The generative artificial intelligence (AI) wave has boosted the prospects for various categories of companies within the tech sector, including semiconductor makers, cloud computing providers, and cybersecurity players. In particular, cloud computing companies are witnessing solid demand for their services that are required to support enterprises and developers in building their generative AI models.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bearing this favorable backdrop in mind, we used TipRanks’ Stock Comparison Tool to place Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) against each other to find the cloud computing company that is the best AI stock and could offer the highest returns from the current level, as per Wall Street analysts.

Microsoft (NASDAQ:MSFT)

While Amazon Web Services (AWS) remains the market leader in the cloud infrastructure market, rival Microsoft Azure is catching up rapidly. In the March quarter (Q3 FY24 for MSFT), revenue from Azure and other cloud services increased 31% compared to AWS’ sales growth of 17% in the comparable quarter.

During the Q3 FY24 earnings call, Microsoft CEO Satya Nadella stated that Azure is grabbing market share, with customers using the company’s platforms to build AI solutions. The CEO added that the company provides a diverse selection of AI accelerators, including the most recent offerings of Nvidia (NVDA), AMD (AMD), and MSFT’s own AI chip.

Microsoft claims that over 65% of the Fortune 500 companies are using Azure OpenAI service, thanks to continued AI innovation that is backed by the company’s strategic partnership with ChatGPT creator OpenAI. Overall, Microsoft’s cloud business is seen as one of its key growth drivers.

Meanwhile, an update by cybersecurity company CrowdStrike (CRWD) caused a massive outage for millions of Microsoft Windows users, disrupting the operations of major airlines and several other sectors.

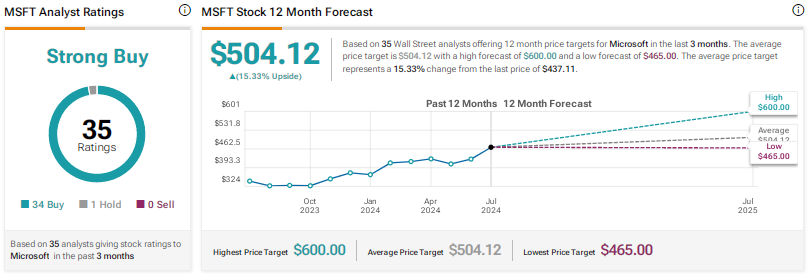

Is Microsoft a Buy or Sell?

Microsoft is scheduled to announce its Q4 FY24 results on July 30. Analysts expect the company’s adjusted earnings per share (EPS) to rise 9% year-over-year to $2.93.

Ahead of the results, TD Cowen analyst Derrick Wood reaffirmed a Buy rating on MSFT stock and boosted the price target to $495 from $470. The analyst expects the company to deliver another upbeat quarter of growth and margins. He is optimistic about Azure’s potential, with data points indicating continued growth acceleration trends. Overall, MSFT remains “best-positioned for AI monetization,” according to Wood.

With 34 Buys versus one Hold recommendation, Microsoft stock scores a Strong Buy consensus rating. The average MSFT stock price target of $504.12 implies 15.3% upside potential from current levels. Shares have advanced more than 16% so far this year.

Amazon (NASDAQ:AMZN)

Despite rising competition, Amazon’s AWS unit continues to maintain a dominant position in the cloud computing market. According to Synergy Research Group, AWS commanded a 31% market share of the cloud infrastructure services market in Q1 2024, while Microsoft Azure and Google Cloud had market shares of 25% and 11%, respectively.

In the first quarter of 2024, AWS’ sales grew 17% year-over-year to $25 billion. This growth rate marked an acceleration compared to the 13% increase experienced in Q4 2023. It is worth noting that AWS is a vital growth engine for Amazon and is highly profitable. In Q1 2024, AWS accounted for 17.5% of the overall sales but contributed more than 61% of the company’s operating income.

Amazon is optimistic about the robust potential of its AWS business. CEO Andy Jassy stated during the Q1 2024 earnings call that the company is seeing notable momentum on the AI front, which is accumulating a “multibillion-dollar revenue run rate already.”

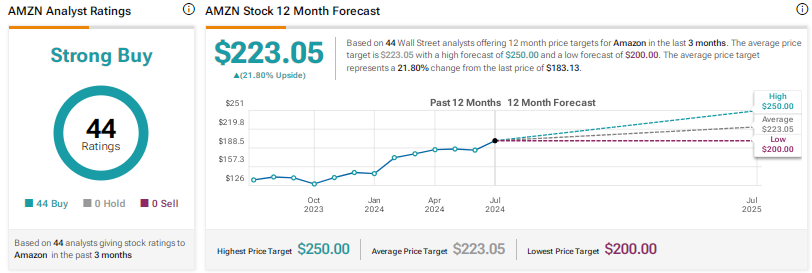

What is the Target Price for Amazon Stock?

Ahead of Amazon’s Q2 results scheduled to be announced on August 1, analysts at Morgan Stanley reaffirmed a Buy rating on the stock, with a positive near-term outlook. Morgan Stanley expects AMZN to report a notable EBIT (earnings before interest and taxes) beat in the second quarter and issue favorable guidance for the third quarter.

In particular, Morgan Stanley’s EBIT estimate is 17% higher than the Street’s consensus for Q2 and 10% more than the Q3 forecast. The optimistic outlook is based on AMZN’s North America Retail profitability and accelerating AWS growth. Meanwhile, Wall Street expects Amazon’s EPS to increase to $1.02 from $0.65 in the prior-year quarter.

Amazon stock earns a Strong Buy consensus rating based on 44 unanimous Buys. At $223.05, the average AZMN stock price target implies about 22% upside potential. Shares have risen 21% year-to-date.

Alphabet (NASDAQ:GOOGL)

Tech giant Alphabet is well known for its Google search engine. That said, the company’s Google Cloud business is grabbing Wall Street’s attention with its rapid growth. Alphabet impressed investors with its solid first-quarter results, which were driven by a major jump in Google Cloud’s profitability.

In Q1 2024, Google Cloud’s revenue increased 28.4% year-over-year to $9.57 billion, while its operating income surged to $900 million from $191 million in the prior-year quarter. The results reflected Alphabet’s increased investments in the Cloud business. Interestingly, during the Q1 2024 earnings call, management highlighted that the company introduced over 1,000 new products and features in its Cloud business over the past eight months.

The company believes that one of the aspects that differentiates its Cloud business from rivals is its AI Hypercomputer, which offers cost-effective and efficient infrastructure to train and support AI models.

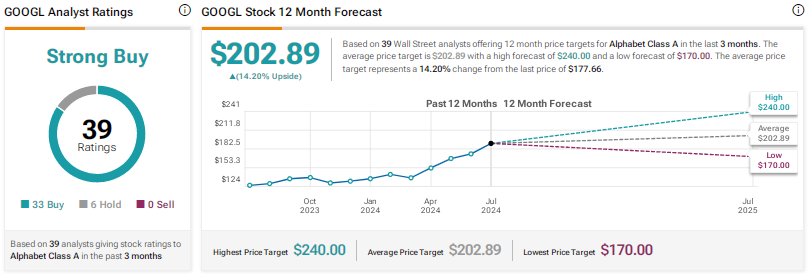

Is it a Good Time to Buy GOOGL?

On July 18, analysts at Jefferies reaffirmed a Buy rating on GOOGL stock with a price target of $220. They expect Alphabet to report strong Q2 results, supported by resilient customer spending and consistent Cloud business. However, Jefferies cautioned investors about slightly tougher comparisons in Q2, mainly in the ad business.

After a solid year-to-date rally in GOOGL stock (up 27.2%), Jefferies expects continued rise but at a gradual pace due to high expectations following robust Q1 performance and above historical average valuation levels.

Alphabet will announce its Q2 2024 results on July 23. Wall Street expects Alphabet’s Q2 EPS to rise 27% to $1.83.

Wall Street has a Strong Buy consensus rating on GOOGL stock based on 33 Buys and six Holds. The average GOOGL stock price target of $202.89 indicates 14.2% upside potential from current levels.

Conclusion

Wall Street is bullish on the long-term growth potential of the top three cloud computing players, driven by the continued transition of enterprises to the cloud and AI-related tailwinds. Currently, they see slightly higher upside potential in Amazon stock than in Microsoft and Alphabet shares. Aside from the attractive growth potential of the AWS business, analysts’ optimism about Amazon is also backed by the company’s leadership in e-commerce and its growing advertising business.