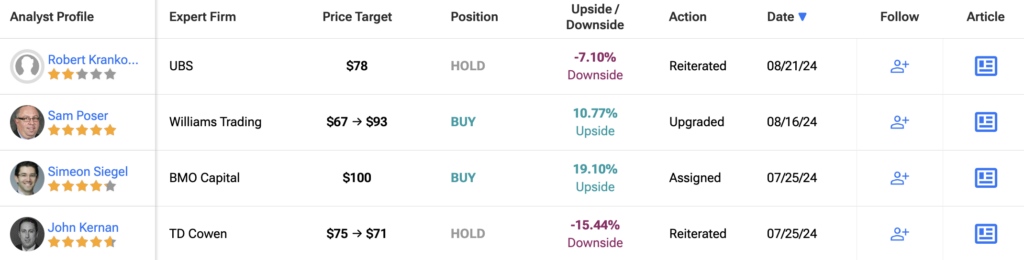

Furthermore, I am encouraged by analysts’ positive outlook on Nike, which supports my bullish view. Evercore ISI analyst Michael Binetti has set a Buy rating on Nike with a price target of $105, suggesting a 24.8% upside from current levels. Binetti’s view that Nike’s turnaround will take time but is on track reinforces my belief in the company’s potential for long-term gains. The overall analyst sentiment is a Moderate Buy based on 15 Buys and 16 Holds. The average NKE price target of $93.17 implies an 11% upside potential from current levels. This further confirms my optimistic view on Nike’s future performance.

Adidas Shows Strong Performance and Potential Market Gains

Similarly, Adidas also had a strong showing at the Paris Games, with its logo visible on athletes from 18 nations. The upcoming Paralympic Games present Adidas with an opportunity to showcase new training gear designed for athletes with disabilities. Despite a 136% increase from its October 2022 lows, Adidas stock remains down over 35% from its 2021 highs, suggesting room for further growth. This potential for market expansion supports my bullish view on Adidas because it shows the brand’s ongoing efforts and market presence could drive future gains.

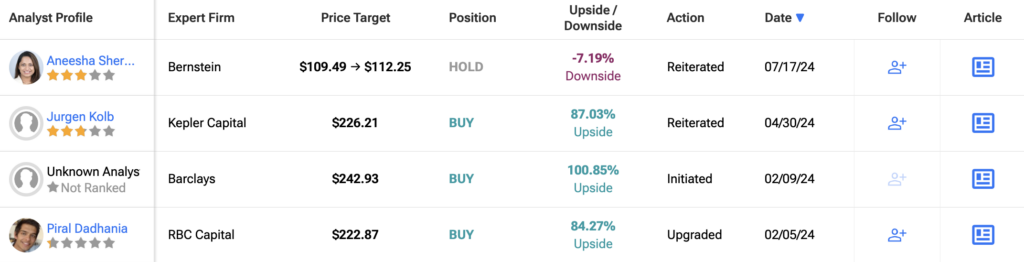

Although Adidas’ forward P/E ratio of 63.6 times is higher than Nike’s, the premium could be justified if the company successfully narrows the gap with Nike in key markets. Despite a recent Hold rating, the average price target of $112.25 implies a generally positive outlook. This reinforces the author’s bullish stance, as the valuation reflects confidence in Adidas’ continued growth potential and ability to capitalize on its strong market position.

See more ADDYY analyst ratings

Paralympics Set to Boost Brand Presence

Looking ahead, we don’t yet know how much of a sales boost the Olympics will give Nike and Adidas. But with the Paralympic Games coming up soon, both brands have another shot to strengthen their market presence and build even more brand loyalty. This ongoing visibility from major global events backs up my positive outlook, as it shows that both companies are set to make the most of these marketing chances to drive future growth.

Key Takeaway: Positive Outlook for Both Brands

In summary, both Nike and Adidas are positioned for success following their notable performances at the Olympic Games. Nike’s favorable valuation and recovery potential, along with Adidas’ ongoing market gains and expansion opportunities, support a positive outlook for both brands. While analysts show a slight preference for Nike due to its valuation, I am confident in the growth prospects for both companies. Overall, I lean towards Nike for its valuation and recovery potential but remain bullish on both apparel giants.