Shares of the streaming giant Netflix (NASDAQ:NFLX) are among the most-discussed stocks on the social media platform Reddit. While NFLX stock has risen over 36% year-to-date and exceeded the S&P 500 Index (SPX) with its returns, Wall Street analysts’ average price target suggests further upside potential from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

With this backdrop, let’s understand what’s in store for NFLX shareholders in the future.

Is Netflix Stock a Buy, Hold, or Sell?

Netflix’s crackdown on password sharing has significantly boosted its paid membership base. For instance, NFLX’s paid net additions were 8.76 million in Q3, reflecting a notable growth both sequentially and year-over-year. However, the average revenue per user (ARPU) fell by 1%, reflecting an increase in membership from countries with lower ARPU, a shift in plan mix, and limited price increases over the past 18 months.

Looking ahead, Netflix expects its paid net additions to be similar to Q3. However, it expects ARPU to stay flat due to limited price hikes.

In a note to investors dated October 18, Alicia Reese of Wedbush wrote that Netflix will benefit from the password-sharing crackdown, which will increase its subscriber base. Further, the analyst believes that the ad tier will reduce churn. Reese is upbeat about NFLX stock and expects the company to generate solid earnings and cash flows. However, Reese noted that the ad tier continues to hurt the company’s ARPU.

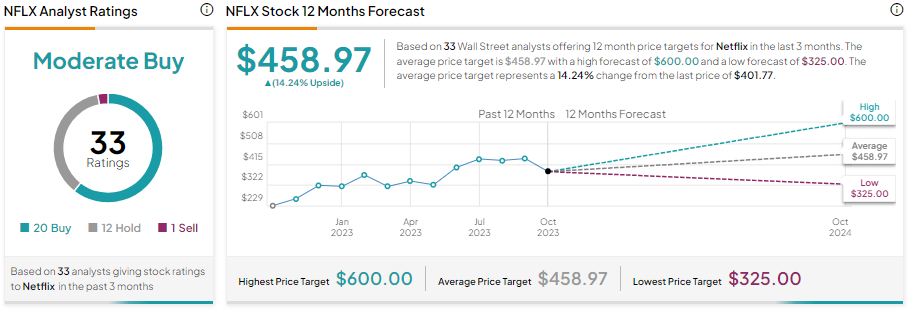

Overall, Netflix’s strong focus on content and efforts to drive its revenue and earnings augur well for long-term growth. However, the near-term pressure on ARPU and increased competition in the streaming business keeps analysts cautiously optimistic about NFLX stock. It has received 20 Buys, 12 Holds, and one Sell recommendation for a Moderate Buy consensus rating. Meanwhile, the average NFLX stock price target of $458.97 implies 14.24% upside potential from current levels.

Bottom Line

Netflix’s growing paid subscriber base, strong content, ability to generate solid free cash flows, and focus on returning substantial cash to its shareholders through buybacks support the bull case. However, heightened competition in the streaming business and ongoing pressure on ARPU remain a short-term drag.

In summary, this trending Reddit stock has good long-term prospects. However, investors must exercise caution in the near term, as reflected by the Moderate Buy consensus rating.