Nio’s (NASDAQ:NIO) recent quarterly results were a disappointing affair with the Chinese EV maker delivering bigger-than-expected losses. The aim for the company, as management has stated, is to find the right balance between volume and profitability. At the same time, Nio wants to preserve its brand and take share in the luxury EV market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

On the volume side, Morgan Stanley Tim Hsiao thinks there are several initiatives that will help the company meet its goals.

“On top of the 5 upcoming models to expand NIO’s product offering as both volume drivers and brand shapers, the accelerating deployment power swap network and the fast iteration of NOP+ (Navigate on Pilot) assisted driving software could meaningfully enhance the user experience and hence drive vehicle sales to NIO’s monthly target of 30k units by year end,” the analyst explained.

As far as improving the profitability profile, while Nio anticipates that in 1Q23 vehicle margins will continue to be negatively impacted from the legacy ES6/EC6/ES8 models, the company expects margins will bounce back to mid-teens in 2Q23. The coming months should see the launch of new NT2.0 products and when combined with “economies of scale,” the company is confident that by 4Q23 it will reach its 18-20% GpM target.

The company should also benefit from its plan to invest in expanding its power swap network to lower-tier cities. 300 of the power swap stations being built this year will be in tier 1 and 2 cities and 400 will be situated alongside highways. The remaining 300 will be built in tier 3 and 4 cities, where traditional luxury brands remain beneficiaries of early-mover advantage.

“NIO believes that enhancement of the charging experience and word-of-mouth marketing will meaningfully increase its mind share in lower-tier cities,” Hsiao noted.

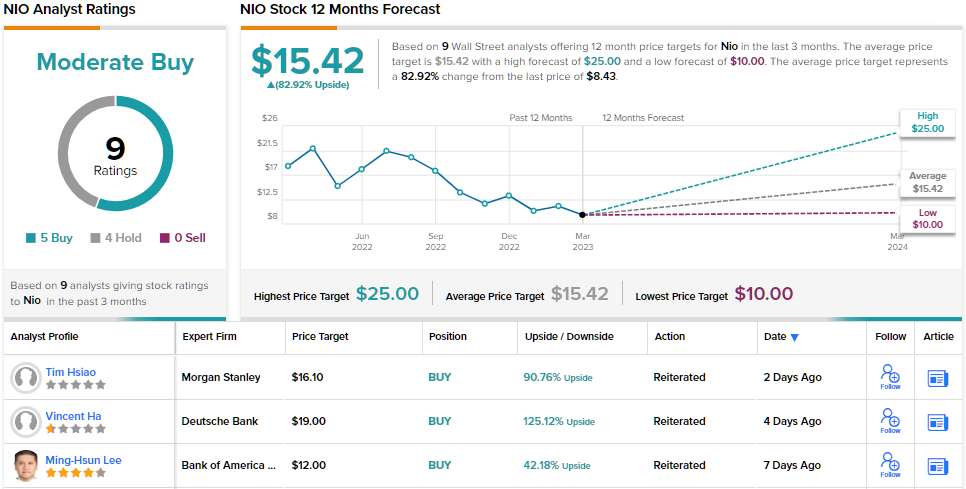

Down to the nitty-gritty, what does it all mean for investors? The Morgan Stanley analyst reiterated an Overweight (i.e., Buy) rating on NIO shares, along with a $16.10 price target. Should the target be met, investors are looking at returns of ~91% in the year ahead. (To watch Hsiao’s track record, click here)

Turning now to the rest of the Street, 5 Buys and 4 Holds have been assigned in the last three months. As a result, the analyst consensus rates NIO a Moderate Buy. Based on the $15.42 average price target, shares could gain ~83% in the next year. (See Nio stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.