Athletic footwear, apparel, equipment, and accessories maker Nike (NYSE:NKE) will release its Fiscal Q1-2024 financial results after the market closes on Thursday, September 28. Analysts expect the company’s earnings to remain under pressure due to higher product costs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this in mind, let’s delve into the expectations for Q1.

Here’s What Consensus Estimates Reveal

Wall Street analysts expect Nike to post revenues of $13 billion in Q1, reflecting year-over-year growth of about 2.4%. In comparison, management expects the company’s first-quarter revenue growth to either stay flat or register low-single-digit growth due to the restrained marketplace inventory.

Providing estimates for Q1, Robert Drbul of Guggenheim said that Nike’s revenue could grow by 3%. The analyst expects lower wholesale shipments over the next few quarters. Drbul reiterated a Buy on NKE stock on September 22.

While Nike’s top line is expected to improve slightly, increased labor and fulfillment expenses within certain segments of the company’s supply chain will likely weigh on its bottom line. Additionally, higher promotional costs and investments to drive efficiency could hurt its near-term profit margins.

Given the short-term headwinds, analysts expect Nike to post earnings of $0.76 per share, down from $0.93 in the prior-year quarter.

Is Nike Good to Invest in Right Now?

Nike stock is trading in the red and has significantly underperformed the broader equity markets year-to-date. Heightened expenses related to freight and logistics and markdowns to boost sales have impacted its profit margins and stock price.

While Nike could continue to encounter margin challenges in the short term, these issues are temporary and likely to subside, keeping analysts cautiously optimistic about the stock. Moreover, management remains confident and expects sales and margins to improve as the fiscal year progresses.

Nike stock has a Moderate Buy consensus rating ahead of Q1 earnings, reflecting 20 Buy, seven Hold, and two Sell recommendations. Moreover, the average NKE stock price target of $124.32 implies 37.87% upside potential from current levels.

Insights from Options Trading Activity

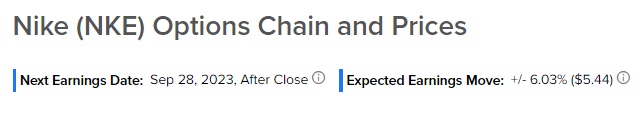

Options traders are pricing in a +/- 6.03% move on earnings, greater than the previous quarter’s earnings-related move of -2.65%.