Tech titans Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) will release their quarterly earnings after the market closes on Tuesday, January 30. Artificial Intelligence (AI) tailwinds, strength in the cloud business, and cost-cutting measures are likely to drive the top and bottom lines of these companies.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As both MSFT and GOOGL are poised to deliver solid growth, let’s look at the Street’s consensus estimate for their upcoming earnings.

MSFT – Q2 Expectations

Wall Street expects Visa to post revenue of $61.14 billion, up from $52.75 billion in the prior-year quarter. Increasing contributions from AI and ongoing strength in Office 365 will likely support its top-line growth.

Meanwhile, higher revenues will cushion its bottom line. Analysts forecast that MSFT’s earnings will show year-over-year growth in Q2. Wall Street expects Microsoft to report earnings of $2.77 per share, up from adjusted EPS of $2.32 in the prior-year quarter.

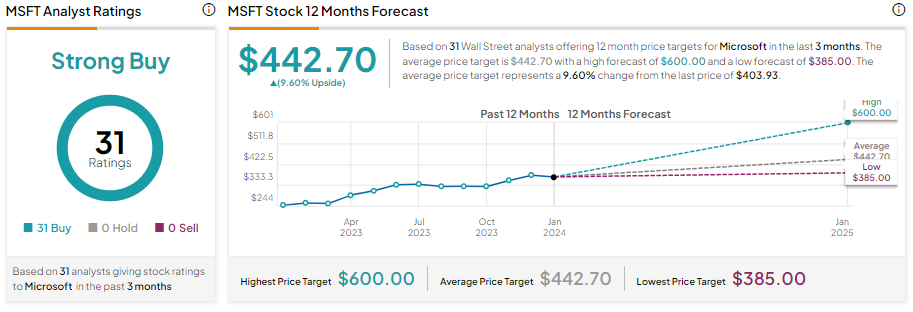

Is Microsoft a Buy, Sell, or Hold?

Microsoft stock has gained nearly 68% in one year. Moreover, analysts are bullish about its prospects ahead of the Q2 print. MSFT stock has 31 unanimous Buy recommendations, translating into a Strong Buy consensus rating. Analysts’ average price target of $442.70 implies upside potential of 9.6% from current levels.

As analysts are bullish about MSFT stock, options traders are pricing in a +/- 4.70% move on earnings, higher than the previous quarter’s earnings-related move of 3.07%. The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement. Learn more about TipRanks’ Options tool here.

GOOGL – Q4 Expectations

Analysts expect GOOGL to post revenue of $85.27 billion in the fourth quarter, up from $75.33 billion in the prior-year quarter. The expected year-on-year revenue growth in search and YouTube advertising and the potential benefit from AI solutions will likely drive its financials in Q4.

The leverage from higher sales and the focus on reducing its cost structure will drive GOOGL’s bottom line in Q4. Wall Street expects Alphabet to report earnings of $1.59 per share, up from adjusted EPS of $1.05 in the prior-year quarter.

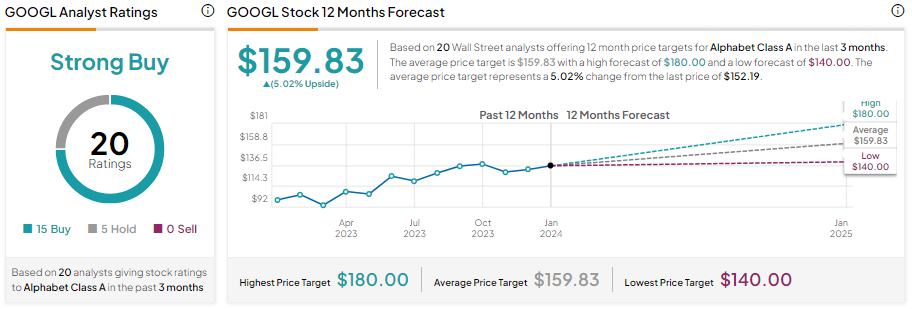

What is the Prediction for Alphabet Stock?

With 15 Buys and five Holds, Alphabet stock has a Strong Buy consensus rating. Further, analysts’ average GOOGL price target of $159.83 implies 5.02% upside potential from current levels.

While analysts are bullish about GOOGL stock, options traders are pricing in a +/- 5.42% move on earnings, smaller than the previous quarter’s earnings-related move of -9.51%.

Analysts’ Opinions

TD Cowen analyst Derrick Wood expects stronger new booking trends and growing AI tailwinds to drive Microsoft’s Q2 Fiscal 2024 financials. The analyst added that continued AI workload growth will drive its Cloud business. Wood reiterated a Buy on Microsoft stock on January 19.

As for Alpahbet, Jefferies analyst Brent Thill expects solid Q4 results and a strong year-end finish from GOOGL. The analyst believes GOOGL stock may continue to trend higher even after rising significantly over the past year. Alphabet stock appreciated by about 57% in one year. The analyst reiterated a Buy on GOOGL stock ahead of Q4 earnings on January 24.

Bottom Line

Tech giants MSFT and GOOGL are poised to benefit from AI tailwinds, growing cloud business, a reduction in cost structure, and easier year-over-year comparisons. However, MSFT and GOOGL stocks have gained significantly over the past year, so analysts’ average price target shows limited upside potential over the next 12 months.