After finishing 2023 with solid gains in all the major stock indexes, there are two key questions for investors to answer: Will 2024 keep up the momentum, and if so, which sectors will offer the strongest gains? Answer these, and the future is wide open.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The equity analysis team at Morgan Stanley has taken up this challenge, and come down with an interesting answer. Looking at the Machinery and Construction segment, firm analyst Angel Castillo tells investors that there are attractive opportunities going past the non-residential construction sector, and has tagged some old-school stock picks as potential gainers for the young year; namely, industrial stocks.

Castillo advises investors to look into heavy machinery and industrial transportation, writing, “We see ample high conviction investment ideas within Machinery, despite our outlook of a peaking US Non-Resi cycle and uncertain macro… We expect the largest Machinery end-market of US Non-Resi to peak in 2024/25. That is likely to be compounded near-term by macro and political uncertainty, resulting in negative earnings revisions across a lot of our coverage. While the impact of this cannot be ignored, we would advise against generalizing it to the entire group. Said another way, we see attractive risk-rewards across various other end-markets that we think may be troughing (i.e., Trucks, Locomotives, etc.).”

Castillo doesn’t just analyze the sector generally, but he also provides a specific recommendation of two stocks that investors should consider. Do other analysts agree with Castillo? We’ve used the TipRanks database to find out.

Martin Marietta Materials (MLM)

First on our MS-backed list is Martin Marietta Materials, a long-time stalwart of the American industrial scene. The company traces its roots back to 1939, as an aggregates company, and over the years it merged with both the Martin and Lockheed aircraft companies. Martin Marietta Materials spun off from Lockheed in 1996, and has since operated as an independent company focused on its original roots: the production of aggregates and heavy construction materials.

Martin Marietta Materials has found success as a commercial company producing vital construction materials. The company was added to the S&P 500 index in 2014, and has facilities located across 28 states. The company’s presence is particularly strong in the Southeast, the upper Ohio and Mississippi valley regions, East Texas, and California. Martin Marietta’s product lines include engineered aggregate materials of sand, gravel, and crushed stone; cements and cement treated materials; ready mix concrete; asphalt paving materials; and magnesia chemicals and lime.

When we zoom into MLM’s financial results, we find a company whose last quarterly release showed earnings above expectations and revenue that was up year-over-year. For 3Q23, the company’s top line of $1.99 billion in revenue was up 9.9% yet missed the estimates, albeit by just $10 million. At the bottom line, MLM’s GAAP earnings per share came to $6.94, or 92 cents per share ahead of expectations.

For Castillo, writing the Morgan Stanley review on this stock, this presents an easy choice – MLM is a stock to buy, based on its sound foundation in an essential industry, and clear potential for further profitability and share growth. Castillo says of the company, “MLM is our preferred way to play the construction theme for a number of reasons, including: i) pricing power allowing the company to grow earnings profitably even if non-resi spending weakens; ii) greater overlap to Mega Projects compared to peers; iii) leverage to a troughing Residential cycle; iv) BS strength and a highly fragmented industry offer ample inorganic growth opportunity; and v) re-rating opportunity as shares continue to trade at a discount to peer VMC.”

Quantifying his stance, the analyst gives the shares an Overweight (Buy) rating, with a $595 price target that implies a 20% gain on the one-year horizon. (To watch Castillo’s track record, click here)

Overall, MLM gets a Strong Buy consensus rating from the analysts, based on 12 recent reviews that include 11 to Buy against just 1 to Hold. The shares are trading for $495.88 and their $550.80 average target price points toward a one-year upside potential of 11%. (See MLM stock forecast)

Cummins, Inc. (CMI)

No heavy industry can work without power, and power is the specialty of the next stock on our list. Cummins is well-known as a maker of top-end, heavy duty engines and powerplants for industrial plant and large vehicle use. The company bills itself as a ‘global power leader,’ and its product lines include diesel engines for large trucks and construction equipment; generators and other power systems for home, RV, commercial, and industrial use; ancillary engine components; and new power technologies such as batteries and electrolyzers for hydrogen fuel systems, under the Accelera name.

While this may sound like a niche business, there’s really a pretty good chance that the average investor has been in a vehicle powered by a Cummins engine. The company’s marketing targets include the heavy- and medium-duty truck segments, municipal busses, recreational vehicles – and Cummins has engines suitable for lighter duty automotive uses, too. On the more industrial side, Cummins engines and power generators have found wide use in the construction, mining, railroad, and marine industries, and in numerous types of military equipment.

Cummins has been in business since 1919, and since then has expanded into a global powerhouse. The company’s network includes thousands of dealer locations, parts suppliers and distributors, and dedicated service and repair centers. The company employs over 73,000 people worldwide, and in the last full year reported, 2022, Cummins had total sales of $28.1 billion, giving net earnings of $2.2 billion.

In the company’s last earnings release, for 3Q23, Cummins had $8.4 billion in total revenue. This was up 15% year-over-year and came in $250 million ahead of the forecast. At the bottom line, Cummins reported a non-GAAP EPS of $4.74, 5 cents better than had been anticipated. Cummins’ net cash from operations in Q3 reached a company quarterly record of $1.5 billion.

All of this presents a sound picture of an industrial firm with a solid foundation and a good reputation – and that’s the background to Castillo’s comments on the stock. Laying out his bullish thesis, he writes, “More modest than expected downturn in HD trucks in the US, solid growth in MD, and strong execution of Accelera growth strategy result in better than expected sales and margins, driving positive earnings revisions. More importantly, a rebound in US Class 8 orders shifts investor focus to a stronger 2025/26, driving shares higher.”

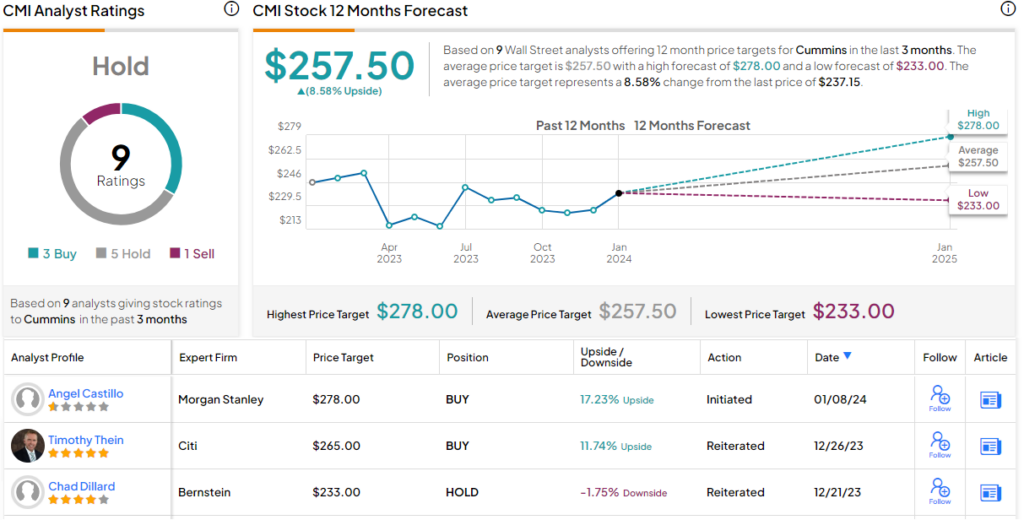

Putting this into quantifiable terms, Castillo rates the shares as Overweight (Buy), and he sets a $278 price target that suggests a 17% one-year upside potential.

Castillo represents the bulls on this stock, but Wall Street is not quite ready to join him. The shares have a Hold consensus rating, based on 9 recent reviews with 3-5-1 breakdown to Buy-Hold-Sell. The stock is trading for $237.15, and its $257.50 average target price implies an 8.5% increase over the one-year time frame. (See Cummins stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.