The video-gaming wars are poised to take it to the next level, with the emergence of next-generation hardware, the rise of virtual and augmented reality, and entertainment bundles. In this piece, we’ll compare three promising video-gaming stocks — Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Take-Two Interactive (NASDAQ: TTWO) — to see where analysts stand and how they’ll influence the future of the gaming industry. TTWO has the highest upside potential based on analyst estimates, but let’s dig deeper.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Undoubtedly, video gaming is a fast-growing market, but it’s one that can be tough to break into, given the large upfront investment that’s no guarantee of a good return. Indeed, the business of gaming is similar to that of video streaming.

Though any firm can break into the gaming scene, mitigating risks associated with costly flops is tough. That’s why I think the market favors firms with deep pockets and a willingness to take risks for a shot at outsized gains. Tech titans like Microsoft and Apple are video-gaming behemoths that have made quite a splash in the world of gaming over the years.

With its fast-growing Xbox segment, Microsoft is one of North America’s most powerful console and PC video game kingpins. Meanwhile, Apple boasts the throne in mobile gaming — the fastest-growing gaming medium. Then there are the gaming pure-plays like Take-Two Interactive, which have been rumored to be attractive takeover targets amid rampant industry consolidation.

Microsoft (MSFT)

Recently, Microsoft announced its plans to launch its own mobile gaming store. Such a store could give Apple a good run for its money in mobile games without compromising the growth to be had from console and PC.

Microsoft has the tech talent, industry expertise, and deep pockets to change the video-gaming industry as we know it. Its latest mobile-gaming plans may be just the start of its gaming division’s next leg higher.

Looking into the future, I’d look for gaming to gravitate away from the “a la carte” game purchases we’ve all grown accustomed to and toward more of a subscription model.

Indeed, Microsoft’s Game Pass is a profoundly successful subscription in the world of gaming. As Microsoft continues spending considerable sums to enhance the value proposition of Game Pass, I’d look for Microsoft’s Xbox to widen the gap with its rivals.

Microsoft awaits approval to buy Activision Blizzard (NASDAQ: ATVI). Should it successfully close the deal, some of the hottest franchises (think Call of Duty and Diablo) could be headed straight to Game Pass in what could be a huge win for the consumer and a gut punch to other firms looking to make a move into gaming.

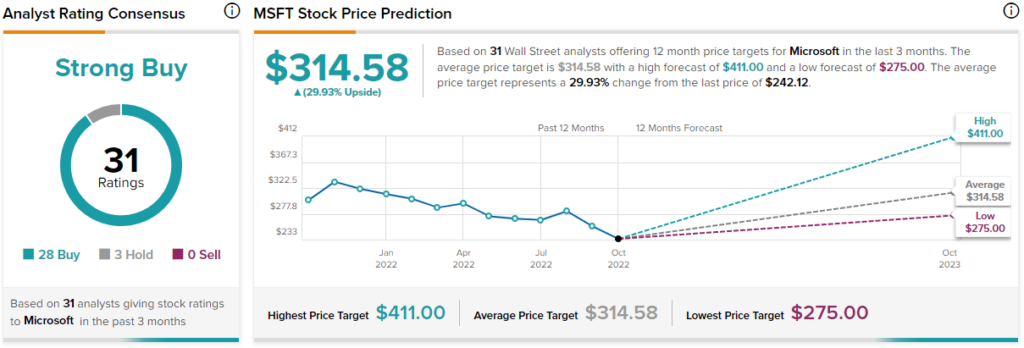

What is the Price Target for MSFT Stock?

Wall Street loves Microsoft, with a “Strong Buy” rating based on 28 Buys and three Hold ratings. The average MSFT price target of $314.58 implies 29.9% upside potential.

Apple (AAPL)

With Apple Arcade and the App Store, Apple has a mobile-gaming foundation that’s tough to stack up against. As Apple looks to improve its line-up while benefiting from service bundling advantages (video, games, music, fitness, news, and cloud storage), the firm should have little issue with Microsoft’s mobile-gaming push.

Still, Apple needs to do more than play defense. It needs to go after Microsoft’s gaming share in PC, console, the cloud, and, eventually, the metaverse. To expand into such realms, Apple must spend money to make money.

In that regard, Apple’s job of expanding into triple-A titles would be easier if it acquired a studio amid the latest plunge in tech valuations. After all, Apple does have an applaud-worthy track record of acquiring its way into new markets.

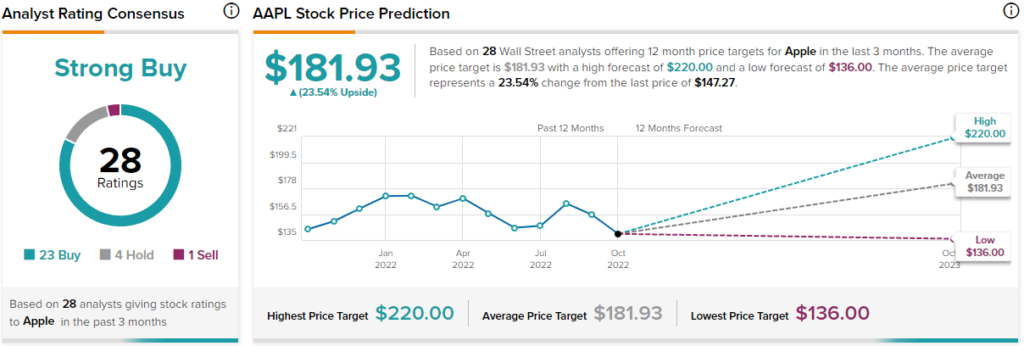

What is the Price Target for AAPL Stock?

Wall Street can’t get enough of Apple, with a “Strong Buy” rating, just like Microsoft. This is based on 23 Buys, four Holds, and one Sell rating. The average AAPL stock price target of $181.93 implies 23.5% upside potential.

Take-Two Interactive (TTWO)

As the video-game dominance of Microsoft and Apple grows, traditional video-game pure-plays like Take-Two Interactive could feel a bit of a squeeze until they’re ultimately gobbled up.

Indeed, Take-Two is a prized asset for any firm looking to enhance its gaming arsenal, with its valuable open-world franchises (think Grand Theft Auto and Red Dead Redemption) that are sure to be overwhelmingly popular, regardless of which medium they’re enjoyed on.

Despite recent industry headwinds, Take-Two is standing on its own two feet (pardon the pun), even as fans and investors grow fed up with how long it’s taking for the next Grand Theft Auto title to land.

Like most other gaming firms, Take-Two is looking to the mobile-gaming market for greater growth. Its acquisition of Zynga gives it a foot in the door to unlock impressive growth between its biggest-budget releases.

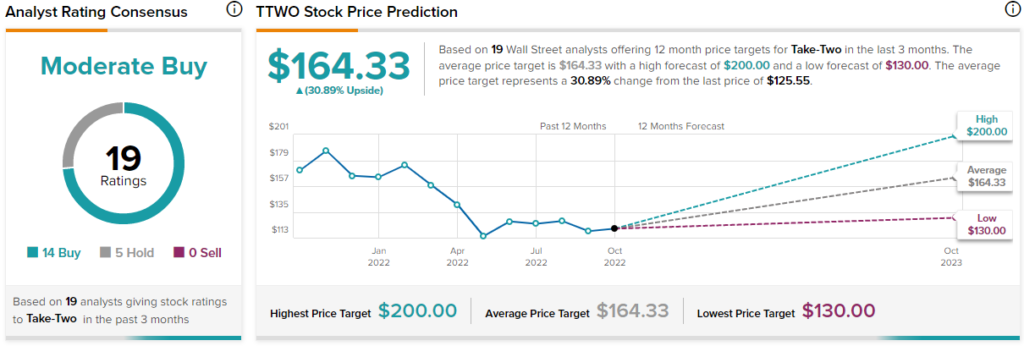

What is the Price Target for TTWO Stock?

Wall Street is cautiously optimistic about Take-Two, with a Moderate Buy consensus rating based on 14 Buys and five Hold ratings. The average TTWO stock price target of $164.33 implies 30.9% gains over the year ahead.

Conclusion: Analysts Love MSFT Stock the Most

Microsoft and Apple are two behemoths that are duking it out in yet another market that Take-Two calls home. Fortunately for all three firms, many winners will likely be minted as the video-gaming market evolves.

Between the three firms, Wall Street is most bullish on Microsoft, with MSFT’s Strong Buy rating coupled with its similar upside potential to TTWO. It’s just a master in any market it sets foot in, whether it be gaming, the enterprise, or the cloud.