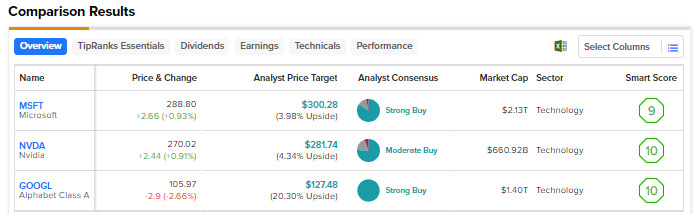

The launch of artificial intelligence (AI)-powered chatbot ChatGPT in November 2022 sparked tremendous interest in generative AI, which is capable of producing content-like text and images in response to prompts. Piper Sandler analyst Brent Bracelin estimates generative AI to emerge as the next $100 billion opportunity in technology. With that thought in mind, we used TipRanks’ Stock Comparison Tool to place Microsoft (NASDAQ:MSFT), Nvidia (NASDAQ:NVDA), and Alphabet (NASDAQ:GOOGL, GOOG) against each other to pick the most attractive AI stock, as per Wall Street experts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft (NASDAQ:MSFT)

Microsoft has gained immense attention this year due to its growing focus and huge investments in AI, including a $10 billion investment in ChatGPT creator OpenAI. In February, the company launched its AI-powered Bing search engine and Edge browser.

The company also introduced Microsoft 365 Copilot, an AI-powered tool to boost productivity and creativity in the workplace. Overall, Microsoft is harnessing the power of AI to enhance its tools and drive additional business.

Is MSFT Stock a Buy Now?

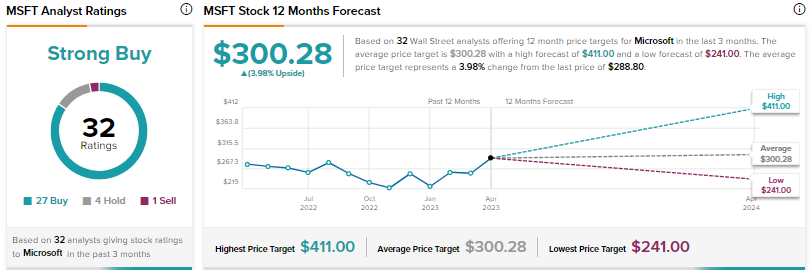

On Monday, Morgan Stanley analyst Keith Weiss reiterated a Buy rating on Microsoft with a price target of $307. The analyst noted that the latest AlphaWise survey indicated that the company is “best positioned” to win market share of overall IT budgets. Weiss expects Microsoft and Google to be the major beneficiaries of AI.

Weiss highlighted that AI as a proportion of cloud spend is poised to increase over the next three years from 3% to 9%, and Microsoft is “most frequently” seen as the largest share gainer of AI and machine learning (ML) spending this year and in the next three years. Weiss thinks that the opportunity for Microsoft in AI goes well beyond its Search and Azure businesses.

Wall Street’s Strong Buy consensus rating for Microsoft stock is based on 27 Buys, four Holds, and one Sell. The average price target of $300.28 suggests nearly 4% upside. Shares have risen over 20% year-to-date.

Nvidia (NASDAQ:NVDA)

The demand for Nvidia’s graphic processing units (GPUs) is expected to accelerate due to their extensive use in AI applications. Tens of thousands of Nvidia’s A100 chips were used to build ChatGPT.

At the recently held GTC conference, Nvidia announced the availability of new products and services featuring the NVIDIA H100 Tensor Core GPU, which will address the growing demand for generative AI training and inference. The company calls H100, a successor of A100 and based on the NVIDIA Hopper GPU computing architecture, the world’s most powerful GPU for AI.

Many companies, including OpenAI, Meta Platforms (META), Stability AI, Twelve Labs, and Adobe (ADBE) are, or will be, using the H100 chips for their generative AI pursuits.

What is the Price Target for NVDIA Stock?

Last week, KeyBanc analyst John Vinh raised his price target for Nvidia stock to $320 from $280 and maintained a Buy rating. Vinh believes that the near-term reset in cloud capital spending could limit the upside in the stock. Nonetheless, the analyst expects the company to benefit from strengthening demand for AI, including OpenAI’s next-gen training cluster built on H100 GPUs.

Additionally, Vinh anticipates the continued ramp of Nvidia’s RTX 40 graphic cards to drive sequential growth and an upward bias to the estimates in the second half.

Wall Street’s Moderate Buy consensus rating for Nvidia is based on 28 Buys, seven Holds, and two Sells. Following nearly 85% year-to-date rally in NVDA stock, the average price target of $281.74 suggests 4.3% upside.

Alphabet (NASDAQ:GOOGL) (GOOG)

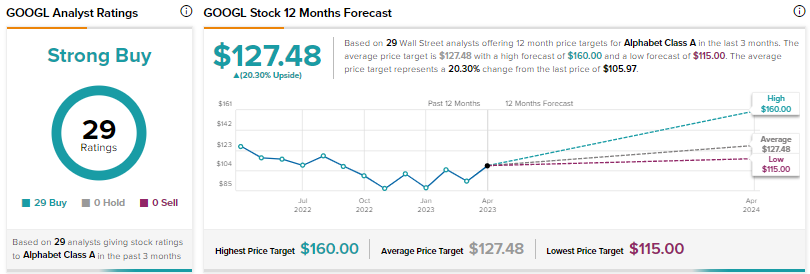

The launch of Alphabet’s new AI-equipped chatbot Bard failed to impress investors when it was introduced, as it shared inaccurate information in a promotional video. This ignited worries about Google losing ground to Microsoft. Nonetheless, Wall Street continues to be optimistic about the company’s ability to advance in the AI space.

Alphabet has already been using AI for many years to improve its search engine and other offerings like YouTube. It expects to leverage its latest AI technologies like LaMDA, PaLM, Imagen, and MusicLM to enhance its products, starting with Search. The company is gearing up to launch various large language model (LLM)-based products and services.

Is GOOGL a Buy, Sell, or Hold?

As mentioned earlier, Piper Sandler’s Brent Bracellin believes that generative AI is the next technology revolution that could have “far reaching implications across both consumer and enterprise sectors.”

The analyst estimates the market opportunity of over $100 billion split between AI-enabled search advertising and AI-powered enterprise application revenue.

In a note to investors last week, Bracellin highlighted that the success of ChatGPT, which had more than 300 million unique visitors in March, intensified “search wars” between Google and Microsoft’s Bing, with a combined 13% rise in search traffic volumes on a combined basis during Q1 2023.

It is worth noting that Bing’s daily mobile downloads increased nine times to 100K+ compared to 13K+ one year ago. Nonetheless, Bing still lags Google Search’s mobile downloads of 300K+ a day.

Overall, Alphabet earns a Strong Buy consensus rating based on 29 unanimous Buys. The average price target of $127.48 implies 20.3% upside. Google stock has advanced 20.1% since the start of 2023.

Conclusion

Microsoft, Nvidia, and Alphabet are well-positioned to capture the opportunities in the AI market. As of now, analysts are very bullish on Alphabet and see higher upside potential in the stock than in the other two AI players. Aside from Wall Street analysts, hedge funds are also optimistic about Alphabet. As per TipRanks’ Hedge Fund Trading Activity Tool, the Hedge Fund Confidence Signal is Very Positive for GOOGL. Hedge funds increased their GOOGL holdings by 27.3 million shares last quarter.

As per TipRanks’ Smart Score System, Alphabet scores a Perfect 10, implying that the stock is capable of outperforming the broader market over the long term.