Chinese EV (electric vehicle) maker Nio (NYSE:NIO) focuses on driving profitability as its stock underperforms. For instance, Nio stock is down about 26% year-to-date. In comparison, shares of Tesla (NASDAQ:TSLA) have more than doubled during the same period. Nonetheless, Nio is broadening its collaboration in battery swapping to alleviate pressure on its profit margins, which bodes well for the company. Nio’s commitment to enhance its profit margins could significantly lift its share price.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s dig deeper.

Nio Expands Battery Swapping Partnership

In a recent development, Nio has revealed a strategic alliance with Zhejiang Geely Holding Group, specifically centered around advancing battery-swapping technology. Notably, the two companies have committed to extensive collaboration covering battery standards, the expansion and operation of the battery swapping network, the development of swappable models, and the management of battery assets. On similar grounds, Nio announced its partnership with Changan Automobile earlier this month.

As Nio focuses on improving margins, its management maintains an optimistic outlook and anticipates significant sequential margin growth in the latter half of 2023. The increased sales and volume of NT2 products, which command higher average selling prices, will drive its margins. Moreover, its cost-control measures will likely support its margins. With this backdrop, let’s check what the Street recommends for Nio stock.

Is NIO Stock Expected to Rise?

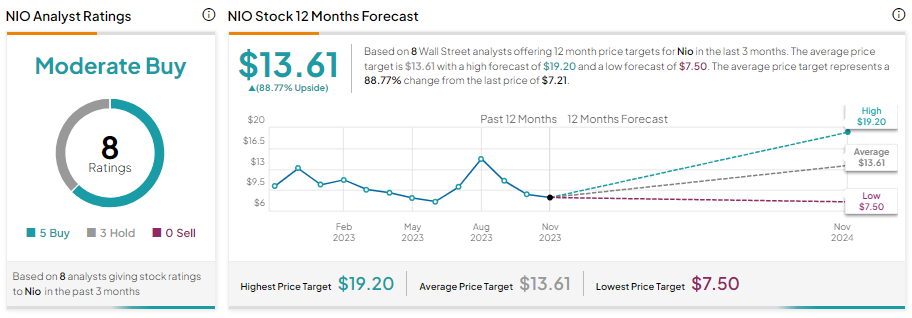

Based on analysts’ average price targets, Nio stock is expected to rise. However, competitive challenges and macro headwinds keep analysts cautiously optimistic about its prospects.

Nio has five Buy and three Hold recommendations, translating into a Moderate Buy consensus rating. Meanwhile, analysts’ average NIO stock price target of $13.61 implies 88.77% upside potential from current levels.