Netflix (NASDAQ:NFLX) stock has continued its robust rally off its mid-2022 lows. When the stock fell off a very steep cliff in late 2021 and early 2022, the company’s growth prospects were questioned. With Squid Game: The Challenge reality series leaning on the strength of its impressive Squid Game franchise and new plans for its video game business, it’s hard not to feel better about the company’s growth story moving into 2024.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Sure, Netflix stock’s 2021-22 crash was rather painful. It’s still quite unheard of to learn of a FAANG stock shedding more than 70% of its value in a matter of months! As it turned out, the stock went from being absurdly overvalued to absurdly undervalued. Today, after marching about 190% since its 2022 lows, the stock more or less looks to be close to a fair valuation.

At writing, shares trade at 29.2 times forward price-to-earnings (P/E) — or 48.0 times trailing earnings — a multiple that reflects robust growth, but it’s not the hyper-growth multiple it once commanded. Of course, a forward P/E of around 30 times doesn’t exactly scream cheap. However, if Netflix can prove to the world it has game (pardon the pun), I do not doubt the firm’s abilities to continue surging into the new year, perhaps on the back of more valuation multiple expansion.

Under the leadership of its new CEO, Greg Peters, who’s done a solid job at the helm in his first year, I do think Netflix’s gaming expedition will prove worthwhile. As such, I’m staying bullish on Netflix stock, as are many analysts, with shares going for just north of $470 per share.

From Squid Games to Video Games, Netflix’s Moat May be Wider Than You Think

Squid Game is more than just a hot show; it seems to be a robust franchise that’s paved the way for an impressive reality series. Reportedly, the premiere of Squid Game: The Challenge drew in 1.1 million viewers in the U.S. The reality series, which, apart from being filmed in a massive former aircraft hangar in the U.K., has plenty of U.K.-based contestants, is also a hit in the U.K. market.

After having binge-watched the entire series, I must say that I’m convinced the Squid Game brand has grown into something special, perhaps a cash cow for Netflix. Like the original Squid Game show, The Challenge is slated for another season, and it’s open to taking in new applications for its second season. Who wouldn’t want to be a contestant on the show and have a shot at the $4.56 million? It’s the biggest prize in reality TV history — one that probably won’t be topped anytime soon.

Looking ahead, Netflix viewers eagerly await the second seasons of Squid Game and Squid Game: The Challenge. Additionally, a video game within the Squid Game universe is also on the horizon. My guess is that it’ll be a hit, too.

At this juncture, I view Squid Games as one of the critical components of Netflix’s moat. While we’ve witnessed a slew of competitors in streaming step forward in recent years, it’s been absolutely remarkable that Netflix has been able to stay top dog. Moving forward, I think it can still stay a leader as its rivals look to team up to offer bundles and better value for prospective customers.

Netflix: Gaming Push is Key to Fending Off Rivals in Streaming’s “Bundling” Era

Indeed, Paramount (NASDAQ:PARA) made headlines for chatter over a potential bundle deal with the likes of Apple (NASDAQ:AAPL), which has its own Apple TV+ service. The deal could help the two streaming underdogs get a nice edge in the streaming space. But don’t look for any such partnership to dethrone Netflix — not while it continues to deliver much-watched content at a respectable rate.

On the bundling front, Netflix is throwing in its gaming offerings to keep subscribers subscribed. Until now, games haven’t been a massive draw for the company. However, in 2024, games may be what keeps Netflix as one of the stickiest subscriptions in streaming.

The company offers a slew of mobile and cloud games that users can play on their TVs. Such games are relatively small games that aren’t drawing in hardcore gamers and fans of triple-A titles. This is bound to change. Netflix not only has close to 90 games in the works, but it is also bringing one of the biggest game franchises to its platform: Grand Theft Auto (GTA) Trilogy, and it won’t cost subscribers extra to access the gaming content.

I view the aggressive gaming move as a genius one. As gamers await GTA VI, which recently dropped its much-awaited trailer and release year (2025), I’ll bet that many will want to revisit the classic titles in the GTA franchise in 2024.

Is NFLX Stock a Buy, According to Analysts?

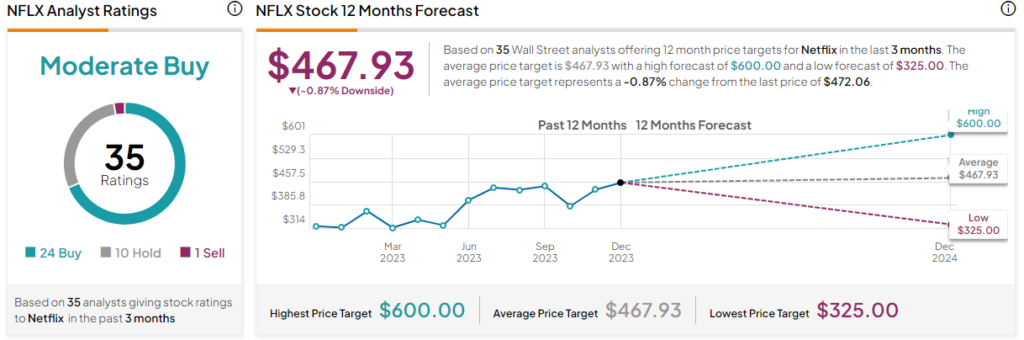

On TipRanks, Netflix stock comes in as a Moderate Buy. Out of 35 analyst ratings, there are 24 Buys, 10 Holds, and one Sell recommendation. The average NFLX stock price target is $467.93, implying downside potential of 2.5%. Analyst price targets range from a low of $325.00 per share to a high of $600.00 per share.

The Bottom Line on Netflix

With all the gaming titles and Squid Game content coming, I think Netflix will have no issues raising prices again when the time comes. Netflix isn’t just another streamer. It has a magic formula and a willingness to step outside of its comfort zone in search of greater growth.