Cloudflare (NET) stock is gaining big. The cybersecurity and web services firm saw its share price grow over 25% in the past month.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

NET stock seems to be back in business after a relatively muted performance in the past few months. Moreover, the risks surrounding the elongation of the Russia-Ukraine War seem to have lessened. Additionally, the improvements in the macro-economic environment, in general, are having a positive impact on NET stock.

Cloudflare has plenty of growth catalysts due to its robust competitive advantages and products. It is among the most innovative data companies globally, and its pivot towards enterprise infrastructure and technology stacks could pay many dividends down the road.

It operates an immensely profitable business, where it leverages its proprietary AI and ML to expand its tech infrastructure. I’m bullish.

International Expansion Is Key

International demand for networking and data storage is rising briskly and has exceeded supply.

Sensing the colossal opportunity, Cloudflare aims to establish a dominant position outside its core markets by leveraging its existing relationships with top software vendors. Through its partnerships, the tech firm can provide access to its top-of-the-line content delivery networks to multiple underserved markets.

Cloudflare’s management understands how it grabs a much larger piece of the pie with its revenues from outside the U.S. Currently, the business has less than 50% of its sales from outside the U.S., which is why it wants to push on to penetrate new markets.

Though profitability remains elusive, it’s perhaps the right decision to branch out and possibly expand. Its profile is stable and is preparing Cloudflare to make enough to focus on international expansion.

However, it mustn’t compromise its financial positioning in its expansion efforts. It could easily enter into a downward spiral, so effective capital allocation is imperative.

Moving Towards Profitability

As mentioned earlier, profitability has been a major concern for Cloudflare and its investors. However, we see how the business has been inching closer to breaking even in the past several quarters.

Its revenues have grown from $287 million in 2019 to $656.4 million last year. Its top-line expansion has outpaced expenses and has led to a healthy increase in positive free cash flows. The business generated a sizeable $8.6 million in free cash flows during the fourth quarter.

The company isn’t profitable, though, which is largely due to its non-cash expenses. However, the ability to create free cash flows is a step in the right direction. A glance at its cash flow trajectory suggests that positive earnings are right around the corner.

It has to do with Cloudflare’s ability to transform its business from a CDN provider to one offering a suite of cutting-edge products, including computing and security.

These innovative new verticals have taken the company’s addressable market from a whopping $32 billion in 2018 to $86 billion in 2022. Its customers have embraced its latest products and spend a truck-load on its services, reflecting a 125% revenue retention rate during the fourth quarter of 2022.

Management expects its sales to reach $932 million this year, 42% of last year’s results. Cloudflare has had a solid track record of beating analyst estimates every quarter since listing, and it seems likely that it will end the year with over 50% growth.

Wall Street’s Take

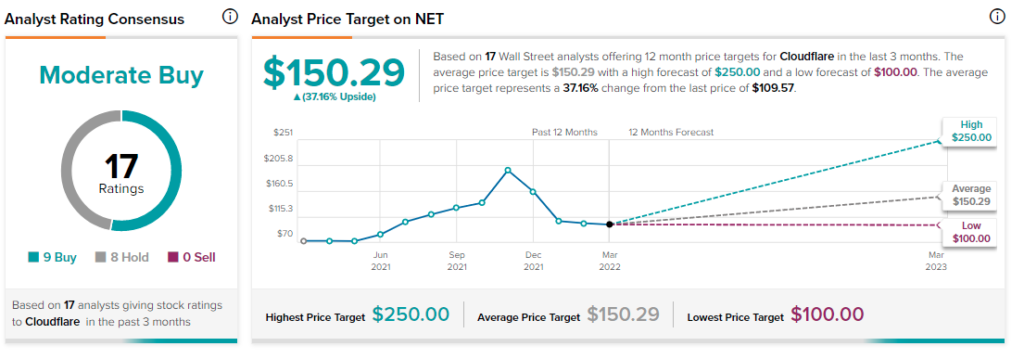

Turning to Wall Street, NET stock maintains a Moderate Buy consensus rating. Out of 17 total analyst ratings, nine Buys, eight Holds, and zero Sell ratings were assigned over the past three months.

The average NET price target is $150.92, implying 37.2% upside potential. Analyst price targets range from a low of $100 per share to a high of $250 per share.

Final Word On NET Stock

Cloudflare has been a growth juggernaut, expanding its revenues by over 50% in the past five years. With its recent performance, profitability could be right around the corner.

Hence, investors can look forward to more growth as the company innovates. By 2024, it expects its addressable market to be an incredible $100 billion.

However, there is plenty of concern over the company’s premium valuation. It trades at over 35 times forward sales, which isn’t unlike its peers.

Yet, its incredible track record of launching products and blowing past estimates speaks for itself. It boasts an attractive pipeline of projects with a recognizable brand to bolster its financial and competitive positioning.

A resolution to the war in Europe could potentially kickstart a bull run for NET stock. However, the outlook remains mighty uncertain as its stock continues to see wild swings in the near term.

Growth stocks have regained strength and gained plenty of ground. Still, investors aren’t ready to support growth stocks, it seems. Nevertheless, the business remains robust and will continue to offer incredible returns for investors in the long run.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure