Recently, Chinese EV manufacturing giant NIO (NYSE:NIO) made waves by inking a deal with sector compatriot Changan Automobile. Under the terms of the partnership agreement, the two parties will jointly facilitate the formulation of standards for swappable batteries. Within the past several days, it also inked a similar agreement with Geely Automobile (OTC:GELYF). Still, the battery swap directive presents both advantages and significant disadvantages. Given the ambiguities, I am neutral on NIO stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A Bold Step Could Help NIO Stock

According to the International Energy Agency, 2022 represented another record year for EV sales. Significantly, the sector reached a new milestone despite various headwinds such as supply chain disruptions and geopolitical uncertainty. Globally, electric car sales – including battery electric vehicles (BEVs) and plug-in hybrid EVs (PHEVs) – exceeded the 10-million-unit mark. On paper, that’s a positive catalyst for NIO stock.

After all, half of the world’s electric cars are in China, states the aforementioned agency. However, further adoption of EVs may encounter difficulty because of the inconveniences associated with charging. Per the U.S. Department of Transportation, a fast-charging system can charge an EV to 80% between 20 minutes to an hour. Theoretically, a driver can shop for groceries or run other errands while their EV gets juiced up.

However, the combustion-powered paradigm still dominates roadways. What’s more, it doesn’t take much time to fill up a typical sedan or SUV. To remedy this situation, NIO goes against the conventional wisdom of building out more charging infrastructure. Instead, it seeks to expand its battery-swapping stations.

Battery swapping is exactly what it sounds like — swapping out an expended battery pack for a fully charged one. Even better, NIO claims that it can swap batteries in as little as three minutes. If so, NIO drivers can expect about an 80% reduction in wasted time compared to the fastest fast charger.

On paper, this should move the needle for NIO stock. However, battery swapping comes with other challenges that shouldn’t be ignored.

Investors Still Need to be Cautious About the Directive

To be clear, NIO’s efforts to distinguish itself amid an extremely competitive field are noteworthy. However, distinction alone doesn’t mean much unless it’s productive or profitable. And that’s the main issue behind NIO stock and the underlying battery-swapping approach. Like it or not, the protocol features many disadvantages that investors need to be aware of.

First, computability concerns long plagued the process and may continue to do so unless standardization is achieved. Essentially, the EV market features numerous battery types. Some manufacturers – likely seeking an edge – deploy different configurations or chemical compounds. Even within the same EV model, batteries might differ depending on the trim or year of production.

Frankly, it’s just not economically feasible to store different batteries for every EV out there. On a related note, safety concerns exist regarding battery swapping. Due to their weight and fire risk, swapping operators require specialized equipment to handle them safely. However, accidents can always occur, which can be devastating due to the challenges associated with battery fires.

Second, battery swapping stations require a heavy investment in infrastructure. Of course, NIO’s partnerships with other Chinese automakers will help spread the cost. Nevertheless, the costs can be enormous because they involve both short and long-term considerations. Beyond the initial large infrastructural investment, each individual station will require specialized equipment along with enough space to store batteries.

With NIO announcing a 10% workforce reduction not too long ago, such heavy outflows appear to contradict the efficiency directive.

Finally, NIO may have difficulty selling the idea of battery swaps abroad. For example, the U.S. invested billions into building out public charging infrastructure. If customers become accustomed to charging, then the swapping concept may fall flat.

Not Great Value, Either

With the magnitude of risk associated with the battery-swapping process, investors will probably need an extra catalyst to help convince them to take a shot with NIO stock. Unfortunately, the valuation front won’t provide much support.

Currently, NIO carries a price-to-sales (PS) ratio of 1.7x. In contrast, the revenue multiple for the auto manufacturing sector sits at only 0.7x. Moreover, NIO is no longer a growth darling. In fact, based on its trailing-12-month sales performance through the second quarter of this year, revenue growth came in negative.

Moving forward, it’s possible that increased sales could be much harder to come by, adding risk to NIO stock.

Is NIO Stock a Buy, According to Analysts?

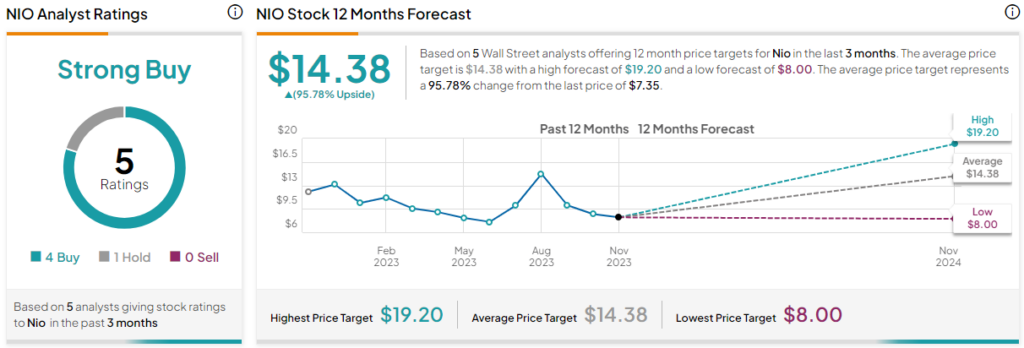

Turning to Wall Street, NIO stock has a Strong Buy consensus rating based on four Buys, one Hold, and zero Sell ratings. The average NIO stock price target is $14.38, implying 95.8% upside potential.

The Takeaway: Different Doesn’t Necessarily Mean Better for NIO Stock

On the surface, NIO’s willingness to march to its own beat regarding battery swaps is commendable amid a fiercely competitive environment. However, that distinction alone doesn’t guarantee success for NIO stock. Looking further into the details, the underlying protocol also suffers from many disadvantages that investors should consider before making an investment decision.