NexPoint Residential Trust (NXRT) is a real estate investment trust (REIT) specializing in acquiring, owning, and running middle-income multifamily properties.

NexPoint makes sure these properties are located in areas that are ideal for families, including large cities, primarily in the Southeastern and Southwestern United States. As of its latest quarterly filings, NexPoint had interests in 39 properties spread across 11 markets.

Specifically, NexPoint’s largest location exposures were in Dallas/Fort Worth, South Florida, and Phoenix, each accounting for 17.5%, 13.2%, and 11.3% of its portfolio’s apartment units, respectively.

I am neutral on the stock.

A Unique, Valued-Added Strategy

Since its public listing in 2015, NexPoint has maintained fantastic growth momentum. The company’s unique value-added strategy has made it possible to demand premium monthly rents versus its more conventional residential industry peers.

The company has conducted 6,398 full and partial upgrades, 4,510 kitchen and laundry appliances, and 9,624 technology packages since its inception, leading to a $139, $48, and $44 average monthly rental boost per unit, and a 21.8%, 70.8%, and 33.5% ROI, respectively.

As working-class Americans keep pursuing safe, clean, and affordable housing full of amenities in markets with elevated job growth prospects, NexPoint combines all the key ingredients to achieve above-average growth.

Along with its serial acquisition strategy, NexPoint has managed to grow its adjusted funds from operations rather impressively. Specifically, the company features a 5-year AFFO/share CAGR of 15.4%, which is quite remarkable.

Latest Results

NexPoint’s latest results continued to demonstrate the company’s ongoing growth momentum, with revenues growing 17.4% to $60.8 million.

Revenue growth during the quarter was powered by same-store average effective rent, total revenue, and NOI increasing by 15.4%, 11.3%, and 16.4%, respectively.

That is, despite occupancy dropping 90 basis points to 94.2%. As a result, adjusted funds from operations expanded to $22.3 million, or $0.87 per share, from $16 million, or $0.64 per share last year. This implies a growth of 39.3% and 35.9%, respectively.

The softer growth on a per-share basis is attributable to a higher share count following NexPoint’s share issuances in order to finance its portfolio growth. Yet, it’s evident that despite a higher share count, the per-share growth in AFFO was only slightly affected, exemplifying management’s ability to create value at a low cost.

NexPoint continued to capitalize on its value-added strategy during the quarter, completing 531 full and partial renovations, 50% more quarter-over-quarter. Notably, it also leased 489 renovated units, accomplishing an average rent premium of $138 per month and a 26.3% ROI on an annual basis.

With performance exceeding their previous expectations, NexPoint management boosted the outlook for full-year results. Its guidance targets an AFFO/share of $3.37 at the midpoint for Fiscal 2022, implying growth of 19.5% year-over-year.

It also implies acceleration in NexPoint’s AFFO/share growth from its five-year average. This is rather noteworthy in an inflationary environment.

Dividend & Valuation

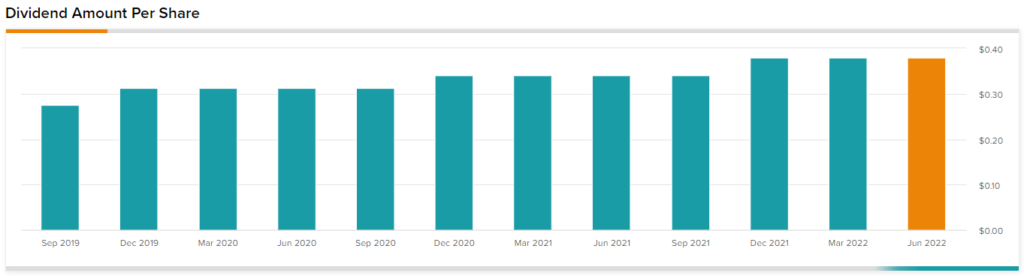

NexPoint has increased its dividend every year since its first payment in 2015, now counting for six years of consecutive annual dividend hikes. The five-year dividend growth CAGR stands at 11.11%, while the latest dividend increase was by a satisfactory 11.3% to a quarterly rate of $0.38.

With AFFO/share accelerating lately, and the midpoint of management’s guidance implying a payout ratio of 45% based on the current DPS run-rate, I believe that dividend growth will be retained in the double-digits moving forward.

However, NexPoints remarkable AFFO and DPS growth do not come at a discount. Assuming the company achieves an AFFO/share of $3.37 for the year, the stock is currently trading at a P/AFFO of 22.6.

This multiple is not necessarily pricey, as the company’s underlying growth and distinctive pricing power could justify it. On the other hand, with interest rates on the rise, shares could be vulnerable to a valuation compression.

This has already taken place to some extent, with the stock trading nearly 20% off its 52-week highs, despite its excellent results.

Wall Street’s Take

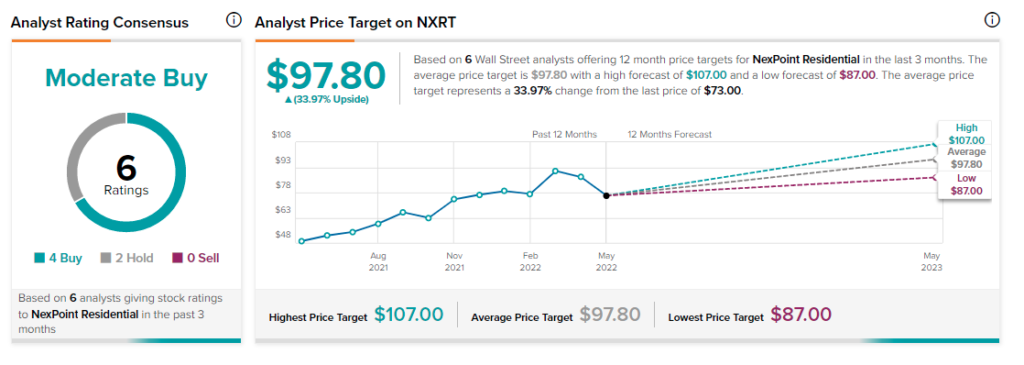

Turning to Wall Street, NexPoint Residential has a Strong Buy consensus rating based on four Buys and two Holds assigned in the past three months. At $97.80, the average NexPoint Residential price target implies 34% upside potential.

Takeaway

NexPoint is a truly unique REIT, with its value-added growth strategy resulting in above-average growth rates. The company’s latest results continued to illustrate the benefits of this strategy, with funds from operations recording robust growth.

While the stock’s yield of 1.9% may not be particularly substantial, NexPoint is likely to keep growing the dividend at a double-digit pace annually, which dividend growth investors are likely to appreciate.

However, note that the premium the company charges for its top-tier amenities means that its prospective performance depends deeply on the income levels of its middle and high-class tenants remaining sound.

Adverse market conditions and downfalls in the financial state of NexPoint’s tenants could notably impact the company. This applies even more to its stock, which could undergo a significant valuation compression in such a scenario.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure