Nexstar Media Group (NXST) is one of the leaders in local broadcasting. It has divisions for both production and digital media. The company has strong fundamentals, causing Wall Street to have high estimates.

Nexstar operates in three divisions, Broadcasting, Networks, and Digital. The Broadcasting division operates 199 television stations in 116 markets. This equates to approximately 68% of all households in the United States.

The Networks division operates different shows across the United States, namely NewsNation. The Digital division operates 120 websites and 284 mobile apps for local content and advertisers. I am bullish on NXST stock. (See Analysts’ Top Stocks on TipRanks)

A Look at Nexstar’s Financials

What really excites Wall Street is the company’s growing financials. From 2015-2020, the company’s revenue increased from $896 million to $4.5 billion. This calculates to an average annual growth rate of 43.1%.

However, the company saw large jumps in 2017 and 2020, increasing by 120.9% and 48%, respectively. If these years were to be excluded from the growth rate, Nexstar has still achieved an impressive average annual growth rate of 15.5%.

The majority of the company’s revenue is from Distribution and Core (non-political) Advertising. In 2020, Distribution accounted for approximately 47.8% of revenue, and Core Advertising accounted for 34.9% of revenue.

Furthermore, the company has impressive margins. From 2015-2020, Nexstar’s average gross margin was an impressive 61.7%. It also attained an average net margin of 12.7%. The large drop from gross income to net income is due to high SG&A costs and depreciation.

The Balance Sheet May Be Misunderstood

When investors first look at Nexstar’s balance sheet, they may be scared off by the company’s $7.8 billion in debt. However, this may not be as bad as some think. When comparing Nexstar to its closest competitors, the stock’s ratios are in-line or below the industry’s median.

The industry’s median ratio for total debt/EBITDA is approximately 4.5, and Nexstar’s is 4.1. This is slightly reduced when accounting for net debt, which comes in at 3.9. Nexstar’s debt is one of the biggest reasons why many pass on the stock, but the company is outperforming its competitors in this aspect.

The Cash Flows Tell an Even Better Story

As mentioned earlier, Nexstar’s earnings are growing at an impressive rate. Combine this with the company’s high depreciation, and a large amount of cash from operations can be calculated.

From 2015-2020, the company’s operating cash flows increased from $205 million to $1.25 billion. As for other cash flows, the company has been repurchasing shares since 2015, except in 2016. Nexstar has also started reducing its debt since 2018, further contributing to the idea that the company’s debt may not be a big issue.

Acquisitions Could Drive the Stock Higher

In August, Nexstar acquired political media company The Hill for $130 million. During 2020, The Hill had approximately 48 million monthly users and attained over 2.2 billion views. Prior to this acquisition, Nexstar’s digital content had 91 million users and attained 7.8 billion views.

Acquiring The Hill could allow Nexstar’s Digital division to grow its users by approximately 52.3% and views by 28.2%. After this acquisition, Nexstar could reach an estimated one-third of all homes in the United States.

This acquisition further drives Nexstar’s revenue to be diversified. In 2020, Digital Content accounted for only 4.9% of the company’s total revenue. With the help of this acquisition, Nexstar could increase this percentage and protect itself from external risks and capitalize on a potential shift to digital content.

Valuing Nexstar’s Stock

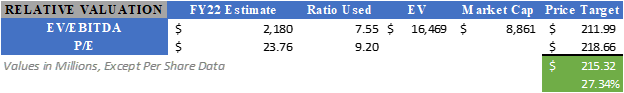

To find a fair value for Nexstar’s stock, a relative valuation was calculated. By averaging EV/EBITDA and P/E price targets from median ratios and Fiscal Year 2022 estimates, a price target of $215.32 was calculated. This implies 27.3% upside potential.

Wall Street’s Take

From Wall Street analysts, Nexstar earns a Strong Buy consensus rating based on seven Buy ratings assigned in the past three months.

The average Nexstar Media price target is $189.14, implying 10.8% upside potential. (See Nexstar Media Group stock analysis on TipRanks)

Conclusion

Nexstar Media Group has strong fundamentals and is an industry leader in the broadcasting industry. The company has been growing at an impressive rate and earned high estimates from Wall Street analysts.

The acquisition of The Hill could massively increase Nexstar’s customer base and increase the presence of its digital division. This will further grow the company’s fundamentals, as well as diversify its revenue to protect itself from outside risks.

Disclosure: At the time of publication, Mark Schiavo did have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article,

and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.