Morgan Stanley (NYSE:MS) reported better-than-anticipated first-quarter results, even as its investment banking business continued to be weak. The bank’s first-quarter revenue declined 2% year-over-year to $14.5 billion, as higher wealth management revenue was more than offset by a 24% drop in investment banking revenue to $1.2 billion. During the Q1 earnings call, Morgan Stanley’s Chairman and CEO James Gorman stated that underwriting and mergers and acquisition (M&As) “remain very subdued.”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Continued Weakness in Investment Banking

Within investment banking, revenues declined across advisory, equity underwriting, and fixed income underwriting businesses in the first quarter. Advisory revenues were impacted by fewer completed M&As, while equity underwriting revenues fell due to lower initial public offering (IPO) volumes. Further, fixed income underwriting revenues declined due to lower non-investment grade loan issuances.

After the deals spree in 2021, the IPO and special purpose acquisition companies (SPAC) market witnessed a major dip as investors avoided high-flying growth investments for safer bets. Persistent macro uncertainty and the recent banking crisis also impacted the deal market. As per Dealogic, M&A volumes plunged 48% year-over-year to $575.1 billion in Q1 2023 (as of March 30).

Aside from Morgan Stanley, Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM) also reported lower investment banking revenues. Nonetheless, banks expect deal activity to pick up in the times ahead. Gorman stated that the underwriting and M&A revenues of Morgan Stanley are “delayed, not dead.”

“Already, we are seeing a growing M&A pipeline and some spring-like signs of new issuance emerging. That said, it largely remains a back half 2023 and full year 2024 story,” said Gorman.

Is Morgan Stanley Stock a Buy?

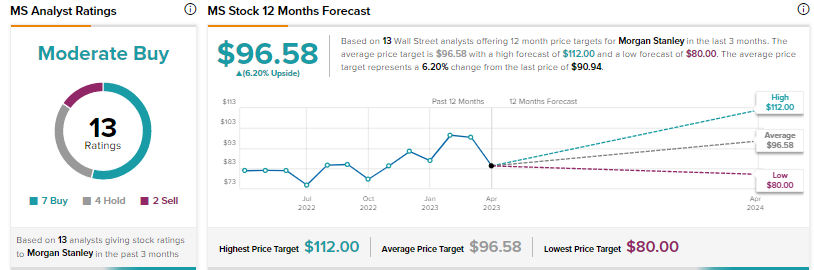

Wall Street’s Moderate Buy consensus rating for Morgan Stanley is based on seven Buys, four Holds, and two Sells. The average price target of $96.58 suggests over 6% upside. MS stock has risen 7% so far this year.