Many bank stocks plunged following the collapse of Silicon Valley Bank (SVB). However, New York Community Bank (NYSE:NYCB) stock has surged recently, making it a notable exception in the sector. In fact, shares of the New York-based bank have bounced more than 50% off of the 52-week low that it hit in the immediate aftermath of the crisis. In this article, I’ll explain why the stock surged and why I believe it’s not too late to buy shares of the $6.1 billion bank even after this massive run.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Signature Bank Move

New York Community Bank stock soared more than 40% intraday on Monday, March 20th, when news broke that its Flagstar Bank subsidiary had agreed to buy the deposits and some of the loan book of Signature Bank. Signature Bank, also based in New York, was shut down by regulators in the wake of the regional banking crisis spurred by SVB. NYCB reportedly acquired $12.9 billion worth of loans at a $2.7 billion discount, and sell-side analysts widely hailed the deal as a favorable one for NYCB.

Analysts Love the Deal; NYCB Rated a “Strong Buy”

Wedbush upgraded NYCB to Outperform, with a price target of $11. Analyst David Chiaverini wrote that NYCB was benefiting from “a sweetheart deal as [the] FDIC priced assets to move quickly.” Meanwhile, D.A. Davidson upgraded NYCB to a Buy rating based on the deal, although it maintained its $11.50 price target. Analysts from Piper Sandler and RBC Capital Markets also have Buy-equivalent ratings on the stock.

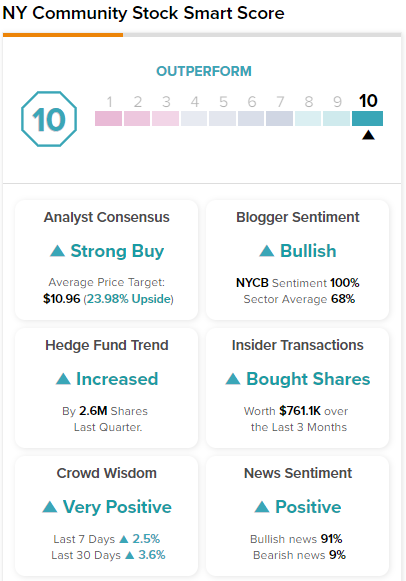

Below, we can see that the analyst community is very optimistic about NYCB. The stock has a consensus Strong Buy rating based on 11 Buys and three Holds assigned in the past three months. Additionally, the average NYCB stock price target of $10.96 implies upside potential of 24% versus current levels.

Additionally, NYCB boasts a ‘Perfect 10’ Smart Score rating on TipRanks, suggesting strong potential for the stock to outperform the market from here. The Smart Score is TipRank’s proprietary quantitative stock scoring system that evaluates stocks on eight different market factors. The score is data-driven and does not involve any human intervention.

NYCB also screens well based on a number of other criteria that TipRanks monitors, such as blogger sentiment and hedge fund involvement. Furthermore, insiders have been buying shares over the past three months.

NYCB Stock is Still Cheap

So, analysts love NYCB’s Signature Bank deal, and they have a Strong Buy rating on the stock, which helped lead it to its 50% gain. If you’re kicking yourself and think that you missed your chance to buy shares, here’s why it’s probably not too late. There’s plenty of room for further upside ahead over time, as the stock still looks exceedingly cheap based on a variety of metrics.

Looking at a classic metric like price/earnings, NYCB trades at under 7x earnings, which is a massive discount to the broader market. For reference, the S&P 500 (SPX) currently has an average price-to-earnings multiple of about 21x. While some discount is warranted given the uncertainty in the banking sector, this is a massive one.

NYCB also trades at a discount (albeit a smaller one) to some of the major banks like JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC), which trade at price-to-earnings multiples of about 10x and 8x, respectively.

Beyond price/earnings, NYCB looks cheap on a variety of other multiples. For instance, NYCB looks very attractive when looking at its price-to-book ratio, a metric commonly used to evaluate financial stocks. NYCB trades at just under 0.7 times book value, meaning that the company is trading at just 70% of what it would be worth if its assets were liquidated. This gives investors a margin of safety when investing in the stock.

Lastly, NYCB looks inexpensive based on its sizable dividend yield of 7.7%. This is much higher than the average yield for the S&P 500 (1.7%) and more than double the yield of the 10-year Treasury note, making this an attractive income investment as well as a value play.

Investor Takeaway

This is a 163-year-old bank that has been serving the NYC community since James Buchanan was President, so it’s not likely to go away any time soon. Furthermore, regulators giving NYCB the green light to acquire much of Signature Bank can be seen as a stamp of approval that they believe the bank is in a strong position.

New York Community Bank has had a massive run-up following its well-received deal for the Signature Bank assets. I recently bought the stock and would be a buyer on any dips from here as the stock still looks very cheap, no matter what way you slice it. Furthermore, the dividend yield of 7.6% is a nice added bonus for shareholders. Lastly, the stock has a ‘Perfect 10’ Smart Score and a Strong Buy consensus rating, meaning that there could be plenty of room to run ahead.