Shares of electric vehicle (EV) manufacturer Nio (NIO) have recently been on a roller coaster ride. On one hand, growth in deliveries is pushing up the stock; on the other hand, the global recession is punching down on the stock.

Though shares now trade at a third of their all-time highs of $60, as seen early last year, they have recovered in the past two months from their 52-week lows of $11.67 and are now trading at around $20.

The Good News for NIO

NIO shares took a downward spiral due to strict COVID-19 lockdowns in Shanghai. However, now, with the easing of the lockdown situation and the resulting resumption of production, shares have bounced back.

For June, NIO reported a whopping 60% year-over-year jump in deliveries to 12,961. Further, sequentially, deliveries posted a record 84.5% growth compared to only 7,024 reported in May.

Additionally, EV stocks got some push from the news that the Chinese government plans to support EV makers in China by providing subsidies and tax breaks.

The Bad News for NIO

EV stocks took a beating due to impending fears of a global recession as well as higher interest rates.

Investors were concerned that Nio may be in need of additional capital like its peers, and may resort to stock offerings that could dilute the value of the shares.

In late June, the stock took a massive hit after the release of a hostile report from Grizzly Research LLC, which accused the company of inflating its revenues and profits.

In response, Nio stated that the report was misleading and inaccurate. Nio committed to creating an independent committee to investigate the concerns raised in the report.

Analysts Are Bullish about NIO

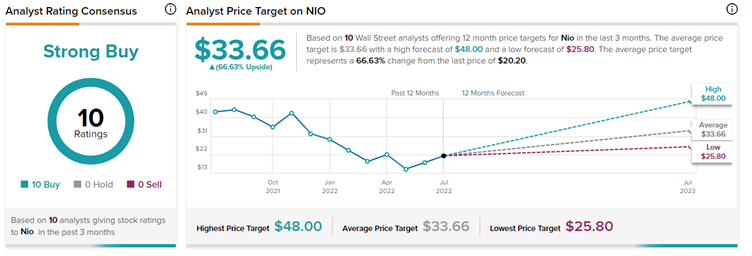

Overall, the stock has a Strong Buy consensus rating based on 10 unanimous Buys. The average Nio price target of $33.66 implies 66.63% upside potential from current levels.

High Smart Score for Nio

NIO scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Concluding Thoughts

Nio deliveries number in June shows that perhaps, the worst is behind the company with the resumption of production in Shanghai, which suffered due to the COVID-19 situation and the long period of lockdowns earlier this year.

The Chinese government support could act as a strong catalyst for the EV maker, assuming NIO management is able to put recent investors’ concerns to rest.