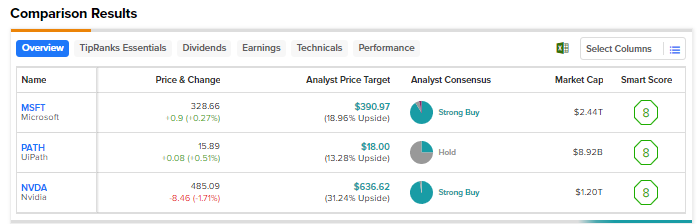

The tech world has been gripped by the generative artificial intelligence (AI) wave since the success of OpenAI’s ChatGPT sparked interest in the latest technology that can generate texts, images, or other media using advanced models. Despite macro pressures, the buzz around generative AI has triggered a rally in several tech stocks this year. We used TipRanks’ Stock Comparison Tool to place Microsoft (NASDAQ:MSFT), UiPath (NYSE:PATH), and Nvidia (NASDAQ:NVDA) against each other to find Wall Street’s favorite AI stock.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Microsoft (NASDAQ:MSFT)

Microsoft stock has advanced 37% since the start of this year, as the company is being considered as one of the frontrunners in the generative AI space. The company has invested billions of dollars in start-up OpenAI, the creator of ChatGPT, and is focused on integrating generative AI across its offerings.

Microsoft delivered better-than-expected fiscal fourth-quarter results. However, the company’s Q1 FY24 guidance fell short of expectations.

Still, most analysts remain bullish on MSFT stock, including Oppenheimer analyst Timothy Horan. On August 25, Horan reiterated a Buy rating on Microsoft with a price target of $410.

The analyst stated that cloud remains in the early innings, with AI increasing the overall total addressable market and adoption rate. Given this backdrop, Horan thinks that Microsoft is best positioned due to its “neutral operating system model,” which can support proprietary and open-source large language models (LLMs) and other applications.

Horan believes in the company’s ability to expand its ecosystem to commercialize advances in AI on top of its Azure offering and use its scale to introduce AI applications like Office 365 Copilot to the masses.

Horan also expects security to be a $200 billion market opportunity, with Microsoft emerging as a “best-of-suite provider” at a 10% market share growing 40% annually.

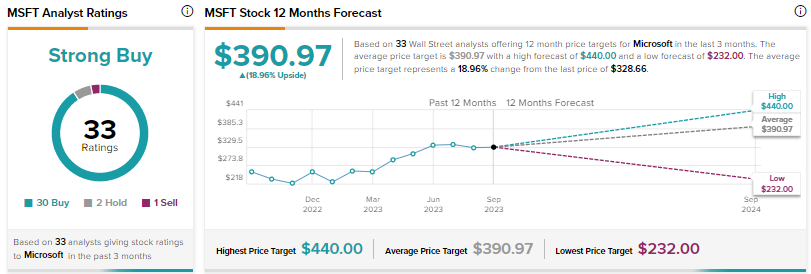

What is the Target Price for MSFT?

With 30 Buys, two Holds, and one Sell recommendation, Microsoft stock has a Strong Buy consensus rating. The average price target of $390.97 implies about 19% upside potential.

UiPath (NYSE:PATH)

UiPath offers an AI-powered business automation platform that helps in automating office tasks. The company delivered better-than-anticipated results for the first quarter of Fiscal 2024 (ended April 30, 2023), with revenue rising 18% year-over-year to about $290 million. Also, annual recurring revenue (ARR) grew 28% to $1.25 billion.

The company’s top-line growth and productivity measures helped it in posting an adjusted EPS of $0.11 in Q1 FY24 compared to a loss per share of $0.03 in the prior-year quarter.

UIPath’s products are gaining traction, as evident in the 43% rise in the number of customers contributing $1 million or more in ARR to 240 in Q1 FY24. The company continues to enhance its platform and enter into strategic partnerships to boost its business.

UiPath is scheduled to announce its fiscal second-quarter results on September 6. Analysts expect the company’s revenue to rise 16.2% year-over-year to $281.5 million. They project the company to report an adjusted EPS of $0.04 compared to a loss per share of $0.02 in the prior-year quarter.

Is PATH Stock a Good Buy?

Wall Street has a Hold consensus rating on UiPath stock based on one Buy and three Holds. The average price target of $18 implies 13.3% upside potential. Shares have risen 25% since the start of this year.

Nvidia (NASDAQ:NVDA)

Shares of chip giant Nvidia have rallied by a massive 232% year-to-date due to the spike in the demand for its advanced graphics processing units (GPUs), which are required for the development and deployment of generative AI models.

Following an impressive 101% revenue growth in the fiscal second quarter, Nvidia expects its fiscal third-quarter top line to grow about 170% to $16 billion (plus or minus 2%). The company projects its supply to increase each quarter through next year to address the growing demand for its products, as customers are directing their capital investments to AI and accelerated computing.

Reacting to the Q2 FY24 performance, TD Cowen analyst Matthew Ramsay said that the company delivered “simply astounding results,” even as it faced lofty expectations. The analyst raised his price target to $600 from $500 on August 24 and reiterated a Buy rating on NVDA stock.

Reacting to concerns about the sustainability of Nvidia’s results, Ramsay said that AI is more than just hype and the party is not yet over for Nvidia. While the analyst acknowledged that rivalry is bound to increase in the lucrative AI space, he believes that NVDA’s moat is wide.

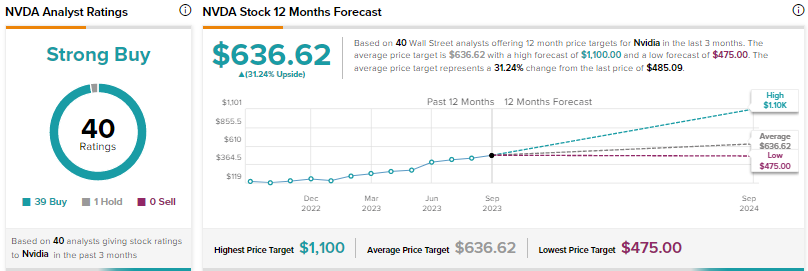

Is NVDA a Good Stock to Buy Now?

Wall Street’s Strong Buy consensus rating on Nvidia stock is based on 39 Buys and one Hold. Despite the spectacular year-to-date rally, analysts see further upside in the stock. At $636.62, the average price target implies 31.2% upside potential.

Conclusion

Analysts are highly bullish on Microsoft and Nvidia due to AI-driven demand, while they are sidelined on UIPath. Wall Street sees higher upside potential in Nvidia than the other two stocks. Nvidia’s advanced technology, continued innovation, strong execution, and dominance in the GPU market are expected to drive the company’s long-term growth.