Nikola Corporation (NASDAQ:NKLA) has taken its shareholders on a wild ride this past week-and-a-bit, nearly tripling in value from a share price of $0.54 on June 6 to $1.40 as of Thursday’s close — a move that may have saved the company from delisting.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Let’s begin with the bad news. On May 24, with its share price languishing under $1 a share for more than a month, Nikola disclosed that the Nasdaq had issued it a warning that Nikola was “not in compliance with the minimum bid price requirements set forth in Nasdaq Listing Rule 5450(a)(1) for continued listing on Nasdaq.” Either Nikola had to find a way to get its shares selling for $1 or more soon, or the company would be delisted from the Nasdaq.

Recall, Nikola had just finished reporting Q1 2023 financial results which showed its revenues up nearly six times in size, but gross losses of nearly $3 for every $1 in sales the company accomplished. On the bottom line, the company lost $0.31 per share — which on the plus side was less money per share than the company had lost a year ago. Unfortunately, the per-share losses only decreased because Nikola issued so much stock that it grew its share count 32%.

So yeah, things weren’t going great for Nikola’s business… and now Nikola’s stock was looking like it was about to get delisted. What would Nikola do to fix this?

Well, on June 6 Nikola proposed a solution to at least the first of these two problems: Issue more shares, sell more stock, and that way Nikola would at least get some cash to use to further accelerate production, sales, and potentially profits. “Proposal 2” at the company’s annual general meeting of shareholders therefore asked Nikola shareholders for permission to increase the number of shares the company was authorized to issue.

Unfortunately for Nikola, not enough shareholders voted in favor of the proposal to secure its passage by June 6… so management postponed the vote until July 6 in hopes of securing the votes it needs.

As of today, it’s still not certain whether Proposal 2 will pass, but even if it doesn’t, management notes that a coming change to the Delaware General Corporation Law should permit it to issue new shares without a majority of shareholders voting in favor. Should Nikola fail to garner the votes it needs by July 6, therefore, it’s like the company will simply postpone the vote again, until August, when the law will change and Nikola management will be permitted to do what it wants.

Now you might think this would upset shareholders. Nikola management wants to dilute shareholders out of some of their investment. A majority of shareholders doesn’t want to let them do this, but… Nikola seems set on doing it anyway. It’s logical to assume this would ruffle some feathers. Instead, however, investors seem to be cheering Nikola getting its way, as Nikola stock skyrockets in price.

Why exactly the share price is rising is something of a mystery, but the good news is that, almost as if by accident, the rising share price has lifted Nikola back about $1 a share, and out of danger (for now) of Nasdaq delisting.

Now, if only Nikola could earn a profit, too, investors would really have something to cheer about.

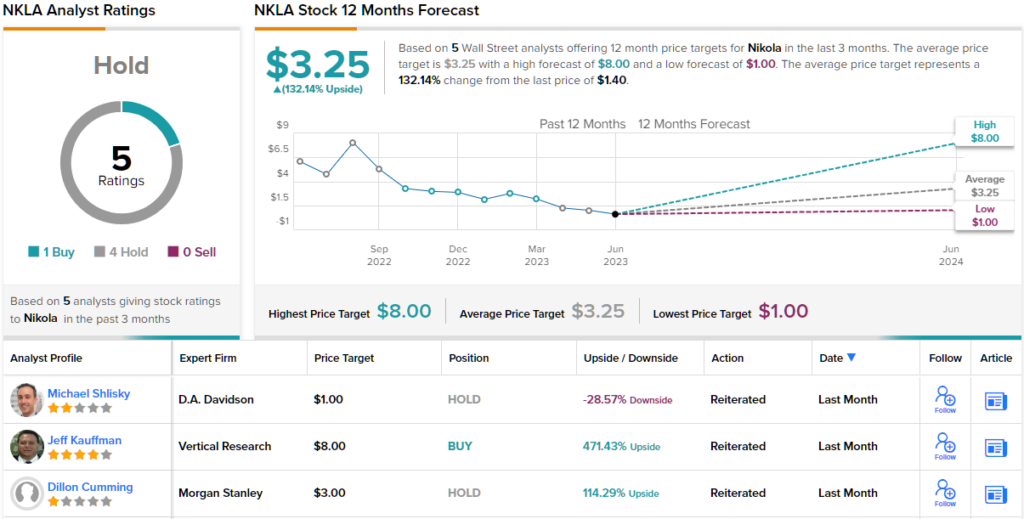

Turning now to Wall Street, investors are presented with a conundrum. On the one hand, based on a single Buy rating and 3 Holds, NKLA stock has a lukewarm Hold consensus rating. However, the analysts expect shares to surge 132% as indicated by the $3.25 average price target. (See NKLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.