Netflix (NFLX) recently released its Q2 results, showcasing continued acceleration in both membership and revenue growth. Despite intense competition, the streaming giant remains dominant, with its scalable unit economics fueling even more significant earnings growth. This positive trend is expected to continue, which is likely to keep fueling the stock’s ongoing bullish momentum, even after its notable recent gains. Consequently, I remain bullish on NFLX stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Q2 Results: Membership Growth Momentum Stuns

The standout feature of Netflix’s Q2 report was its continued acceleration in both membership and revenue growth, a trend that has persisted for several consecutive quarters. To illustrate this ongoing momentum, let’s examine Netflix’s year-over-year growth in paid subscribers over the past 10 quarters:

- Q1 2022: 6.7%

- Q2 2022: 5.5%

- Q3 2022: 4.5%

- Q4 2022: 4.0%

- Q1 2023: 4.9%

- Q2 2023: 8.0%

- Q3 2023: 10.8%

- Q4 2023: 12.8%

- Q1 2024: 16.0%

- Q2 2024: 16.5%

Initially, one might argue that Netflix’s accelerating growth could be due to the slower pace observed between 2022 and 2023, coupled with the company’s efforts to curb account sharing. That said, the sustained acceleration over several quarters suggests a deeper trend: Netflix is solidifying its dominance in the streaming market.

This trend becomes more apparent when compared to other streaming services struggling to maintain, let alone grow, their subscriber base. For example, Disney+ reported 153.6 million members in Q2 2024, down from 157.8 million the previous year. Similarly, Peacock’s paid subscribers in the United States fell from 34 million in Q1 2024 to 33 million in Q2 2024.

In stark contrast, Netflix continues to exhibit robust growth, suggesting that households are gravitating toward Netflix as their primary streaming service while potentially canceling secondary subscriptions.

It’s also important to note that despite Netflix’s announcement in Q1 that it will stop disclosing subscriber figures starting in Q1 2025, which raised concerns about potential subscriber declines, the company’s momentum remains strong. Even if membership growth slows, Netflix clearly will not face an imminent drop in subscribers.

Revenue Growth Reflects Membership Growth, Ad Tier Addition

Netflix’s revenue growth in Q2 reflected the underlying membership expansion while benefiting from the still relatively new ad-supported tier. As you can see in the table below, revenues amounted to just about $9.56 billion, up 16.8%, marking the best quarterly top-line increase in 12 quarters.

In the meantime, management commented that the ad-supported tiers have reached about two hours of viewing time per account per day, which is comparable to the engagement documented in non-ad plans.

Sure, the revenue per user from ad-supported memberships (ads arm) currently lags behind that of non-ad-supported memberships. However, there are two factors to note here: first, the ad-supported tier still brings in revenue that was previously untapped from those not willing to pay at all, and second, the gap between its subs arm and ads arm actually represents a significant revenue growth opportunity as the company keeps expanding its ad inventory and adding quality advertisers.

Netflix’s Valuation Remains Attractive Despite Strong Gains

Netflix stock has rallied 43% over the past year. Yet, following the company’s Q2 results, it’s not hard to argue that the streaming giant’s valuation still remains attractive. The significant re-acceleration in revenue growth and Netflix’s easily scaleable unit economics have translated to even more substantial earnings growth. Specifically, net income grew by 44.3% to $2.15 billion.

Building on strong earnings growth in the year’s first half and anticipating similar performance in the latter half, consensus estimates project a full-year EPS of $19.15, reflecting a remarkable 59.2% increase year-over-year.

This estimate also implies a forward P/E of about 33x based on the stock’s current price, which is not that crazy, given the underlying earnings growth and clear dominance in the space. Analysts expect that EPS will continue to grow by roughly 20% per annum in the coming years, which should easily justify this multiple and even allow for further gains.

Is NFLX Stock a Buy, According to Analysts?

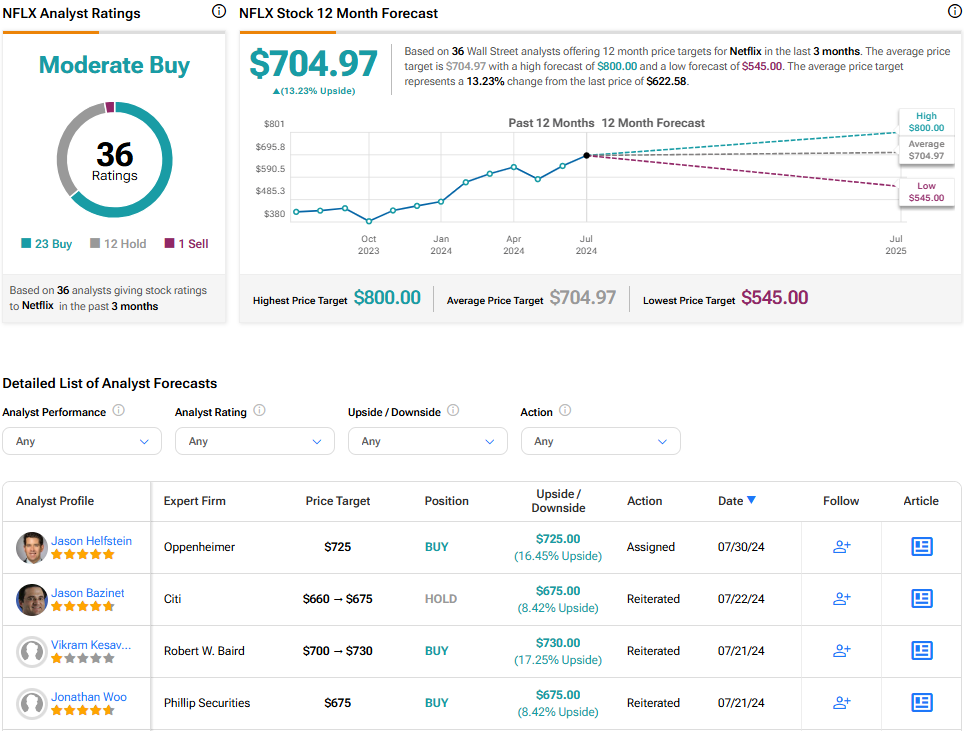

Examining Wall Street’s view on Netflix, the stock has drawn a Moderate Buy consensus rating based on 23 Buys, 12 Holds, and one Sell assigned in the past three months. At $704.97, the average Netflix stock forecast implies 13.2% upside potential.

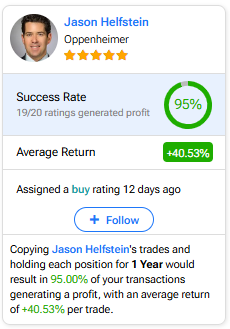

If you have yet to decide which analyst to follow for buying and selling NFLX stock, Jason Helfstein from Oppenheimer is the most accurate one covering the stock over a one-year period. He has an average return of 40.7% per rating and a 95% success rate. Click the image below to find out more.

The Takeaway

Overall, Netflix’s impressive Q2 results highlight its robust growth trajectory, powered by accelerating membership and revenue increases. Despite fierce competition, Netflix’s continued expansion, fueled by its robust demand for its core plans and recently added ad-supported tier, positions it as the prevailing player in the streaming market. With favorable unit economics driving even stronger earnings growth and the stock’s valuation appearing relatively reasonable against its future EPS estimates, it’s hard to bet against its clearly strong bullish case.