Nio Inc. (NYSE:NIO) shares have had a rough month of September, losing a staggering 17.5% of their value.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Obviously, earnings were part of the problem. Reporting on its Q2 performance in late August, Nio missed on both top and bottom lines, with sales coming in at just $1.2 billion — down 15% year over year — and no earnings at all, but rather a loss of $0.51 per share, which was 53.5% worse than analysts had expected. But Nio compounded its problems with investors last week, when it announced that in an effort to shore up a balance sheet weakened by continued losses, it would issue at least $1 billion worth of “convertible senior notes.”

That’s debt, which is convertible into new shares that would dilute investors’ stake in the company. Furthermore, management noted that it might potentially issue as much as $1.15 billion worth of such debt if there was enough market demand.

Rumors that Nio’s troubles are even worse than they seem, appear to have dogged the stock ever since — and to such an extent that on Monday this week, Nio felt compelled to address the rumors and “respond to market speculations” about its financial health:

“The Company has been made aware of certain media speculations claiming that the Company is considering raising certain capital from investors,” noted management. But management reassured investors that “the Company currently has no reportable capital raising activity, other than the recent convertible notes offering that was completed on September 25, 2023.”

In other words, management assured investors that the $1 billion to $1.15 billion in debt is all it needs (at least for now). Furthermore, management advised that it had already taken half the money raised from the initial $1 billion in debt, and used it to roll over $500 million in old debt. The remaining $500 million to $650 million, therefore, will presumably be used “to further strengthen [Nio’s] balance sheet position as well as for general corporate purposes.”

So what should investors take away from all of the above?

As expected, Nio is using the bulk of its new debt to pay off old debt, which doesn’t sound so bad. But there are two caveats. First, the old debt that Nio is paying off paid interest rates of 0% to 0.5% — but the new debt it’s using to pay off that old debt pays interest rates of 3.9% and 4.6%! So Nio’s interest expense is going to rise a bit. $1 billion in new debt, paying an average of about 4.25%, will cost the company an additional $42.5 million in interest over the lifetime of the debt.

Granted, spread across Nio’s 1.8 billion shares outstanding, this works out to only $0.02 per share in profit lost to interest payments. That’s not a huge amount, but it still makes it that much harder for Nio stock to reach profitability.

And second: the fact that Nio has to take out debt at all, and at increasingly onerous terms, rather than generating cash on its own to roll over (or better yet, pay down) its debt, is obviously not great news for Nio.

Investors are right to be disappointed by this development, even if “the Company currently has no [new] reportable capital raising activity,” for now.

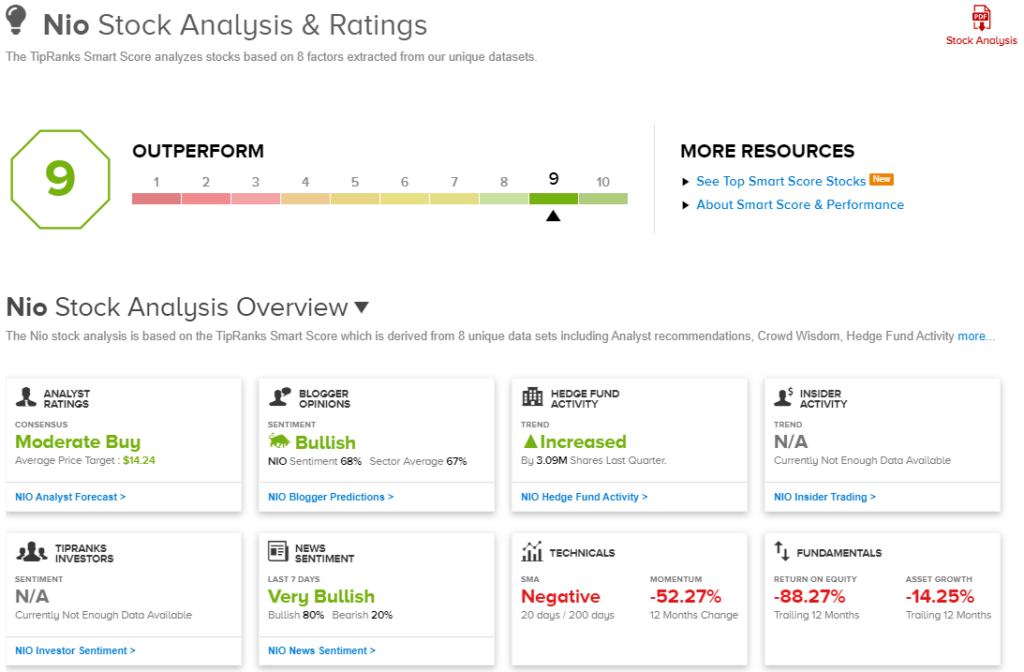

So, what should you make of NIO stock? Currently, NIO sports a solid Smart Score of 9 out of 10, suggesting that it can outperform the market.

Smart Score is TipRanks’ proprietary quantitative stock scoring system that evaluates stocks on eight different market factors. The result is data-driven and does not involve any human intervention.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.