Netflix stock (NASDAQ:NFLX) is reigning supreme in the steaming kingdom, with its most recent results showcasing sustained industry dominance. Boasting over 260 million paid members, the streaming giant keeps posting robust growth in revenues and earnings despite the industry suffering from oversaturation. In fact, improved profitability has enabled management to return significant capital to shareholders, boosting the stock’s appeal. I believe this trend is set to be sustained. Thus, I am bullish on NFLX stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Subscriber Growth Accelerates Against All Odds

Netflix continues to astound with its remarkable ability to consistently attract paid subscribers, even with the fierce competition in the saturated streaming and social media landscape. In an era where tech and media giants fight for consumers’ attention, the company’s sustained subscriber growth is nothing short of astonishing.

Think about this for a minute. The streaming and social media space is more saturated than ever, with numerous players battling for viewers’ precious watch time. Initially, Netflix dominated the space, primarily facing off against outdated cable networks. However, the dynamics have shifted, and Netflix now contends with a multitude of streaming services, including Disney’s (NYSE:DIS) Disney+, Amazon’s (NASDAQ:AMZN) Prime Video Service, AT&T’s (NYSE:T) HBO, Hulu, Peacock, and various smaller players.

Moreover, Netflix faces competition in the “attention economy” from tech giants like Alphabet’s (NASDAQ:GOOGL), YouTube, TikTok, and Meta Platforms’ (NASDAQ:META) Reels. They all strive to capture market share in viewership to increase their advertising revenues. In fact, TikTok’s and Reels’ focus on promoting both short-form and long-form views and even producing shows on their own is proof of their competition with Netflix.

Despite these challenges, Netflix maintains a robust subscriber base, and its paid subscriber growth has even accelerated in recent quarters, including in its latest Q4 results. To illustrate, here are Netflix’s quarterly paid subscriber growth rates over the past two years.

- Q1 2022: 6.7%

- Q2 2022: 5.5%

- Q3 2022: 4.5%

- Q4 2022: 4.0%

- Q1 2023: 4.9%

- Q2 2023: 8.0%

- Q3 2023: 10.8%

- Q4 2023: 12.8%

These figures vividly depict a moderation in paid subscriber acquisition throughout 2022, following the unprecedented surge in subscribers over the preceding two years. The widespread stay-at-home trend during the pandemic fueled remarkable growth in 2020 and 2021, with Netflix experiencing a remarkable 20%+ expansion in paid memberships during that period. Consequently, a deceleration in growth for the subsequent year, 2022, was predictable as the situation began to stabilize.

However, as conditions normalized, subscriber growth rebounded significantly in 2023, showcasing a notable uptick quarter-over-quarter. The most recent quarter’s growth of 12.8% is especially noteworthy, pushing Netflix’s paid subscriber base to a staggering 260.3 million.

Revenues & Earnings Surge, Outlook Appears Very Promising

Powered by an acceleration in subscriber growth, revenue growth has also followed a similar trend. The same goes for earnings, as margins have been on the rise, with the income statement benefiting from improving unit economics. In the meantime, Netflix’s outlook for the first quarter of 2024 suggests that this trend is set to persist.

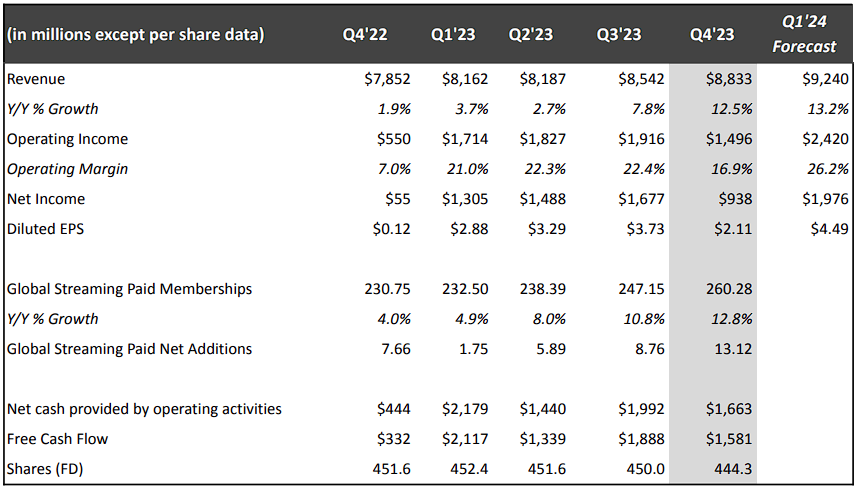

To illustrate, Netflix posted record revenues of $8.54 billion in Q4, a year-over-year increase of 12.5%. As you can see in the table below, revenue growth has also accelerated, in line with subscriber growth. Notably, this increase was the best for the company since Q4-2021’s growth rate of 16%. Simultaneously, NFLX’s operating margin jumped to 16.9%, notably higher than last year’s 7.0%. This combo allowed net income and EPS to skyrocket to $938 million.

Noteworthy is also the fact that Netflix’s share count declined by 1.6% to 444.3 million, with management deploying just over $6.0 billion in buybacks in Fiscal 2023. While not a massive drop, management’s clear intention to boost buybacks should translate to a gradually accretive effect on earnings per share, which is welcomed.

But besides closing the year on a high note, investors were left particularly impressed with management’s Q1-2024 outlook, which points to further acceleration in revenues and a significant expansion operating income margin expansion. In particular, revenues are expected to grow by 13.2%, while operating income margin is expected to reach 26.2%, implying a notable expansion from last year’s 21% and last quarter’s 16.9%.

Is NFLX Stock a Buy, According to Analysts?

Regarding Wall Street’s view on Netflix, the stock has drawn a Moderate Buy consensus rating based on 27 Buys, 13 Holds, and one Sell assigned in the past three months. At $574.01, the average Netflix stock forecast implies 2.6% upside potential.

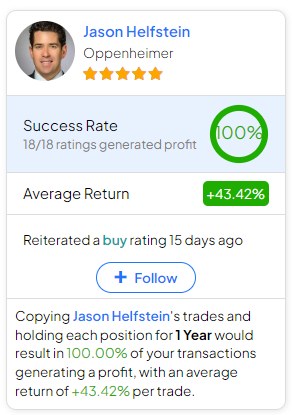

If you’re wondering which analyst you should follow if you want to buy and sell NFLX stock, the most profitable analyst covering the stock (on a one-year timeframe) is Jason Helfstein from Oppenheimer, with an average return of 43.42% per rating and a 100% success rate. Click on the image below to learn more.

The Takeaway

Netflix’s relentless dominance in the streaming realm remains impressive, defying industry saturation and intense competition. The recent acceleration in paid subscribers and surging revenues and earnings paint a promising outlook for the future. With prudent rising share buybacks and optimistic targets by management entering 2024, Netflix stock appears positioned for continued success in 2024.