Mullen Automotive (NASDAQ:MULN) is an ambitious company in the clean energy space, but financial traders should find a different electric vehicle (EV) stock than MULN. I am neutral on Mullen stock because the company’s financial condition is subpar, and MULN could get kicked off of the Nasdaq (NDX) exchange at some point.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Mullen Automotive is an EV manufacturer in California. However, the company has international ambitions. Specifically, Mullen is bringing its I-GO Commercial Urban Delivery EV to Europe. That would be fine if Mullen Automotive had the financial wherewithal to successfully expand its operations for the long term, but that’s doubtful.

Mullen Shouldn’t Be Hiring and Expanding Now

Not only is Mullen Automotive venturing into international EV markets, but the company is also hiring new workers. Meanwhile, other companies are trimming their staff and operations. Mullen shouldn’t be expanding its team and operations now since the company’s financials don’t justify it.

Mullen Automotive’s most recently amended Form 10-K indicates that, in the year ended September 30, 2021, the company had $22.4 million in operating expenses and a $44.2 million net loss. Fast-forward to the year ended September 30, 2022, and Mullen had nearly $97 million in operating expenses and an eye-watering $740 million net loss.

In other words, Mullen Automotive has a terrible spending habit and a rapidly widening net loss. Clearly, the company isn’t in a strong enough financial position to grow its team and operations, which Mullen is attempting to do nonetheless.

Mullen Might Get Booted from the Nasdaq Exchange

In case Mullen Automotive’s financial issues aren’t enough to dissuade prospective investors, here’s another possible problem to consider. MULN stock might actually get booted off of the Nasdaq exchange sometime soon.

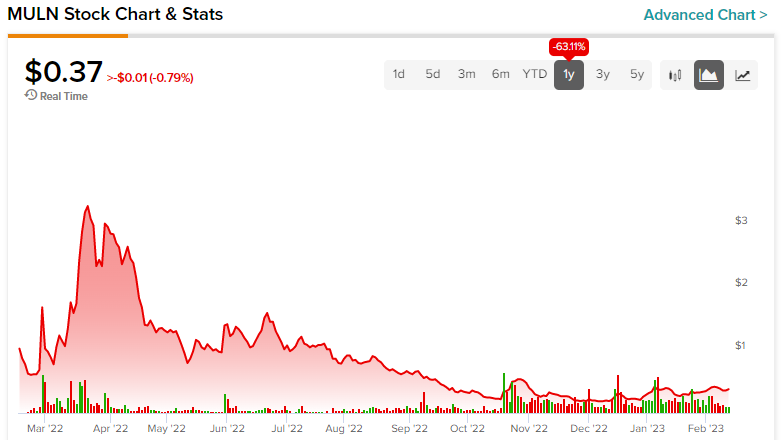

As the company acknowledged, Mullen Automotive “has until March 6, 2023, to meet the Nasdaq minimum bid requirement of $1.00.” The Nasdaq exchange has been known to delist companies if their share prices stay below $1.00 for too long.

MULN stock hasn’t been above $1 since the summer of 2022. Today, the stock price is around $0.37. The situation isn’t completely hopeless, but it’s quite possible that Mullen won’t be able to meet the Nasdaq exchange’s minimum bid requirement. If that happens, the company’s stock shares could be removed from the Nasdaq.

Conclusion: Should You Consider MULN Stock Now?

Mullen Automotive is a textbook example of big ambitions but insufficient means to accomplish those ambitions. It requires a great deal of capital to compete successfully in the hyper-competitive EV market, and Mullen just doesn’t check that box.

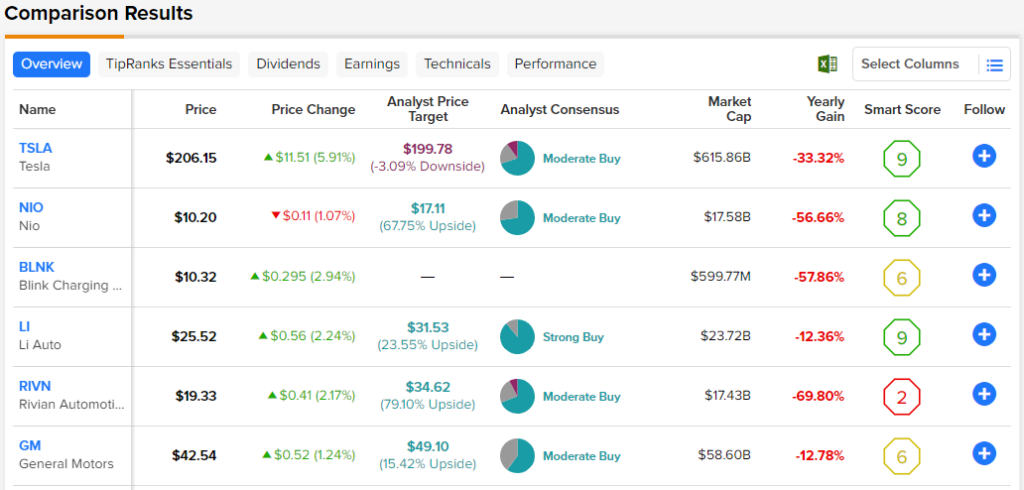

Therefore, I’m neutral on MULN stock and don’t feel that investors should consider it now. Instead, feel free to examine other EV manufacturers, especially ones that are in a better financial position than Mullen Automotive.