Netflix (NASDAQ:NFLX) stock is down around 20% from its 52-week high following its latest bearish plunge. Undoubtedly, the video-streaming beast was in need of a cool-off after soaring nearly 170% from trough to peak. And though there remain considerable challenges ahead, I view the 20% dip as buyable. The broader streaming market may have lost its luster, but Netflix remains a king among men.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As the company branches off into gaming and more immersive content while embracing new tech like generative artificial intelligence (AI) and spatial computing, it’s hard not to be tempted to buy shares now that they’re back below $400. Like so many analysts covering the name, I am bullish.

There’s no sugar-coating it. September 21 was a dreadful day for growth-savvy tech investors, as the Nasdaq 100 (NDX) sunk by nearly 2%, bringing it down just north of 4.5% for the week. The major tech-heavy index may be rolling over, but there is hope for Netflix stock as it looks to buck the trend. Despite Thursday’s market bloodbath, it was notable that Netflix stock only fell by 0.56%, thanks in part to some good news for the industry — the end of the Hollywood strike seems to be in sight.

Finally, Some Progress on the Hollywood Writers’ Strike

Although the strikes — now going on 142 days — aren’t officially over, it certainly seems like there’s light at the end of the tunnel for the broader media and streaming space as negotiations resume. Undoubtedly, a formal end to the strike could act as the tide that lifts all boats in the streaming world. For now, it was a win for Netflix stock to walk away from a horrid day down less than a percentage point as its FAANG rivals plunged, with Amazon (NASDAQ:AMZN) stock shedding 4.4% on the day.

Even if recent Hollywood strike negotiations backtrack, Netflix still has a pretty deep content lineup to keep its users entertained through 2024. In a way, Netflix has stocked up on plenty of water for this Hollywood writers’ drought.

Though strikes are bad news for all players in the streaming scene, a drought is certainly far more painful for a firm that lacks a backlog of content. Further, if strikes push into next year, Netflix may be able to take a bit of market share away from rivals as the pace of new content begins to slip.

In any case, Netflix stock isn’t as sensitive to the strike. With such a backlog to lean on amid strikes, the company has what it takes to outlast its peers. Further, Netflix looks to have the tech talent to make the most of the generative artificial intelligence (AI) boom. Netflix, like many other firms that aren’t actively working on AI hardware or software, has dabbled with AI.

In the long term, the company may be able to introduce AI-generated content and perhaps even the likeness of various actors. Such a potential AI strategy is the premise of one of the episodes (Joan is Awful) from the latest season of Black Mirror. I’d argue that such a dystopian reality may not be far off, given how quickly the field of generative AI is advancing.

Apple Vision Pro: Can Netflix Thrive in the Realm of Spatial Computing?

Apple’s (NASDAQ:AAPL) spatial computer, the Vision Pro, is getting Disney’s (NYSE:DIS) streaming service Disney+ on day one. As streamers make the jump to a new, three-dimensional medium, Netflix needs to follow suit or run the risk of being left behind in 2D. Personally, I think Netflix could thrive as spatial computing moves into prime time. For such an innovative company that’s embraced disruption, Netflix may be the firm that helps pioneer more immersive streaming content.

Of course, one can view 2D video content in Vision Pro via an augmented screen. However, it’s more immersive 3D content that may be the golden opportunity for streamers to reinvigorate their growth profiles. Between Disney and Netflix, I’d be willing to bet that Netflix will be a winner as Apple single-handedly brings us all into the time of spatial computing.

Don’t expect a fully immersive Squid Game anytime soon, but I do think Netflix has many levers it can pull as new tech takes center stage.

Is NFLX Stock a Buy, According to Analysts?

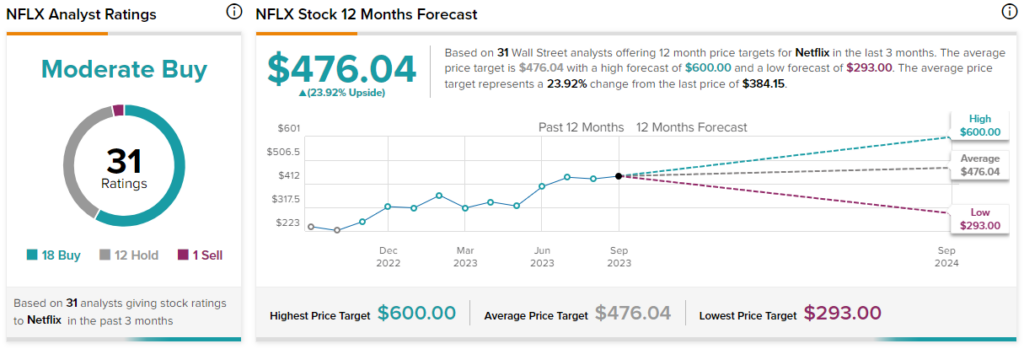

On TipRanks, NFLX stock comes in as a Moderate Buy. Out of 31 analyst ratings, there are 18 Buys, 12 Holds, and one Sell recommendation. The average Netflix stock price target is $476.04, implying upside potential of 23.9%. Analyst price targets range from a low of $293.00 per share to a high of $600.00 per share.

The Bottom Line for Netflix Stock

Netflix is still an innovator at heart, even without Reed Hastings as its top boss. From a long-term vantage point, Netflix has the means to grow as new tech trends take the world by storm. In the meantime, Hollywood strikes and macro headwinds are likely to dictate the trajectory of the stock. Though turbulence could be ahead, I believe the stock’s ongoing fall has created a fantastic entry point.

Netflix may not be one of the “Magnificent Seven” stocks. However, it’s every bit as magnificent as the group that I think it was wrongfully excluded from.