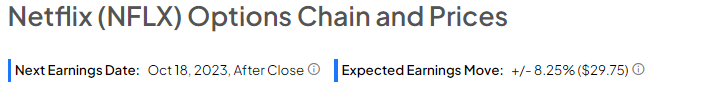

Streaming and entertainment giant Netflix (NASDAQ:NFLX) will release its third-quarter earnings on October 18, 2023. Analysts expect Netflix’s paid subscriber base to increase due to the crackdown on password sharing. However, the ARPU (Average Revenue per User) may continue to face challenges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a research note dated October 6, Alicia Reese of Wedbush wrote that she expects strong growth in NFLX’s membership base, led by the company’s efforts to curb password sharing. However, Reese believes that Netflix’s ARPU will face challenges in Q3. This is attributed to an unfavorable mix of subscription tiers, the introduction of ad-supported subscription plans that have not yet started to contribute positively, the majority of subscriber growth originating from regions with lower ARPU, and tough year-over-year comparisons.

Nonetheless, the analyst is bullish about Netflix’s long-term prospects and reiterated a Buy rating on October 6.

With this backdrop, let’s look at the Street’s consensus estimates for the third quarter.

Netflix – Q3 Expectations

Wall Street expects Netflix to post revenue of $8.54 billion in Q3, which compares favorably to the prior-year quarter’s revenue of $7.93 billion. Moreover, it is slightly higher than the company’s guidance of $8.5 billion.

On the bottom line, analysts expect NFLX to post earnings of $3.49 per share, reflecting improvement on a year-over-year and sequential basis. The company’s profits should benefit from higher revenues. However, pressure on ARPU could restrict EPS growth.

Given the pressure on ARPU, Monness analyst Brian White believes that price hikes are imminent. However, heightened competitive activity poses challenges. White reiterated a Hold on NFLX stock on October 11.

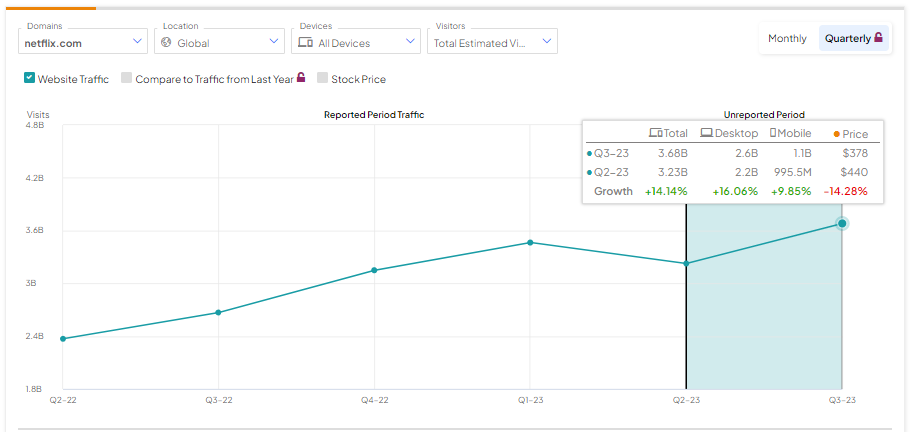

Website Traffic Data Indicates Solid Growth

Though the competition in the streaming business remains high, Netflix’s robust content slate enables it to consistently drive engagement, retain customers, and drive its paid membership base. As for the third quarter, TipRanks’ website traffic screener shows that traffic increased for NFLX sequentially and year-over-year.

Per the tool, the number of visits to netflix.com was up 14.14% quarter-over-quarter in Q3. Moreover, website traffic jumped 37.95% on a year-over-year basis in Q3.

Learn how Website Traffic can help you research your favorite stocks.

What is the Prediction for Netflix stock?

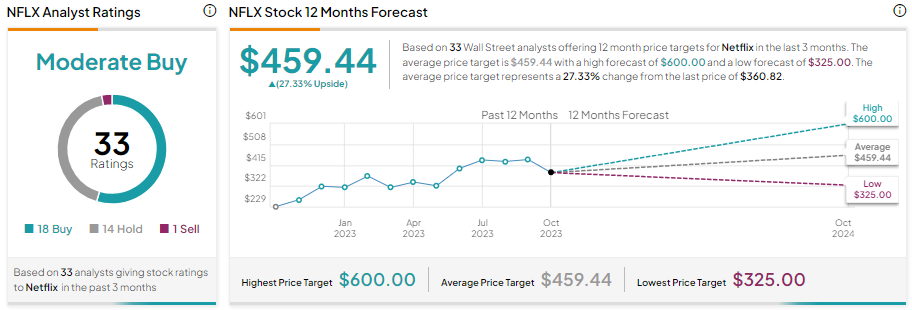

Wall Street analysts are cautiously optimistic about NFLX stock ahead of Q3 earnings. It has received 18 Buy, 14 Hold, and one Sell recommendations for a Moderate Buy consensus rating. Meanwhile, analysts’ average price target of $459.44 implies 27.33% upside potential from current levels.

Insights from Options Trading Activity

Options traders are pricing in a +/- 8.25% move on earnings, lower than the previous quarter’s earnings-related move of -8.41%.

Bottom Line

Netflix is expected to benefit from its efforts to curb password sharing. Further, its strong content continues to support its growth. While its ARPU could remain under pressure in the short term, an increase in pricing and accretion from ad-supported tiers could significantly boost its financials and share price.