Last week, the electric vehicle (EV) industry marked strong momentum based on impressive delivery numbers reported despite the growing macroeconomic uncertainty and supply and logistics challenges. Specifically, Chinese EV maker NIO (NYSE: NIO) reported record-high quarterly deliveries at the end of Q3 with 31,607 vehicle deliveries, up 29.3% year-over-year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

During September itself, Nio delivered 10,878 vehicles, growing 1.88% year-over-year and 1.88% on a monthly basis. Notably, the company started the deliveries of ET5, its premium smart EV sedan, in late September and delivered 221 ET5s.

Impressed by the numbers, Mizuho analyst Vijay Rakesh reiterated his Buy rating on Nio but slightly lowered his price target to $40 (170.8% upside potential) from $42.

Rakesh believes in “NIO’s value leadership in the premium EV segment with solid battery technology and ADAS roadmaps as growth drivers.”

He highlighted, “Its core business, focused on domestic China, is another advantage with regulatory support and market familiarity. Global expansion is in the works, and we believe it will become a meaningful contributor to future growth.”

Is NIO Stock a Buy, Sell or Hold?

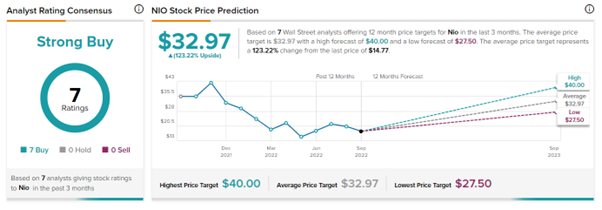

The Wall Street community is clearly optimistic about the stock. Overall, the stock commands a Strong Buy consensus rating based on seven unanimous Buys. Nio’s average price target of $32.97 implies a solid 123.22% upside potential from current levels.

On the contrary, Nio stock has a negative signal from hedge fund managers, who sold 1.5 million shares last quarter. Meanwhile, Nio stock has a Neutral Smart Score of five out of 10.

Conclusion

Overall, the wall street community is bullish on the EV sector’s long-term growth potential and expects Nio to be one of the strongest beneficiaries.