The good times are back for Nio (NYSE:NIO). The shares have gained almost 40% over the past month boosted by a nice bounce for deliveries in June, which marked a turnaround after months of declining sales.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the latest data checks from Morgan Stanley analyst Tim Hsiao, considering the visits made to Nio’s stores in major Chinese cities last month, that is not all that surprising.

On the back of the official respective launches on May 24 and June 15 of new models of ES6 and ET5 touring, consumers have been heading to the stores to get an in-depth look at what’s on offer. The data shows that foot traffic in NIO’s flagship stores in tier 1 cities rose by ~10% month-over-month in June. In terms of absolute volume, foot traffic has surpassed the levels reached toward the end of last October, the highest they have been over the past nine months.

Hsiao has also held talks with salespeople at the stores, and they have indicated that, in June, all models saw “solid sequential growth.” The strength was driven by the all-new ES6 and ET5 series, which combined represented ~80% of all orders. While their contributions weren’t as big, the ES8 and EC7 also registered “exponential growth.”

According to a number of salespeople, the overall new order intake nearly doubled in June to reach 18-20K units. That’s the highest level it has been at since the official launch of the ET5 last September. In the last week of June (June 26 – July 2), Nio delivered 4,100 units, amounting to a 29% week-over-week increase and representing a year-to-date peak.

Despite the recent uptick, Nio hasn’t done quite as well as some of its peers recently, a situation that might be about to change, although Hsiao thinks Nio still remains a ‘show-me’ stock until there is further proof of execution.

“Following startup peer, XPeng’s outperformance in the past few weeks, we look for laggards, like NIO, to gain traction,” Hsiao wrote. “That said, it would take a few more rounds of guidance ‘meet or beat’ to fully restore market confidence in NIO, in our view.”

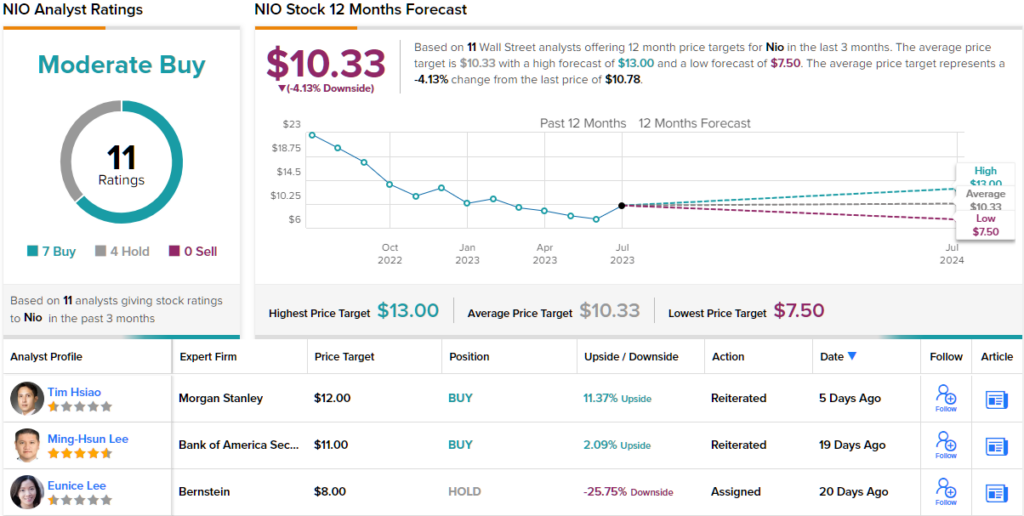

All told, Hsiao reiterated an Overweight (i.e., Buy) rating on the shares along with a $12 price target, implying the stock will deliver returns of 11% over the coming months. (To watch Hsiao’s track record, click here)

On Wall Street, 6 analysts join Hsiao in the bull camp and with an additional 4 Holds, the stock receives a Moderate Buy consensus rating. It looks like most think the shares are currently fairly valued; the $10.33 average target suggests they will stay rangebound for the foreseeable future. (See Nio stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.