The Federal Reserve will hold its November meeting today, and is widely expected to announced a fourth consecutive 75-basis point interest rate hike. The Fed’s likely move, of course, is in response to continued high inflation – but additional context is necessary. Recent earnings reports, especially among the tech giants, have been dismal (Apple was the exception), and the housing markets and consumer savings rates are down; all of this feeds into recession fears, which higher rates will only exacerbate.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Into this gloomy outlook, however, one prominent bear is actually bringing a ray of hope. Morgan Stanley strategist Mike Wilson believes that the Federal Reserve will pivot away from higher rates and monetary tightening sooner rather than later, and that the S&P 500 may climb back as high as 4,150, a 6% gain, in the first half of next year.

Noting that markets recently showed strong gains, despite the poor Q3 earnings reports, Wilson said, “This kind of price action isn’t unusual toward the end of the cycle particularly as the Fed moves closer to the end of its tightening campaign, something we think is approaching.” And if the tightening cycle is nearing an end, investors should start planning for the rebound.

Against this backdrop, the Morgan Stanley stock analysts have picked out two stocks for investors to consider, predicting 40% or better upside for the coming year. Running the tickers through TipRanks’ database, we learned that each has earned a “Strong Buy” consensus rating from the rest of the Street.

Targa Resources Corporation (TRGP)

We’ll start with Targa Resources, a midstream company in the energy industry. Targa’s network is centered around the company’s home state of Texas, and extends from the Texas-New Mexico border region and Oklahoma through Texas to the Gulf Coast and into Louisiana. In addition, the company has assets in North Dakota, in the Badlands region. Targa’s assets include natural gas and NGL pipelines, terminal and gathering facilities, fractionators, LPG export facilities, and gas plants. The company is one of the largest independent midstream operators, with a market cap exceeding $15 billion.

Targa’s stock has been volatile this year, but on the whole the company has benefited from high prices in the natural gas markets. Shares of TRGP are up 34% year-to-date, and have been rising since the end of September.

The company will report its 3Q22 earnings on November 3; in the meantime, it may be beneficial to look back at Q2. Targa showed just over $6 billion in total revenue for Q2, a 77% year-over-year gain, and net income of $596.4 million. The company had a distributable cash flow in Q2 of $533.4 million – an important metric, as it supports the dividend.

Targa last declared its dividend on October 13 for the third quarter, with a November 15 payment set at 35 cents per common share. This is the fourth quarter in a row with the dividend at this level. The annualized payment of $1.40 per common share gives a yield of 2%, right in line with broader market averages.

5-star analyst Robert Kad has written up the Morgan Stanley view on Targa, and believes that the company is primed for gains going forward.

“We like the opportunity to participate in volume recovery through advantaged basin positioning and improving GOR-driven gas exposure rather than requiring an aggressive commodity price call… Potential catalysts include upward revisions to estimates and return of capital, with focus likely now shifting to common share repurchases following the preferred equity buyback execution,” Kad noted.

These comments support Kad’s Overweight (i.e. Buy) rating on the stock, while his price target of $108 indicates potential for a 12-month upside of ~58%. (To watch Kad’s track record, click here)

Overall, the 7 recent analyst reviews of Targa are all positive, making the Strong Buy consensus rating on this stock unanimous. Targa’s shares are selling for $68.37, and the $97.29 average price target suggests a gain of ~42% from that level. (See TRGP stock forecast on TipRanks)

Avantor, Inc. (AVTR)

The second stock we’re looking at, Avantor, is a Pennsylvania-based chemicals and materials company, delivering mission-critical products and services to customers in the fields of biopharma, healthcare, applied materials, education, and government. Avantor distributes more than 6 million products around the world, and employs more than 13,000 people globally. The company boasts a market cap of more than $13 billion, as well as more than 200 facilities in 30 countries.

The company reported its 3Q22 results on October 28, and showed a top line of $1.86 billion and adjusted EPS coming of 34 cents. These figures were roughly flat year-over-year. At the same time, the firm’s Q3 revenues just edged over the estimates, and the EPS was one penny above the 33-cent forecast.

While Avantor has been able to stay profitable through the market turndown this year, the company’s shares have still fallen 52% since January.

However, Morgan Stanley’s Tejas Savant sees the company’s current position as an opportunity for investors to buy in. Laying out this position, Savant writes: “There are certainly some near-term challenges ahead for AVTR to work out, particularly related to turning around performance at Masterflex/Ritter and working post-COVID consumables inventory normalization, in addition to navigating an uncertain/deteriorating macro backdrop, particularly in Europe. However, in light of the steep pullback, we view the substantially reset ’23 outlook as a clearing event that supports an attractive risk/reward skew for patient investors…”

To this end, Savant rates AVTR shares an Overweight (i.e. Buy) and sets a $28 price tag to suggest a one-year gain of ~40% in the next 12 months. (To watch Savant’s track record, click here)

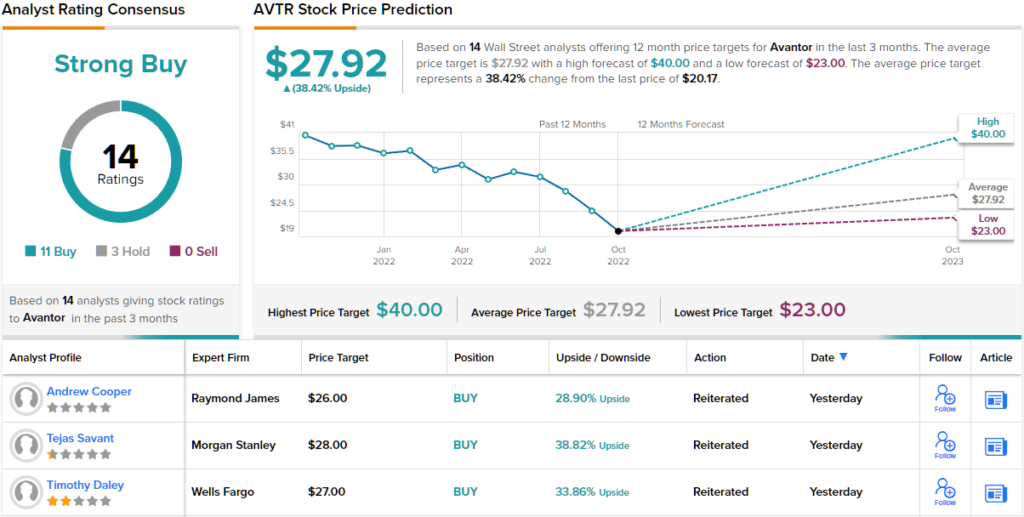

The Strong Buy consensus rating on Avantor’s stock is supported by 14 recent Wall Street analyst reviews, which include 11 Buys and 3 Holds. The Street’s average target of $27.92 is practically the same as Savant’s. (See AVTR stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.