NIO (NYSE:NIO) is making a push for affordable vehicles, but not in the U.S. or China. You’ll have to keep reading to get the scoop on NIO’s surprising recent moves to steal crucial market share from the likes of Tesla (NASDAQ:TSLA). I am also bullish on NIO stock because the automaker just released impressive monthly vehicle delivery results.

NIO is an electric vehicle (EV) manufacturer that’s based in China but has international ambitions. I can actually envision NIO posing a serious threat to Tesla over the next few years.

This doesn’t mean that NIO stock will double or triple in 2023. It’s a long-term story that will take months or years to unfold. NIO stock is far below its peak price, though, and there’s definitely room to rally if the company continues to make all the right moves.

NIO Stuns EV Fans with SUV Deliveries and Radar Tech Partnership

As soon as you think you’ve got NIO figured out, the company comes along with new surprises. First and foremost, NIO reportedly (and unexpectedly) commenced deliveries of the automaker’s EC7 coupe SUV models in China last month.

Apparently, automotive shoppers in Wuhan, Hefei, and several other Chinese cities won’t have to wait any longer to get their hands on a brand-new NIO EC7. This vehicle model has a range of 940 kilometers and can go from zero to 100 kilometers per hour in just 3.8 seconds. Last year, NIO announced that EC7 deliveries in China would start in May. So, this was a nice surprise for eager EV buyers.

Plus, in another head-turning development, NIO is advancing quickly into the self-driving EV market as the company plans to deploy NXP Semiconductors’ (NASDAQ:NXPI) automotive radar technology. NXP, according to the press release, has a “4D imaging radar solution” that assists vehicles with object detection and classification.

Moreover, this technology can expand a vehicle’s radar capabilities “from measuring range and speed, to include direction, angle of arrival, and elevation measurement.” This collaboration could help NIO get ahead of the crowd as self-driving vehicles become more commonplace.

NIO Demonstrates Delivery Growth and Plans to Launch an Affordable EV

In case all that wasn’t enough to convince you, here’s a two-pack of positive news concerning NIO. To start off, we should observe that NIO just released its EV delivery figures for the month of April, and it’s clear that the automaker is selling plenty of vehicles.

As you may recall, NIO grew its vehicle deliveries by 20.5% year-over-year during the first quarter of 2023. That was an exciting quarter for the company because NIO had just launched its network of battery-swapping stations. Fast-forward to April, and NIO kept its forward momentum going, as the company increased its EV deliveries by 31.2% year-over-year during that month.

On top of all that, NIO reportedly just revealed plans to introduce an affordable EV, but not in China or even in the U.S. Rather, it will be a small vehicle that NIO intends to sell in Europe. The target price for this vehicle will be less than 30,000 euros, which would equate to around $33,165. This is a savvy strategy for NIO, as Europe’s economy isn’t running hot in 2023, and an affordable EV could be a best-seller.

Is NIO Stock a Buy, According to Analysts?

Turning to Wall Street, NIO stock comes in as a Moderate Buy based on six Buys and three Hold ratings. The average NIO stock price target is $14.92, implying 85.1% upside potential.

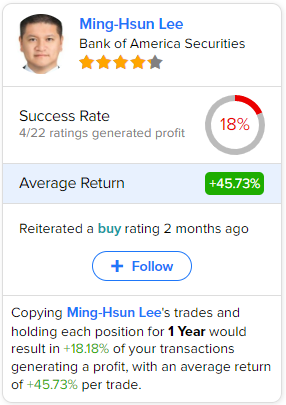

If you’re wondering which analyst you should follow if you want to buy and sell NIO stock, the most profitable analyst covering NIO stock (on a one-year timeframe) is Ming-Hsun Lee of Bank of America (NYSE:BAC), with an average return of 45.73% per rating. See below.

Conclusion: Should You Consider NIO Stock?

From collaborating to deploy self-driving technology to planning a low-priced EV for the European market, NIO is making moves now to potentially steal global market share from Tesla. However, these changes won’t happen overnight, and investors need to be patient.

Still, it’s exciting to witness NIO’s growth and to learn about the company’s ambitious plans for the future. So, I’m feeling bullish about NIO stock for the rest of this year and the next few years, and I believe EV stock investors should consider owning the stock.