Economic and financial market data points have been showing some interesting inconsistencies lately. The labor market remains tight, interest rates remain high even though the pace of inflation is easing, signs are emerging of a general slowdown, bond markets are strong but so are stocks – it’s hard to know which signs to give the most credence. To add to the uncertainty, the stock market is resting on a very narrow, mega-cap base.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Mike Wilson, chief US equity strategist at Morgan Stanley, has been watching the situation with a careful eye for some time now, and has worked out a strategy to both enhance portfolio returns while also keeping a defensive posture.

“The ongoing policy mix of heavy fiscal spending and tight interest rate policy is crowding out many companies and consumers in a way that is unsustainable in our view,” Wilson opined. “Investors have correctly recognized this outcome by bidding up the few stocks of the companies that are doing well in this environment. Until the bond market pushes back via higher term premium or growth slows down in a more meaningful way, we expect this narrow market performance to persist. As such, we continue to recommend a barbell of large cap quality growth with defensives.”

Following this line of thought, Morgan Stanley analyst Joseph Moore has picked out two high-quality large-cap stocks as likely winners going forward. According to the TipRanks database, both stocks get Buy ratings from the Street consensus, and both show sound growth potential. Here are the details.

Analog Devices (ADI)

Up first is Analog Devices, a semiconductor chip company working in the field of signal processing and data conversion. Analog has developed a product portfolio with applications in a wide range of fields, from high-speed logic to optical communications and sensing, to processors and microcontrollers, to amplifiers and audio products. The company works with customers across numerous fields, including aerospace, automotive manufacturing, consumer technology, data centers, healthcare, IoT, and wireless communications. Analog’s chipsets work in power monitoring, motor controls, clocks and timing, and industrial ethernet – this list can go on, but you get the idea – Analog Devices is a generalist, building its success by making something for everyone.

That multimodal approach has paid off handsomely for both Analog and its investors. Analog brought in more than $12 billion in sales revenue last year, and over the past decade has returned $19 billion to its shareholders. The company boasts more than 100,000 customers, from all segments of the tech and industrial worlds and has a market cap of $114.5 billion.

The strong foundation is necessary, as Analog has been wrestling with lower demand in recent quarters – and lower revenues. The company’s most recent report, covering fiscal 2Q24, showed a top line of $2.16 billion – down more than 33% year-over-year although it should be noted the figure beat the forecast by $50 million. Earnings also beat expectations; the non-GAAP EPS of $1.40 came in 13 cents per share better than had been expected.

Also of note, Analog generated significant cash during the quarter, reporting a free cash flow of $3.1 billion on a trailing 12-month basis.

When we check in with analyst Joseph Moore, we find that Morgan Stanley’s 5-star tech expert is upbeat on Analog for the long term, citing an industry shift toward an upcycle and Analog’s strong overall position. He writes, “The company has excelled in managing the downcycle and remains our preferred name as we enter an analog upcycle… Multiples are stretched vs historic across the space, but for ADI we see value in the company’s ability to generate 40% OPM with revenue 30% below peak, which combined with >50% margin in the prior peak points to structural improvement. With sequential growth ahead, we see no reason to deviate from our OW call.”

Along with that Overweight (Buy) call, Moore gives Analog a $260 price target, pointing toward a one-year upside better than 12.5%. (To watch Moore’s track record, click here)

Overall, Analog Devices has a Moderate Buy rating from the analyst consensus, based on 22 recommendations that include 16 Buys and 6 Holds. The shares are currently trading for $230.89 and have an average target price of $253, suggesting a 9.5% gain heading into next year. (See ADI stock forecast)

Western Digital (WDC)

The second stock we’ll look at is Western Digital, a relatively smaller semiconductor chip firm. Just remember, however, that the chip industry includes such giants as the $3-trillion-plus giant Nvidia – so Western Digital is a small player, even with its market cap of nearly $25 billion putting it solidly in the large-cap category.

On the product side, Western Digital is a memory specialist, designing and distributing chip lines that include SSDs, hard drives, memory cards, USB flash drives, and larger-scale data center platforms and drives. The company’s tech can be found in external drives, portable drives, and commercial-grade removable storage, and even in the humble memory card.

These chipsets and semiconductor products have found uses in a wide range of applications, from high-capacity HDDs and data center server platforms to embedded flash memory to SSD replacements for traditional hard drives to high-end gaming memory. The company has a solution for just about any computing memory need, from the small and portable to the truly large multi-terabyte backup packages.

Computer memory is always in demand, especially as new technologies like generative AI come in, with their voracious need for higher capacity computing and storage facilities. So we shouldn’t be too surprised to see that Western Digital’s stock has gained over 47% so far this year. On the company’s financial side, we see that fiscal 3Q24, the last reported quarter, had a total of $3.46 billion in revenues. This was up more than 23% from the prior-year period and beat the forecast by $110 million. Cloud revenue was a major driver, and was up 45% quarter-over-quarter. At the bottom line, Western’s non-GAAP earnings came to 63 cents per share, 48 cents per share better than had been expected.

Checking in again with analyst Moore, we find him taking an optimistic outlook here based on improved conditions in the memory market. Moore also notes that this stock should remain strong for the long term, with the upcoming separation of its HDD and Flash businesses acting as another plus. As he writes, “While conditions have moved from very challenging to very positive, and earnings have gone from large losses to healthy profits, there have been expectation issues consistently along the way; that should matter less if the separation of the hard drive and NAND business leads to longer-term investor endorsement such as we have seen for primary peers in both businesses… We would focus on the upward revision to earnings over the longer haul rather than shorter-term tactical issues, and we remain bullish.”

Remaining bullish leads to an Overweight (Buy) rating, and an $86 price target that implies a one-year upside potential of 11.5% for the stock.

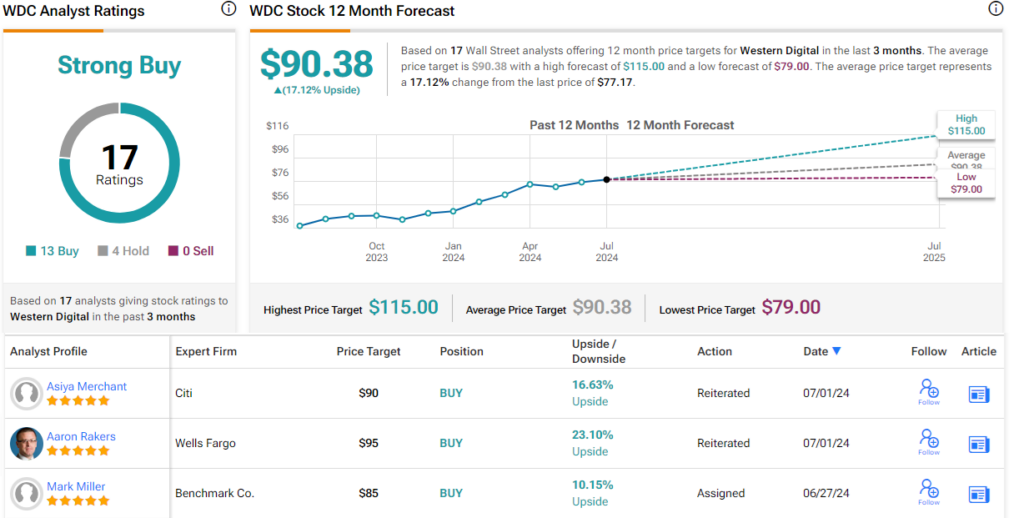

This stock holds a Strong Buy rating from the Street’s analysts, based on 17 recent reviews with a 13 to 4 split favoring Buy over Hold. The stock’s $90.38 average target price and $77.17 current trading price together suggest a 17% gain on the one-year horizon. (See WDC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.