It sounds like a bad joke — something you’d expect to read on as a Babylon Bee headline, or on The Onion — but would-be electric van company Mullen Automotive (NASDAQ:MULN) has just announced it’s considering running its second reverse share split in as many months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Yes, you read that right. Just six weeks after reverse splitting its shares 1-for-25 (transforming 25 shares worth $0.06 apiece into one single share worth $1.50), on Tuesday, June 13, Mullen filed a proxy statement with the SEC listing the agenda of questions to be addressed at its August 3 annual general meeting of shareholders.

Some of the proposals were mundane: electing a couple of directors to its board, approving salaries for corporate officers, and ratifying the board’s choice of independent auditor. Others were less so:

- Reincorporating the company in Maryland rather than Delaware (more on that in a moment).

- Awarding up to 52 million Mullen shares as equity incentives for company insiders (that’s about 21% of all shares currently outstanding, by the way).

- And pre-approving a decision to effect a second reverse split — just six weeks after the last reverse split — that could swap anywhere from two to 10 existing Mullen shares for one single Mullen share (i.e. a 1-for-2 or 1-for-10 reverse split).

Again, it all sounds like a joke — but investors aren’t laughing.

Mullen shares plunged 18% on Tuesday, the day the proxy statement was filed with the SEC, then collapsed a further 30% on Wednesday, as the news began to spread.

And no wonder. Mullen really seems intent on giving away the store here, folks — and specifically, on giving 21% of the “store” to company insiders — and then collapsing its share count once again in order to remain in compliance with Nasdaq listing requirements (which require that the share price be brought back up above $1, from the $0.225 the shares are worth today).

At this point, investors are probably wondering: How can this get any worse? Well… I’ll tell you how.

Remember the bit about shifting Mullen’s incorporation to Maryland? Well, farther down in the proxy statement, Mullen explains its rationale for wanting to do this — and you’re probably not going to like it. Turns out:

“The charter of a Maryland corporation may provide the board of directors of a Maryland corporation the power to amend the charter of the corporation, without a stockholder vote, to increase or decrease the aggregate number of authorized shares of stock or the number of shares of any class or series of stock that we are authorized to issue” (emphasis added).

Furthermore: The Maryland General Corporation Law “provides… the board of directors of a Maryland corporation… may amend the charter of the Maryland corporation to effect reverse stock splits without a stockholder vote so long as the combination of shares of stock is at a ratio of not more than 10 shares of stock into one share of stock, in the aggregate, over any 12-month period” (emphasis added).

I don’t know about you, but it sure sounds to me like — as crazy as the idea of reverse splitting Mullen’s shares two times in a row already sounds — Mullen is laying the groundwork for allowing itself to conduct even more reverse share splits in the future. And the only reason I can imagine for Mullen to do that would be… because reverse splitting the shares is the only way Mullen can keep its share price from repeatedly sinking below $1.

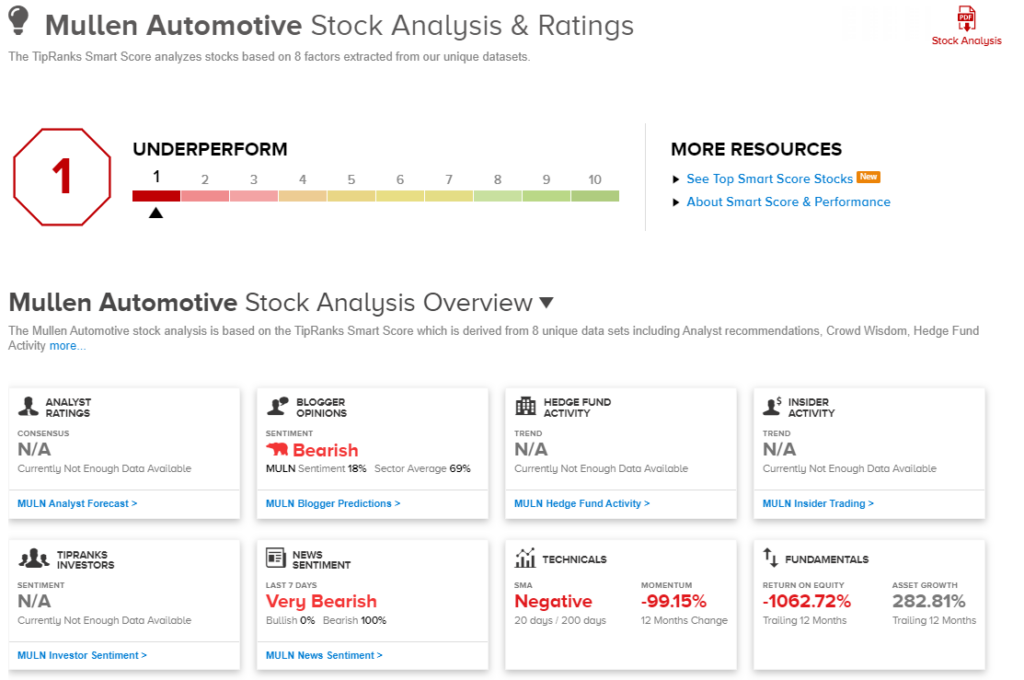

Overall, MULN has a Smart Score of 1 (out of 10) on TipRanks, meaning that it is likely to underperform the market. (See MULN stock analysis)

Smart Score is TipRanks’ proprietary quantitative stock scoring system that evaluates stocks on eight different market factors. The result is data-driven and does not involve any human intervention.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.