In the five days following the June 3 closure of its merger with VectoIQ — an event that put Nikola (NKLA) on the Nasdaq under its own name — shares of the electric truck company skyrocketed an incredible 135%. This happened without a single word of support for the company from Wall Street.

Eight more days of ups and downs later, Nikola stock is still trading 90% higher, and at long last, Wall Street has taken notice.

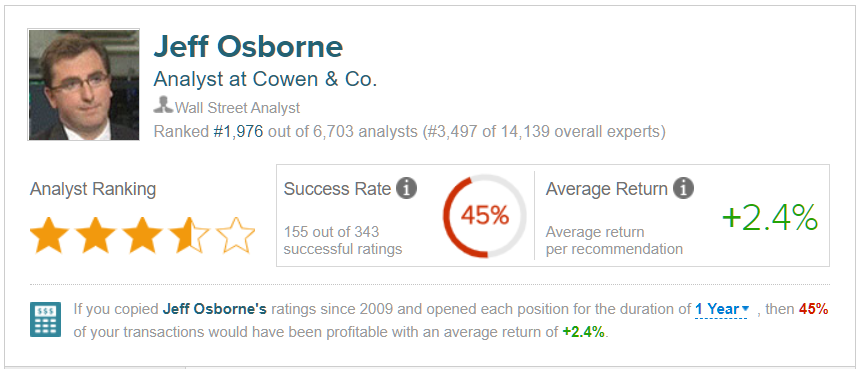

Cowen analyst Jeff Osborne became the first Wall Street investment bank to endorse Nikola, initiating coverage with an “outperform” rating and a $79 price target that promises at least another 21% upside to new investors today.

Now, Osborne began its research note with an admission: “Nikola is likely to be a controversial stock in the eyes of many investors and onlookers given it is pre-production.” Put plainly, this is a company without any products actively on the market, without profits, and with revenues of under $0.5 million. And yet Cowen analyst Jeffrey Osborne insists Nikola is nonetheless “an intriguing investment opportunity.”

So… what exactly does Osborne like about it?

In essence, somewhat like Tesla disrupted the market for luxury gas-engine automobiles by inventing an electric car that’s just as luxurious, with the added benefit of conferring “green credentials” upon its owner, Nikola is aiming to disrupt the market for commercial long-haul semi-trucks. For one thing, Nikola is turning trucking “green.” But at the same time, it’s trying to provide a luxurious truck cab atop a vehicle that can cut costs for its owner.

As Osborne tells it, Nikola’s plan is to lease electric and hydrogen fuel cell trucks to truckers, rather than sell them. Bundled with both fuel and service, the total cost of ownership (or perhaps lessor-ship) of a Nikola One, Two, or Tre truck should end up being cheaper than what it costs to own and operate a conventional semi today. The plan will be to lease an entire truck, along with the fuel to run it for 100,000 miles a year, and the services to maintain it, for “~$665,000 of revenue” over a period of seven years. Within this price, “about 35% [of the cost] is truck, 50% fuel and 15% service.”

If it’s able to convince customers to bite (and a few have already, albeit at no money down), Nikola is promising to deliver an entire trucking ecosystem that will cost perhaps $0.95 per mile to operate, versus the $0.95 to $1.15 per mile cost of operating current trucks powered by conventional fuels.

The question is whether Nikola can deliver on that promise, and do so profitably for investors?

Osborne thinks it can, and forecasts that by Q3 2021 we will see Nikola’s first electric truck go to market, followed by a hydrogen fuel cell truck in Q1 2023. Profits won’t come immediately, but margins will grow steadily, reaching profitability in 2024, and rising into the 25% to 30% range for gross margins, and 12% for operating profit margin, “in the ’25 to ’26 time frame.”

Well and good. Maybe Nikola can do that… but it’ll take five to six years to find out. In the meantime, however, Osborne is suggesting — with a straight face I might add — that you should be willing to pay 5.5 times the annual sales the sales Nikola might produce in 2025, and pay that price today.

To put that in context, Tesla today is selling for only about 2.4 times estimated 2025 revenues — and not too many investors arguing that Tesla is a cheap stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.