Shares of Nike (NYSE:NKE) and Foot Locker (NYSE:FL) have lost their footing in recent quarters, thanks to wild shifts in consumer spending. Undoubtedly, Nike is a legendary brand that has survived worse economic conditions, and it will likely arise from its historic decline in due time. That said, there’s no denying or discounting the macro and industry headwinds the sneaker scene has faced over the past year and a half.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though it’s unclear when the tides will turn, I view plenty of value to be had while the bar is low and the price of admission is on the lower end of the historical range. Indeed, it’s hard to catch a falling knife, but numerous analysts seem to think both Nike and Foot Locker are intriguing buys at these levels.

Foot Locker: The Sneaker Slump Continues

Should a recession be in the cards, there may very well be more pain ahead, at least over the medium term, for the sagging sneaker plays. Discretionary (nice-to-have) apparel just isn’t atop the shopping lists of many consumers these days, and it’s unclear when demand will rebound as interest rates (and perhaps recession risks) go on the rise again. Indeed, investors seem quite nervous this September after a remarkably strong first-half recovery in the broader markets.

Given its exposure to Nike and other discretionary apparel brands that are also under pressure, footwear retailer Foot Locker has also felt the pinch. Being in the business of brick-and-mortar retail comes with its own pains. That’s a major reason why Foot Locker stock has been in a nasty downtrend since early 2017. More recent headwinds faced by the broader apparel scene have only acted as salt in the wounds of an already ailing company.

In many ways, a brick-and-mortar retailer seems like dead money at this juncture. However, deep-value investors may wish to give the name a second look, as the magnitude of pessimism surrounding the firm and the rest of the industry becomes overblown. At writing, FL stock goes for 11.5 times trailing price-to-earnings, well below the footwear & accessories industry average of 27.4 times.

In a market where some have criticized valuations, Foot Locker certainly stands out as one of the deep-value “cigar butts” that could have many puffs left. Also, given how battered the stock is, it may be spared if the rest of the market were to reverse violently. Due to the discounted valuation, I am cautiously bullish.

What’s the Price Target of Foot Locker Stock?

Foot Locker is a Moderate Buy on Wall Street, with five Buys and nine Holds assigned in the past three months. The average FL stock price target of $19.54 implies 5.2% upside from here, with the highest price target of $30 implying more than 60% upside potential.

There may be few, if any, catalysts to look forward to for Foot Locker stock. However, as shares tumble to lower levels, longer-term value investors may be enticed to step in at some point.

Nike: A Dow Dog That Probably Won’t Stay Down for Long!

Though Nike has recovered considerably off its lows (shares lost more than 53% of their value from peak to trough), the stock’s back on the retreat, now off over 23% from its 52-week high. With newfound negative momentum hitting broader markets this September, the footwear giant may find itself back to the ominous depths not seen since September 2022.

As the effects of inflation and macro headwinds weigh while year-ahead recession odds fluctuate, Nike certainly still seems like a risk-on play. That said, I find it tough to pass up on one of the strongest brands out there at a valuation that’s skewed toward the low end of its historical range.

The stock trades at 30.3 times trailing price-to-earnings (P/E), well below the five-year historical average of 44.4 times. Nike’s premium brand warrants a premium price tag on the stock. It’s times like this, when the economy begins to lose its footing, when it tends to be a wise idea to be a buyer of Nike shares. It’s hard to tell when the consumer will feel better. Regardless, investors can look forward to Nike’s longer-term value drivers, including its ongoing direct-to-consumer push and its digital strategy.

For now, I’m staying bullish alongside the many optimistic analysts who believe Nike will hit the ground running once the macro picture has a chance to improve.

What’s the Price Target of Nike Stock?

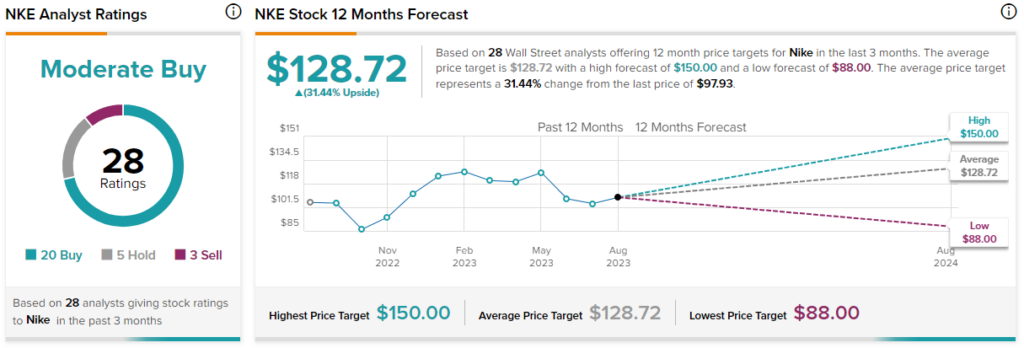

Nike is a Moderate Buy on Wall Street, with 20 Buys, five Holds, and three Sells assigned in the past three months. The average NKE stock price target of $128.72 implies 31.4% upside potential.

Guggenheim analyst Robert Drbul thinks the Jordan brand, which accounts for around 13% of sales, could act as a catalyst to help Nike reverse course from here.

With a new Air Jordan 11 shoe coming for the holidays, Nike may very well be able to run higher on the back of one of its most successful sneakers of all time. At $230 per pair, the sneakers do not come cheap. However, it will certainly be tough for sneakerheads (those who collect or trade sneakers as a hobby) to resist buying a pair, even if the budget is a bit tighter this time of year.

The Bottom Line

Sneakerheads and casual users will eventually be in the market for a new pair of kicks. Though the turbulent economy could pave the way for sluggish coming quarters, I think it’s hard to pass up what I believe is a golden opportunity. Between FL and NKE, analysts expect more upside from the latter. I’m inclined to agree. Nike is a legendary brand that has what it takes to jump higher from its historic funk.