The major investment bank Morgan Stanley has been sounding alerts about the increasingly difficult economic conditions for several months now, and the firm’s chief US equity strategist Mike Wilson headed up a recent note on the topic of defensive investing, especially dividend investing.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wilson lays out a clear strategy for dividend investors, starting with the fact that the best dividend stocks, by their nature, provide an income stream that is both secure and stable, and will provide protection for investors in any market environment.

“We believe the ‘dividend sweet spot’ is not to find the highest yielding stock,” Wilson says, “but to find consistent companies who can grow their dividend year-over-year and have a proven track record. It’s this underlying stability combined with the dividend return that can provide a defensive cushion during periods of market turbulence – similar to today’s environment.”

Against this backdrop, the analysts at Morgan Stanley have picked out stocks that offer investors some of the most reliable dividends available. Using the TiipRanks platform, we’ve pulled up the details on three of those picks. Let’s dive in.

Philip Morris International Inc. (PM)

The first stock we’ll look at, Philip Morris, is well-known as one of the world’s largest tobacco companies, and the owner of venerable Marlboro brand cigarettes. While cigarettes and other smoking products make up the lion’s share of the firm’s sales, PM is strongly emphasizing its smokeless product lines. These include vapes, heated tobacco products, and oral nicotine pouches. The company boasts that its smokeless products, especially the heated tobacco lines, have helped over 13 million adult smokers worldwide quit smoking.

The company’s dividend is worth a close look, as it offers investors a reliable payment with a long-term history of steady growth. PM first started paying out the dividend in 2008, when it went public; since then, the company has not missed a quarterly payment – and has raised the dividend every year, with a CAGR of 7.5%. The current quarterly dividend payment is $1.27 per share, up 2 cents from the previous quarter. The dividend annualizes to $5.08 per common share, and yields a strong 5.3%. The newly raised dividend is scheduled for payment on September 27.

The dividend payment is supported, and fully covered, by PM’s regular quarter earnings, which in 2Q22 came in at $1.32 per diluted share. Philip Morris is targeting full-year diluted EPS in the range of $5.73 to $5.88, which is good news for dividend investors, as achieving that target will keep the dividend easily affordable for the company.

Analyst Pamela Kaufman, covering this tobacconist for Morgan Stanley, takes notice of the company’s increasing sales in smokeless products, as well as its generally sound financial position, in recommending the stock.

“Q2 results reflect many of the key tenets of our thesis, including attractive IQOS momentum with accelerating new IQOS user growth, solid combustibles fundamentals with positive international cigarette market share/volumes, and increased underlying guidance,” Kaufman opined.

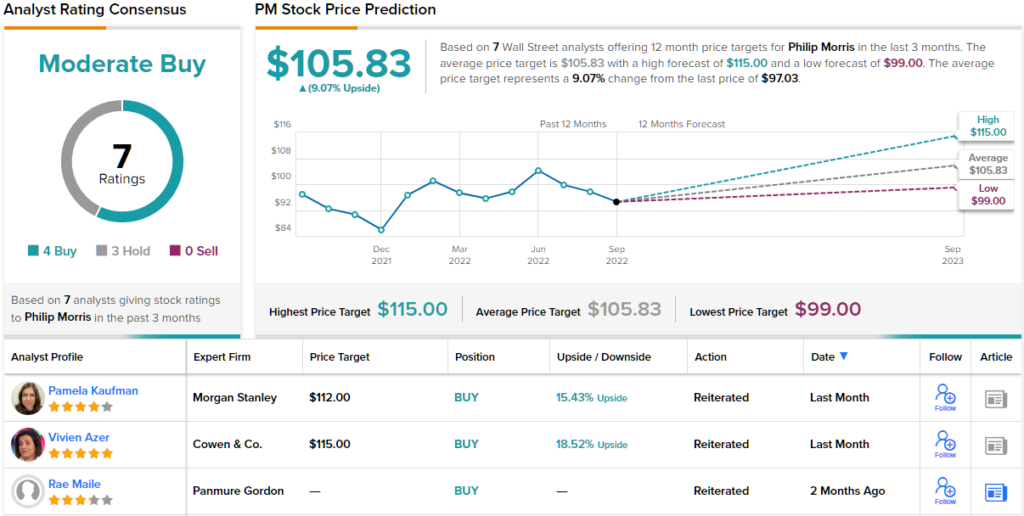

Looking forward, Kaufman rates PM an Overweight (i.e. Buy), and sets a $112 price target for ~16% upside potential. (To watch Kaufman’s track record, click here)

Overall, Philip Morris shares have a Moderate Buy from the Street consensus, based on 7 reviews that include 4 Buys and 3 Holds. (See PM stock forecast on TipRanks)

Citizens Financial Group, Inc. (CFG)

Next up is Citizens Financial Group, a retail banking firm in the US markets. Citizens Financial is based in Rhode Island, and operates through 1,200 branches in 14 states, centered in New England but extending to the Mid-Atlantic and Midwest regions. Retail and commercial customers can access a full range of services, including checking and deposit accounts, personal and small business loans, wealth management, even foreign exchange. For customers unable to reach a branch office, CFG offers mobile and online banking, and more than 3,300 ATM machines.

Citizens Financial saw revenues exceed $2.1 billion in 2Q22, a year-over-year jump of 23.5%. Earnings came in below expectations; at $364 million, net income was down 43% y/y, and EPS, at 67 cents, was less than half of the $1.44 reported in the year-ago quarter.

Despite the drop in earnings and share value, Citizens Financial felt confident enough to expand its capital return program. The Board authorized, in July, share repurchases up to $1 billion, and increase of $250 million from the previous authorization.

At the same time, the company also announce an 8% increase in its quarterly common share dividend payment. The new payment, of 42 cents per share, went out in August; it annualizes to $1.68 and gives a yield of 4.5%. Citizens Financial has a history of both reliable dividend payments and regular increases going back to 2014; the dividend has been raised twice in the last three years.

This stock has caught the eye of Morgan Stanley’s Betsy Graseck, who lays out an upbeat case for buying into CFG.

“We are Overweight Citizens due to its above-peer earnings growth driven by multiple broad-based drivers, including its differentiated loan categories which drive better-than-peer loan growth, disciplined expense management, and EPS upside from bolt-on fee based acquisitions,” Graseck wrote.

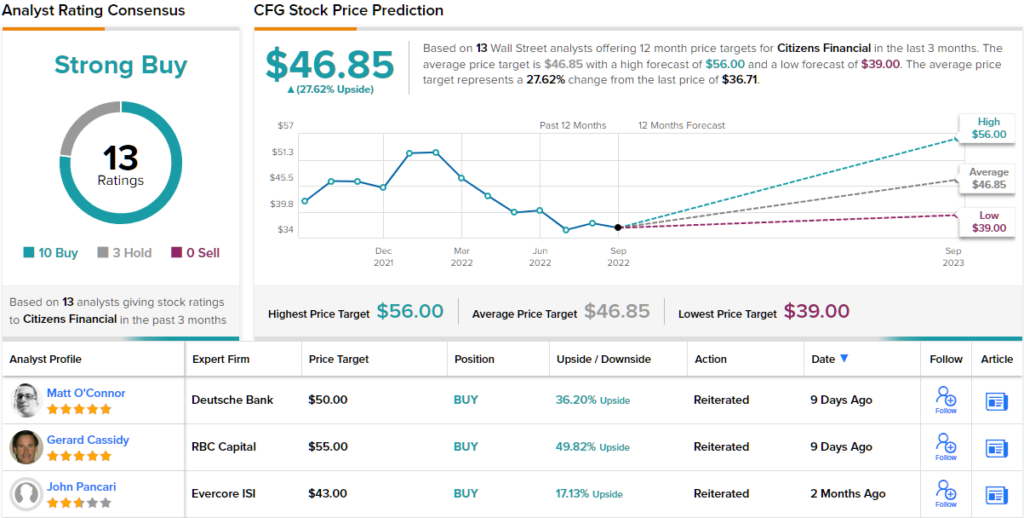

Graseck’s Overweight (i.e. Buy) rating comes with a $51 price target. Should her thesis play out, a twelve-month gain of ~37% could potentially be in the cards. (To watch Graseck’s track record, click here)

Financially sound banking firms are sure to pick up Wall Street interest, and CFG shares have 13 recent analyst reviews on file, including 10 to Buy and 3 to Hold, giving the stock a Strong Buy consensus rating. The average price target of $46.85 implies ~28% one-year gain from the trading price of $36.76. (See CFG stock forecast on TipRanks)

AvalonBay (AVB)

The third Morgan Stanley pick we’re looking at is AvalonBay, a real estate investment trust (REIT) focused on apartment properties. REIT’s have a strong reputation for paying out solid dividends; they are required by tax codes to return a certain percentage of profits directly to shareholders, and frequently use dividends to comply with the regulatory demands. AvalonBay owns, acquires, develops, and manages multi-family developments in the New York/New Jersey metropolitan area, in New England and the Mid-Atlantic regions, in the Pacific Northwest, and in California. The company targets properties in leading urban centers of its operating areas.

Rising rents have been a large component of the general increase in the rate of inflation, and that has been reflected in AvalonBay’s top line. The company’s Q2 revenue, of $650 million, was the highest in the past two years. On earnings, a ‘noisier’ metric, AvalonBay reported $138.7 million in net income attributable to stockholders; diluted EPS came in at 99 cents per share, down from $3.21 in the year-ago quarter.

While earnings per share were down, the company did report a year-over-year gain in a key metric, fund from operations (FFO) attributable to common stockholders. On a diluted basis, the FFO grew 22% y/y, from $1.97 to $2.41. This should be noted by dividend investors, as FFO is commonly used by REITs to cover the dividend.

AvalonBay’s dividend was last paid out in July, at $1.59 per common share. The next payment, for October, has already been declared at the same rate. The $1.59 quarterly payment annualizes to $6.36 per common share, and gives a yield of 3.3%. AvalonBay has paid out a quarterly dividend in every quarter – without missing a beat – since it went public in 1994, and over the past 28 years has average a 5% annual increase in the payment.

Morgan Stanley analyst Adam Kramer sees a path forward for this company, and explains why investors should get in now: “We think AVB can trade at a premium to [peers] in our coverage given peer-leading SS-Revenue and strong FFO per share growth and a differentiated development program. We believe investors have a ‘free option’ on the development pipeline as the current stock price implies a ~19.7x multiple on our ’23e FFO ex. external growth.”

Kramer uses these comments to support his Overweight (i.e. Buy) rating on the stock, and his price target, set at $242, suggests that AVB has a 26% upside potential ahead of it. (To watch Kramer’s track record, click here)

All in all, AVB shares have 8 Buys and 11 Holds, making the analyst consensus rating here a Moderate Buy. The stock is the most expensive on this list, at $190.87 per share, and the $226.17 average price target is indicative of ~18% upside potential for the coming months. (See AVB stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.