The tech sector sold off chaotically on Wednesday, the day after Alphabet (GOOGL) and Tesla (TSLA) reported quarters that, while not abysmal, were far from perfect. The brutal day of selling seemed more like an overreaction than a sign that the AI trade, as we know it, is dying. Undoubtedly, it could take a few more days to settle before it’s off to the races for the AI names again.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

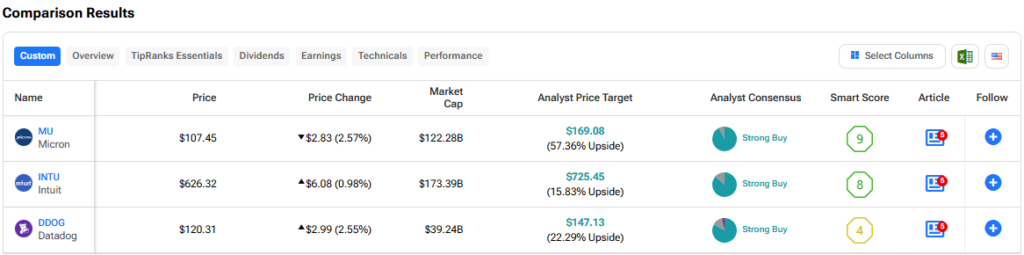

Therefore, let’s use TipRanks’ Comparison Tool to evaluate three intriguing tech names — MU, INTU, DDOG — if you’re looking for dip buys after the Nasdaq 100’s (NDX) 9% drop from its highs.

Micron (MU)

Micron suffered a 3.5% drop on Wednesday, about in line with the Nasdaq 100, which was off by a similar amount. With shares of the high-performance memory chip maker now down over 30% from their June peak, perhaps it’s time to start thinking about buying. After all, demand for high-performance memory chips hasn’t nosedived as MU stock has. As analysts stay upbeat, I’m inclined to stay bullish on the name.

Arguably, Micron is a much stronger buy than it was a month ago, but it certainly doesn’t feel that way after the latest beatdown. Additionally, investors still seem put off by the company’s latest in-line guide, which caused many to completely overlook what was an impressive third-quarter showing that saw AI power around 50% in sequential data center sales growth.

The company is gaining share in high-bandwidth memory, and the trend seems likelier than not to continue into the year’s end as the AI boom keeps marching forward, even as AI stocks move backward. In the face of retreating expectations, it’s tough not to love MU stock while it’s down nearly a third from its peak.

At 12.8 times forward price-to-earnings (P/E), MU stock goes for a gigantic discount to the semiconductor industry average of 25 times.

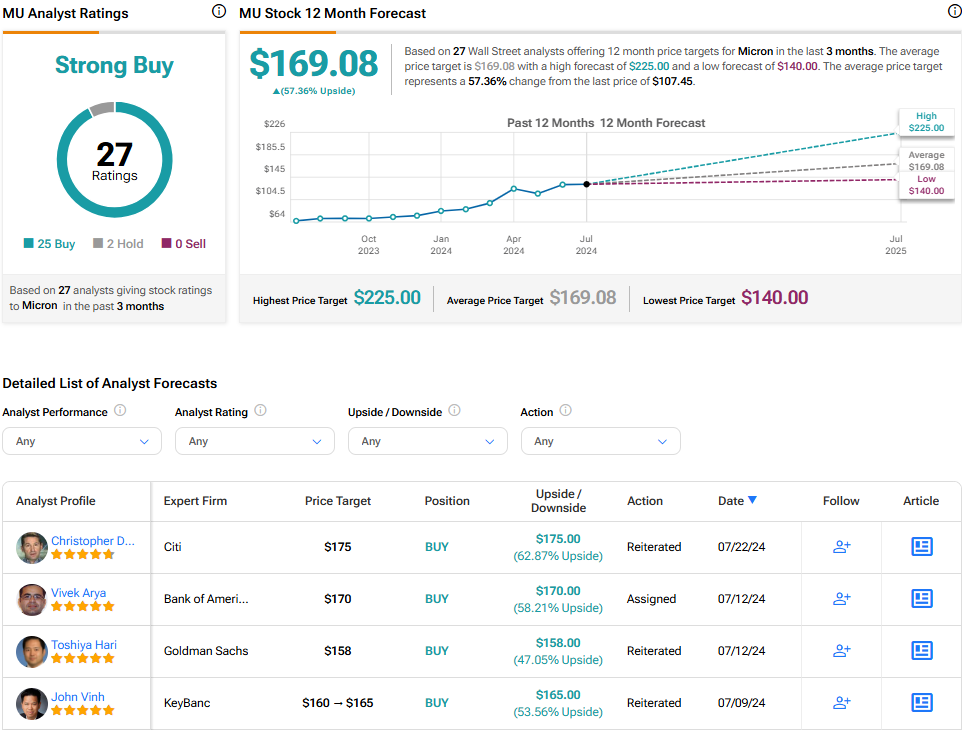

What Is the Price Target for MU Stock?

MU stock is a Strong Buy, according to analysts, with 25 Buys and two Holds assigned in the past three months. The average MU stock price target of $169.08 implies 57.4% upside potential.

Intuit (INTU)

Shares of financial software developer Intuit have been treading water for the last six months, and now, they’re starting to sink, with the stock now down over 7% from its recent high. Though the chart looks ugly, I’m inclined to stay bullish as Intuit restructures its workforce to better capitalize on the AI boom.

Indeed, accounting, taxation, and other financial responsibilities aren’t fun, at least for most people. Given this, Intuit has a real opportunity to leverage AI to remove (or at least lessen) a top stressor in many people’s lives.

With the company laying off 1,800 employees (about 10% of staff), more than half of whom fell short of expectations, Intuit seems ready to rebuild itself from the ground up. Also, management clarified that layoffs are not about cost-cutting; they’re more about shoring up capital to go on a hiring spree in Fiscal Year 2025.

In the AI age, a different set of skills will be needed to thrive. Data scientists, big-data analytics experts, machine learning specialists, and other talented AI-savvy talent will be increasingly necessary for Intuit to take its growth to the next level. And though layoffs are such a terrible thing, I view Intuit’s AI-focused hiring shift as a sign that it’s serious about seizing the multi-year AI opportunity at hand.

Further, committing to expensive AI projects is no longer enough to keep investors happy. They want to see R&D spent deliberately. When it comes to Intuit, it’s doing its fair share of hiring and firing to find the optimal balance for its new AI-driven road map. All things considered, I view the long-term AI-induced upside as considerable for Intuit.

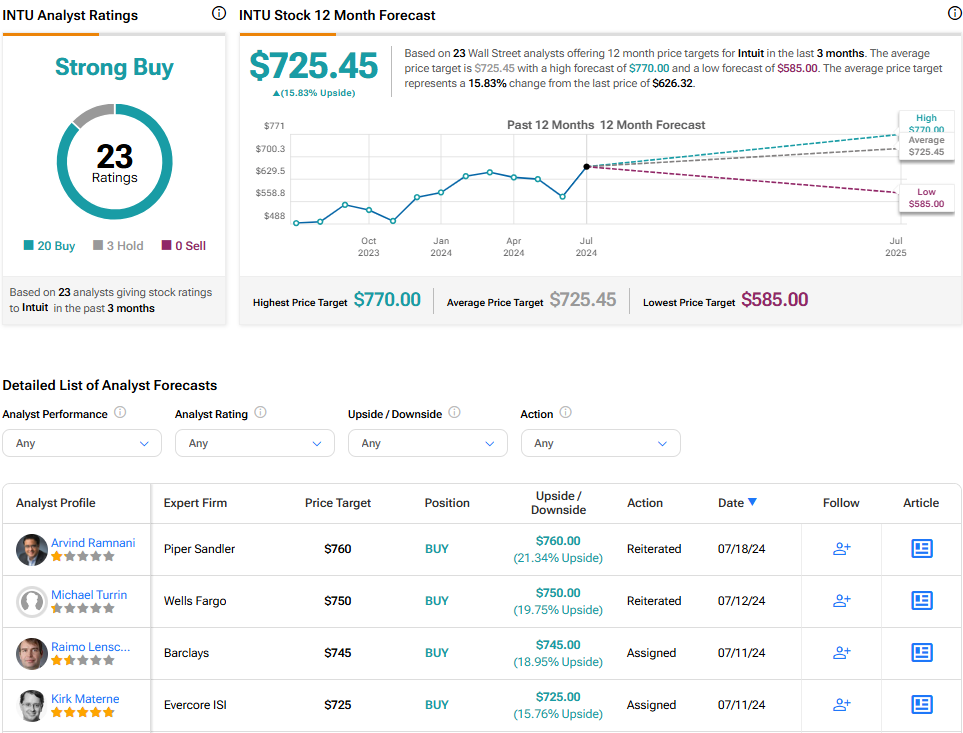

What Is the Price Target for INTU Stock?

INTU stock is a Strong Buy, according to analysts, with 20 Buys and three Holds assigned in the past three months. The average INTU stock price target of $725.45 implies 15.8% upside potential.

Datadog (DDOG)

After plunging 5% on Wednesday, shares of observability service provider Datadog are now off 13% from their recent 52-week high. The firm is in the running to acquire GitLab (GTLB), but Barclays (BCS) analysts don’t seem to be big fans of such a deal. As the stock fades along with high-multiple tech, I’m inclined to be bearish on the name, at least until the valuation cools off and there’s more clarity with what the firm intends to do with GitLab.

GitLab stock isn’t just a bit lofty at more than 13 times price-to-sales (P/S); it’s a hefty takeover target (shares have an $8.5 billion market cap) for a firm like Datadog, which boasts a $40.2 billion valuation. As Barclays pointed out, such a deal would represent “about a quarter of DDOG’s market cap.”

Barclays also noted that such a big deal would go against the firm’s “small tuck-in acquisition” strategy and push Datadog away from its “core observability market.”

Indeed, Datadog seems to be biting off more than it can chew with GitLab. Though a deal isn’t set in stone, Barclays’ comments are concerning, especially since such a deal would likely add a heavy pile of debt to the balance sheet. At this juncture, Datadog seems keen on making a deal to add to its product portfolio.

With tech valuations as high as they are, the odds of overpaying for a deal are high. Either way, perhaps nibbling on small-scale deals makes more sense at a time like this. At 68.9 times forward P/E, I’d argue there are cheaper places to look if you want tech exposure. In any case, I wouldn’t count on the wobbly niche tech firm to fetch the best returns in the second half of the year.

What Is the Price Target for DDOG Stock?

DDOG stock is a Strong Buy, according to analysts, with 25 Buys, four Holds, and one Sell assigned in the past three months. The average DDOG stock price target of $147.13 implies 22.3% upside potential.

The Takeaway

Wednesday’s tech wreck has “buy the dip” written all over it. The trio of Strong Buys outlined in this piece are among the most praised by analysts right now.

Micron still has a lot to gain from the AI boom as it meets high-performance memory demands associated with it. As for Intuit, it’s restructuring its talent pool to thrive in the AI age, whereas Datadog seems keen on making a deal, even if it deviates from its original plan to pursue tuck-in deals. Of the trio, analysts see MU stock as having the most room (more than 57% upside potential) to run in the year ahead.