There were plenty of interesting developments to digest in Netflix’ (NASDAQ:NFLX) latest earnings. Ultimately, investors liked what they got, the highlight being the huge beat on net subscriber additions.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In 4Q22, the Street was expecting 5.4 million new adds, but Netflix added 7.66 million subscribers, boosted by a strong content slate including offerings such as the Harry & Meghan docu series and Addams Family spin-off Wednesday.

In total, revenue climbed by 1.9% year-over-year to $7.85 billion, in-line with the consensus estimate, although the company missed on the bottom-line, delivering EPS of $0.12 against Street expectations of $0.45. Netflix attributed the miss due to a loss correlated to “a $462M non-cash unrealized loss from the F/X remeasurement on our Euro denominated debt.”

The quarter marked the first to include its new ad-supported tier, which went live in November. The company did not divulge how many of the new subs chose the cheaper offering.

There was also a massive reshuffle in the C-suite. Co-founder Reed Hastings is vacating his co-CEO role to become executive chairman. Current co-CEO and chief content officer Ted Sarandos will be joined in the CEO position by chief business and product head Greg Peters.

For Q1, the company expects revenue growth of 4%, above the 3.7% Wall Street had anticipated. In its efforts to combat password sharing Netflix will also roll out its paid sharing program in Q1, monetizing users piggybacking on family accounts.

This is a key growth driver, says Pivotal’s Jeffrey Wlodarczak, who also hails an “unquestionably solid” quarter and outlook.

“NFLX represents a frankly unique tech growth story and remains well positioned to generate solid subscriber and revenue/free cash flow growth even given the reasonably high chance of a global recessionary environment via their better monetization of the approximate 100+M households that currently utilize NFLX outside of the paying household via password sharing,” Wlodarczak said.

The analyst also thinks Hastings stepping down might be indicative of a prospective sale of the company in 2025, following the U.S. election. Ad partner Microsoft is “the most logical candidate to acquire the company.”

All told, Wlodarczak sticks with a Buy rating and thinks a price target hike is due; the figure rises from $375 to $400, suggesting the shares have room for ~17% growth over the coming year. (To watch Wlodarczak’s track record, click here)

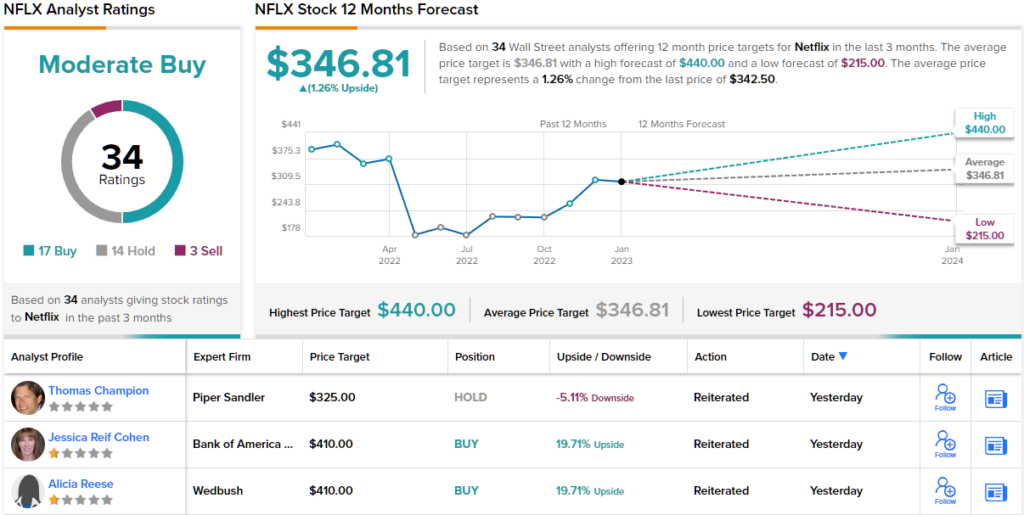

Looking at the consensus breakdown, based on 17 Buys vs. 14 Holds and 3 Sells, the stock claims a Moderate Buy consensus rating. The shares are anticipated to stay range-bound over the coming year, considering the average target stands at $346.81. (See Netflix stock forecast on TipRanks)

Subscribe today to the Smart Investor newsletter and never miss a Top Analyst Pick again.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.