Streaming giant Netflix (NASDAQ:NFLX) is scheduled to announce its Q4 earnings on January 23. The implementation of an ad-supported tier, efforts to address password sharing, and a robust content lineup will likely drive Q4 financials and the paid membership base. Meanwhile, in a key development ahead of the results, the company announced that Scott Stuber, head of films, will be leaving the streaming giant in March to start his own media venture. Interestingly, as per a Bloomberg report, Stuber’s media company will also produce projects for Netflix. Stuber is credited with making Netflix one of the premier movie studios in Hollywood.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Netflix’s efforts to monetize its platform efficiently augur well for future growth. However, NFLX stock has trended higher and appreciated over 35% in one year, implying that the upside potential could be capped. Let’s dig deeper.

Netflix – Q4 Expectations

Wall Street expects Netflix to report revenue of $8.72 billion in Q4, which compares favorably to the prior-year quarter’s revenue of $7.85 billion. Moreover, it is in line with the management’s guidance and shows a slight sequential improvement.

The expected year-over-year improvement in its top line and lower spending will likely drive its operating income and bottom line. Analysts expect Netflix to post earnings of $2.21 per share in Q4, reflecting a significant improvement from $0.12 per share in the prior-year quarter.

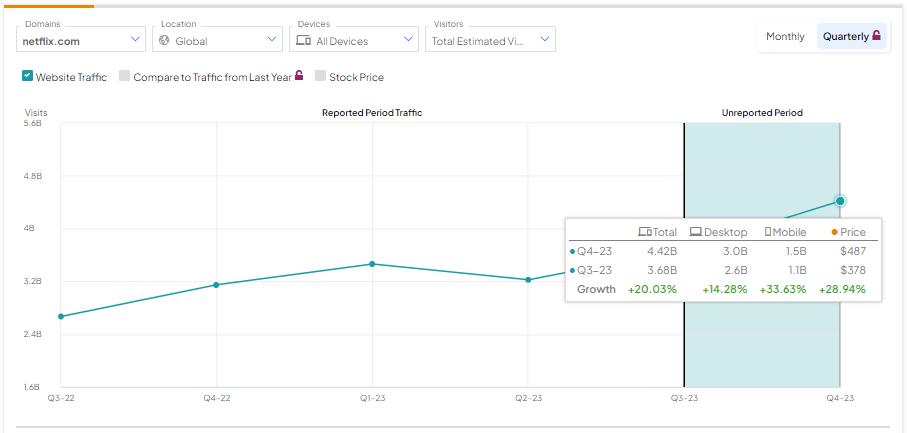

Website Traffic Shows Growth

The quality of Netflix’s content consistently drives user engagement on its platform, which plays a vital role in retaining and growing its customer base. TipRanks’ website traffic screener shows that traffic increased for NFLX sequentially and year-over-year.

According to the tool, the number of visits to netflix.com increased by 20.03% sequentially in Q4. Moreover, website traffic jumped 40.3% on a year-over-year basis.

Learn how Website Traffic can help you research your favorite stocks.

Is Netflix a Buy, Hold, or Sell?

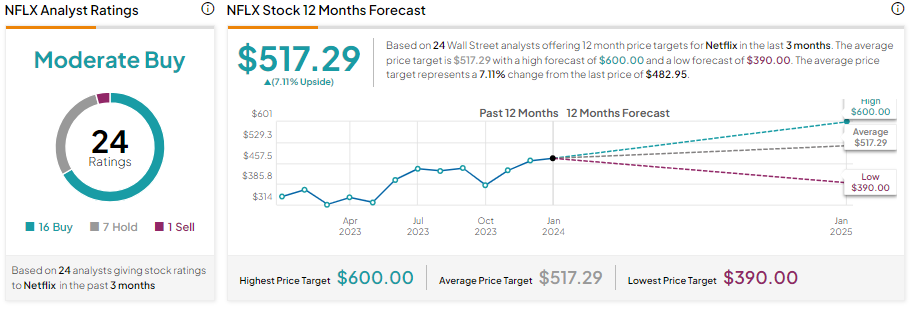

Wall Street is cautiously optimistic about Netflix stock ahead of Q4 earnings. The stock has 16 Buys, seven Hold, and one Sell recommendation for a Moderate Buy consensus rating. Analysts’ average price target of $517.29 implies a limited upside potential of 7.11% from current levels.

Insights from Options Trading Activity

While analysts are cautiously optimistic about NFLX stock, options traders are pricing in a +/- 7.96% move on earnings, smaller than the previous quarter’s earnings-related move of 16.05%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.